If you’re a Touch ‘n Go (TNG) eWallet user, you probably received constant reminders and notifications to update the app to the latest version. Turns out TNG has introduced a couple of new features which would restrict the way you can cash out your eWallet balance. They have now split your eWallet balance with transferable and non-transferable buckets.

Since TNG introduced its Go+ investment feature, the app allows users to cash out their balance to a local bank account and it still remains probably the only major eWallet in Malaysia to do so. Prior to this, TNG only has a single eWallet balance regardless if it is reloaded by online banking, debit, or credit card, and you can reload up to the permitted maximum wallet size of RM20,000 without clear restrictions for wallet to wallet, or wallet to bank account transfers.

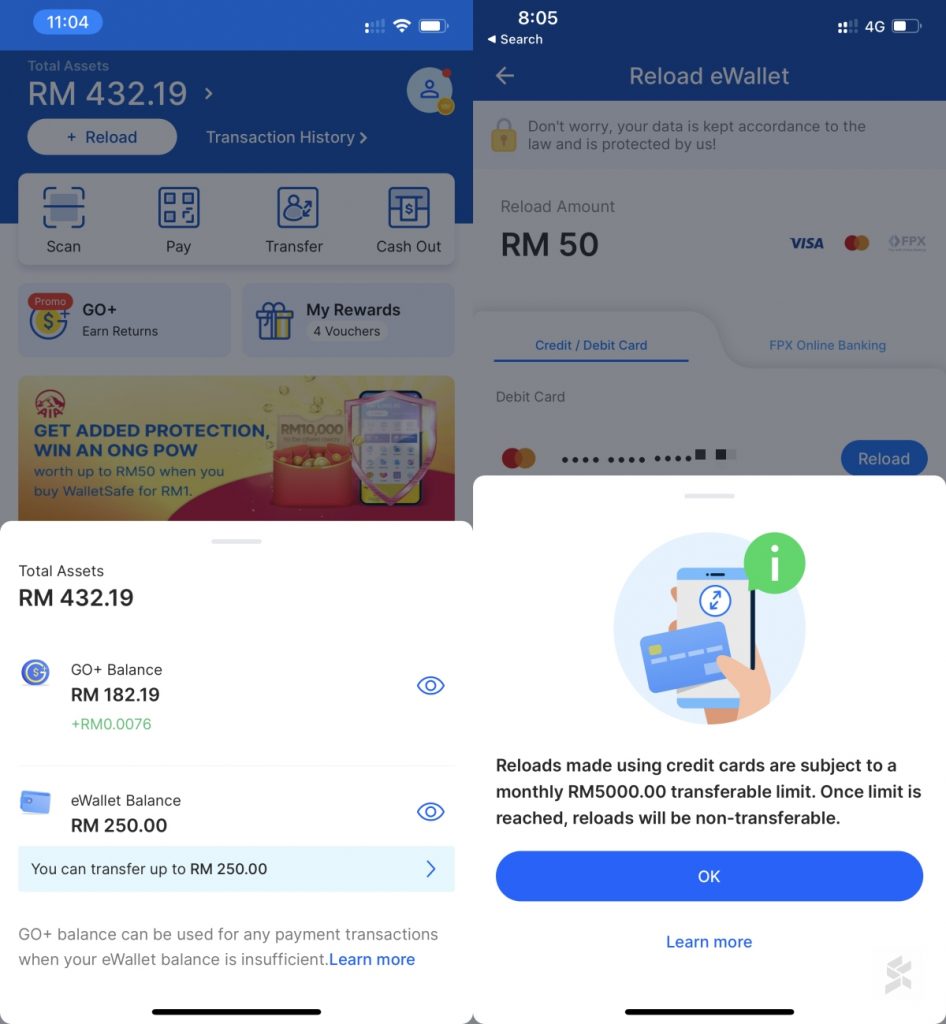

With the latest update, the TNG eWallet will now prominently display your maximum transferrable amount on various interfaces. If you tap for more info, the app will break down the definition and balance of Transferable and Non-transferable eWallet buckets. Transferable funds are basically reloads made from all sources except for credit card and government initiatives which may include eTunai and eBelia. If you reload via credit card or received funds from the government, it will be considered non-transferable.

