ShopeePay, the built-in eWallet for Shopee, has just introduced a new transferable and non-transferable balance “feature”. This seems to be a move by the eCommerce platform to curb credit card cashouts.

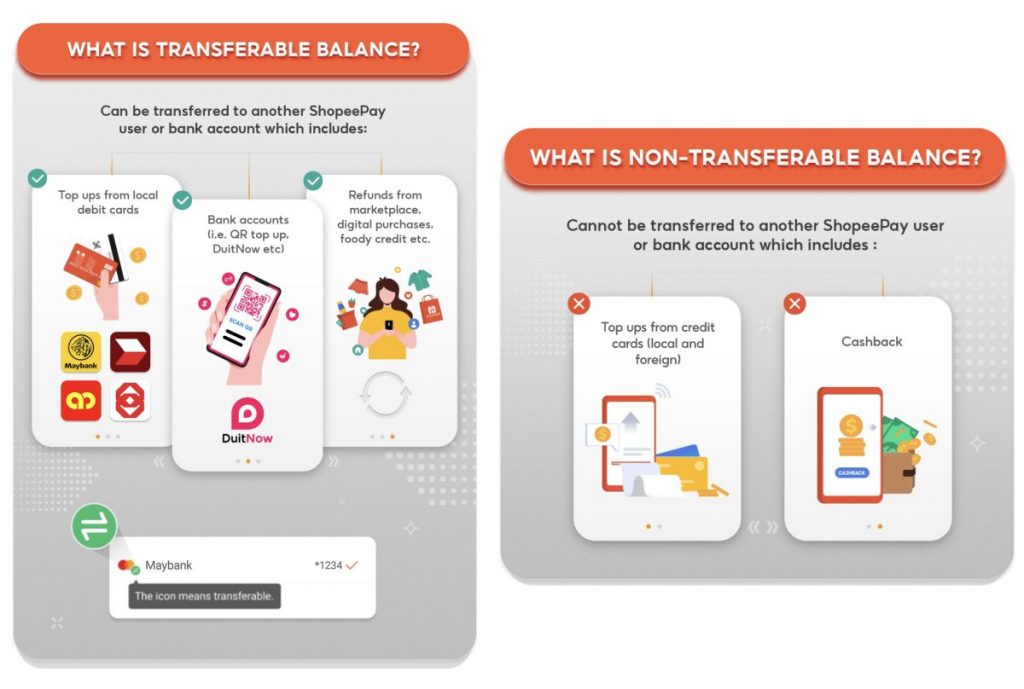

According to ShopeePay, reloads made from credit cards (both local and foreign) as well as balances from cashback are deemed non-transferable. Only reloads made from local debit cards, bank accounts (online bank-in or DuitNow) and refunds from the marketplace, digital purchases and foody credit will be considered Transferable Balance.

As defined in their FAQ, non-transferable balances can only be used for offline and online checkouts but they can’t be used for P2P transfers. This means you can’t reload your ShopeePay eWallet via credit card and then transfer the funds to your local bank account. You can still transfer your ShopeePay balance out to your bank account if the reload was made via online banking, Cash, P2P transfer or debit card.

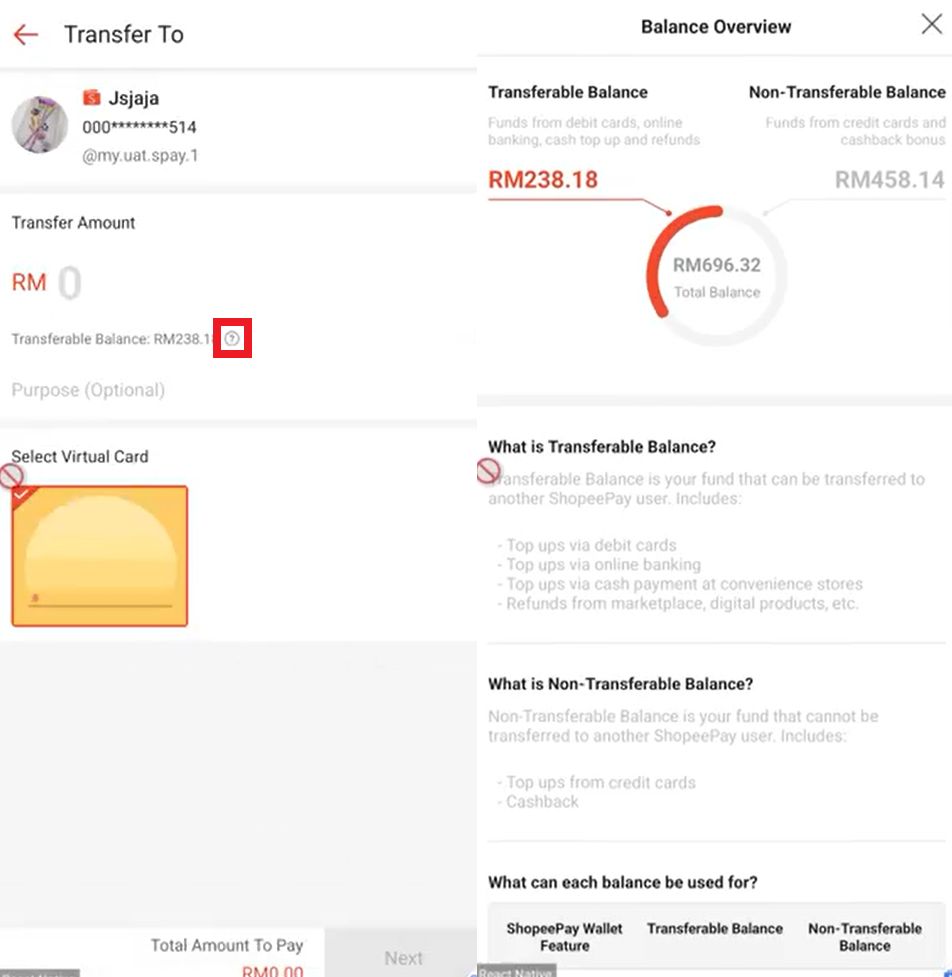

According to Shopee, you can check your current Transferable and Non-Transferable balance when you try to transfer your eWallet balance. Under the “Transfer Amount” field, there will be a little icon which you can click to view your balance overview.

At the time of writing, this feature isn’t implemented yet for our Shopee account as we are still able to transfer the balance that was reloaded by credit card. It is likely that this new non-transferable feature is being rolled out in stages.

ShopeePay isn’t the only eWallet player to impose new measures to curb credit card cashouts. It is publicly known that some users have been using eWallets with cash-out features as a way to avoid paying expensive cash advance fees imposed by credit cards. Touch ‘n Go eWallet introduced its non-transferable balance last year but it provided a transferable quota of RM5,000 per month for balances reloaded by credit card. Effective 22nd March 2023, they are reducing the transferable limit to just RM1,000 per month and users that need to transfer more than RM1,000 are still allowed to do so with a 1% fee.

In late 2020, BigPay also limited credit card reloads with a limit of RM1,000 per month. Eventually, they allowed higher reloads up to RM10,000 per month but they started charging a 1% fee for credit card reloads exceeding RM1,000 per month.

For more info, you can check out ShopeePay’s Transferable & Non-Transferable Balance FAQ.

Related reading

- Touch ‘n Go eWallet imposes extra fee if you want to transfer more than RM1,000 from credit card reloads

- BigPay reduces credit card reload limit to RM1,000 a month

- BigPay now lets you reload up to RM10,000 via credit card but you’ll have to pay a fee

- Can you withdraw from a credit card for free via Touch ‘n Go eWallet? | Ask Us Anything #21