Setel, the petrol and EV charging payment app from Petronas, will soon introduce a 1% convenience fee for credit card reloads. According to its notification message, the 1% fee was introduced to enable Setel to continue offering the convenience and security users deserve.

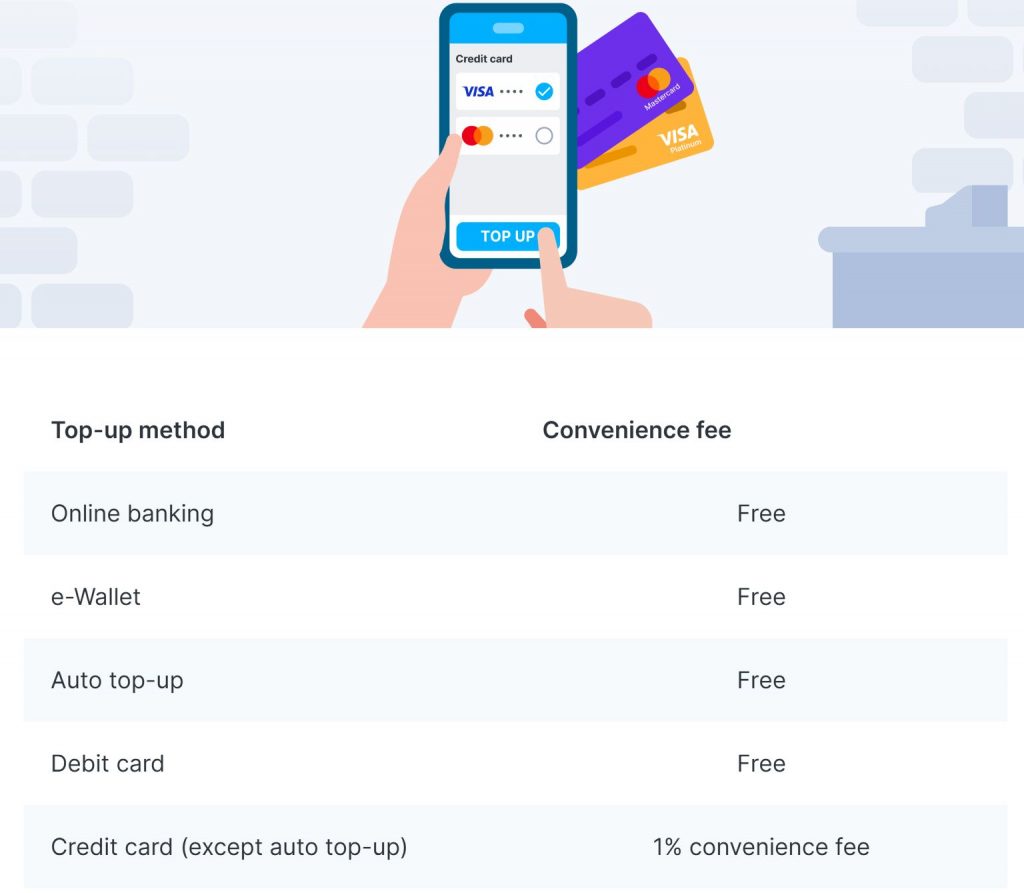

The 1% convenience fee will be imposed starting 5th December 2024 and it will be reflected across its Product Disclosure Sheet and Terms & Conditions. From the looks of it, the 1% fee is only applicable when you reload your Setel eWallet manually via credit card.

According to Setel, auto top-ups and purchases made via CardTerus using credit cards are exempted from the 1% convenience fee until further notice. Other reloads such as online banking, debit card and eWallet (Boost, GrabPay and ShopeePay) remain free of charge.

It is also worth pointing out that in the event of a refund, the convenience fee is non-refundable and will not be returned to the user.

Besides Setel, other Malaysian-based eWallets have started imposing fees for credit card reloads. Touch ‘n Go eWallet imposed a 1% fee for credit card reloads since February 2024, followed by GrabPay in September 2024. Meanwhile, Boost started charging a convenience fee for all credit card reloads but they reduced the fee from 1% to 0.75% from 14th October 2024.