The limitation of non-transferable balance is that you can’t use it to transfer it to other eWallets, cash out to bank accounts or used it for Go+ or other investment products. You are still able to use it for other normal merchant transactions or toll payments for RFID and PayDirect. It is worth highlighting that TNG isn’t fully restricting the usage of balance reloaded by credit cards just yet as they have their own “FUP” of sorts.

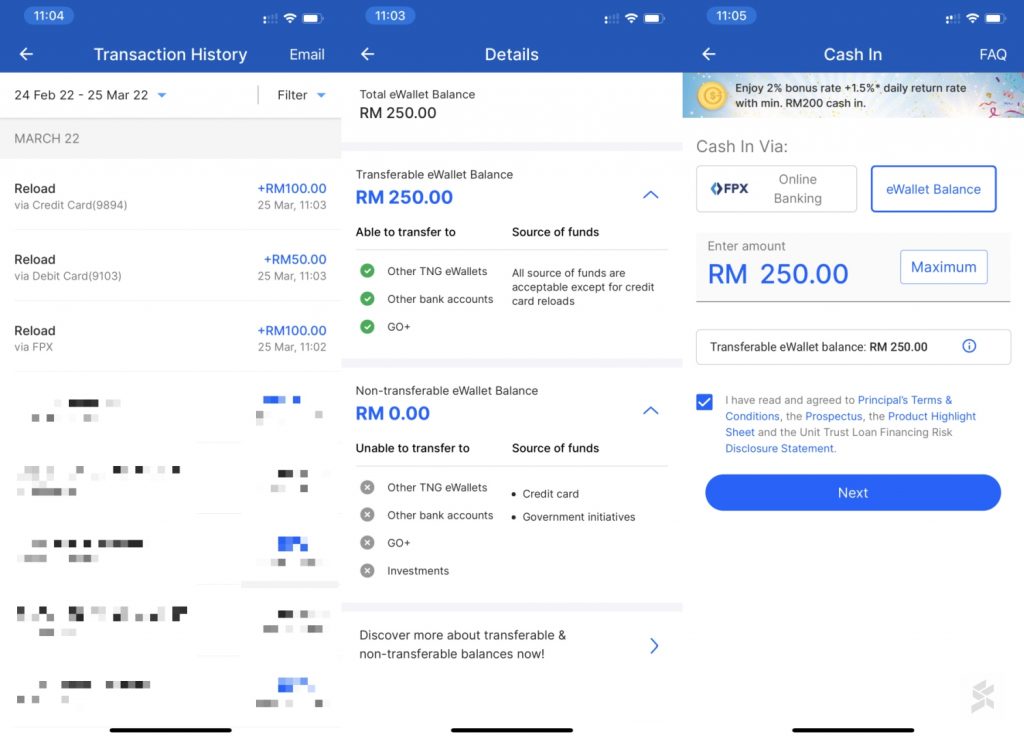

According to their FAQ, they are providing some quota for all users who have completed their account verification (e-KYC). If your account is on a “Pro” or the previous “Premium” level with a RM5,000 wallet size, you are permitted a quota of RM2,000 per month which will reset on the 1st day monthly. For users on the highest Premium tier and a RM20,000 Wallet size, you are given a monthly quota of RM5,000. Any excess credit card reloads above the quota will be considered non-transferable. This means if you have a quota of RM5,000 but made a credit card reload of RM8,000, the remaining RM3,000 will be non-transferable.

Despite the split, the total eWallet balance will still be shown on the home screen regardless if it is transferable or non-transferable.

We tried reloading a combination of RM100 by credit card, RM50 by debit card, and RM100 via online banking, and we are able to get a RM250 balance under the transferable bucket. This is because we have not hit our RM5,000 quota as a Premium account user. You can learn more about TNG eWallet’s new Transferable and Non-Transferable feature here.