[ UPDATE 3/03/2022 16:00 ] BigPay has officially launched its Digital Personal Loan offering with instant loans up to RM5,000 and instalments up to 12 months.

===

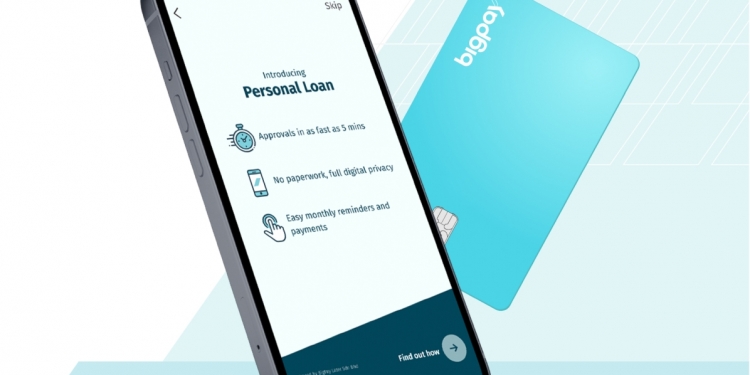

BigPay, the eWallet product invested in by Capital A, is launching a brand new feature where you can apply for loans with instant approval. It claims to be the first fully digital personal loan product in Malaysia.

According to the teaser image, BigPay’s personal loan product offers approvals as fast as 5 minutes and there’s no paperwork required. The app will push monthly reminders and users should be able to make repayments easily within the app itself. BigPay is providing a walkthrough of their product next week and the full details should be revealed very soon.

In case you missed it, BigPay has received a provisional licence for lending back in November 2020 from the Ministry of Housing and Local Government (KPKT). According to Capital A CEO Tony Fernandes, the licence will allow users to get fast loans at low-interest rates. He also said although the B40 group will be the biggest beneficiary from the approval, the financing would be available to others as well.

Besides BigPay, other companies such as Axiata Digital Capital, Grabfin Operations, GHL Payments, Presto Credit, JCL Credit Leasing, Fortune Tree Capital, and Hoop Fintech have also been issued a provisional licence by KPKT.

BigPay’s personal loan offering comes at a time when several eWallet players have started offering Buy Now Pay Later (BNPL) products. Some BNPL options offer interest-free instalments for a short term duration of 3-4 months but they are often limited to retail and online purchases.

Personal loan offers greater flexibility as users can utilise them for emergency situations like medical or home repairs. It could be used for debt consolidation or to fund a new business, provided that the interest rates are favourable. Since its introduction, BigPay and its physical prepaid card have been popular among international travellers as it offers lower foreign exchange rates and ATM withdrawal fees. On top of that, the app also offers remittance services at lower rates than traditional banks. Recently, BigPay has increased its wallet size to RM20,000 but it still doesn’t support DuitNow QR.

BigPay has submitted its application for a Digital Banking Licence in Malaysia last year and it hopes to offer full-fledged financial services for individuals, freelancers and mSMEs. Last year, they have also secured USD 100 million (about RM418 million) in financing from South Korea’s SK Group.