As promised by Touch ‘n Go, they started releasing their physical eWallet-linked Visa card last month but only for a small number of users. It appears that more Touch ‘n Go eWallet users are finally getting the new Visa card option on the app’s home screen, and they can now apply for the card for free.

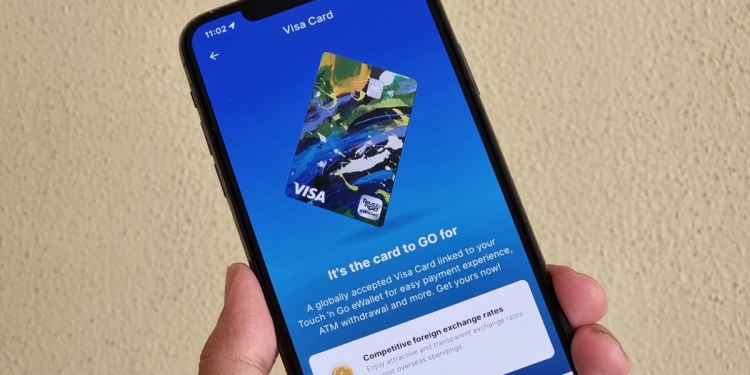

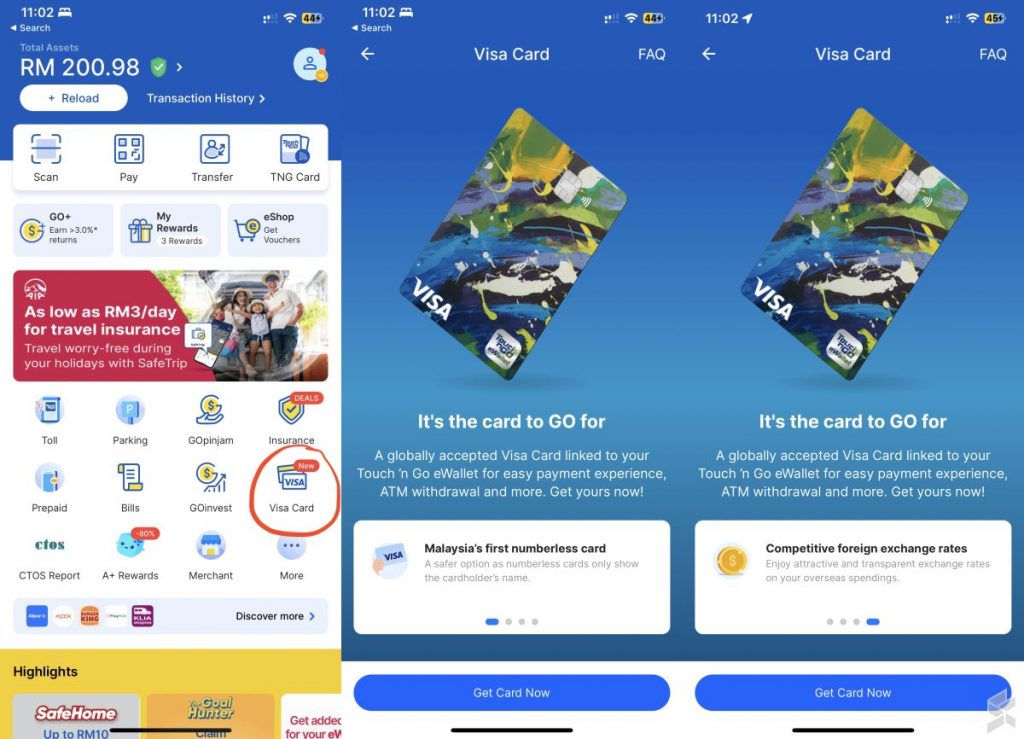

The Touch ‘n Go Visa card allows Touch ‘n Go eWallet users to spend their balance at more shops and retailers worldwide that can accept Visa card payments. This would be great for travelling overseas or when making payments online that don’t accept eWallet payments. To apply, just launch the Touch ‘n Go eWallet app and you should see a new “Visa card” option on the home screen.

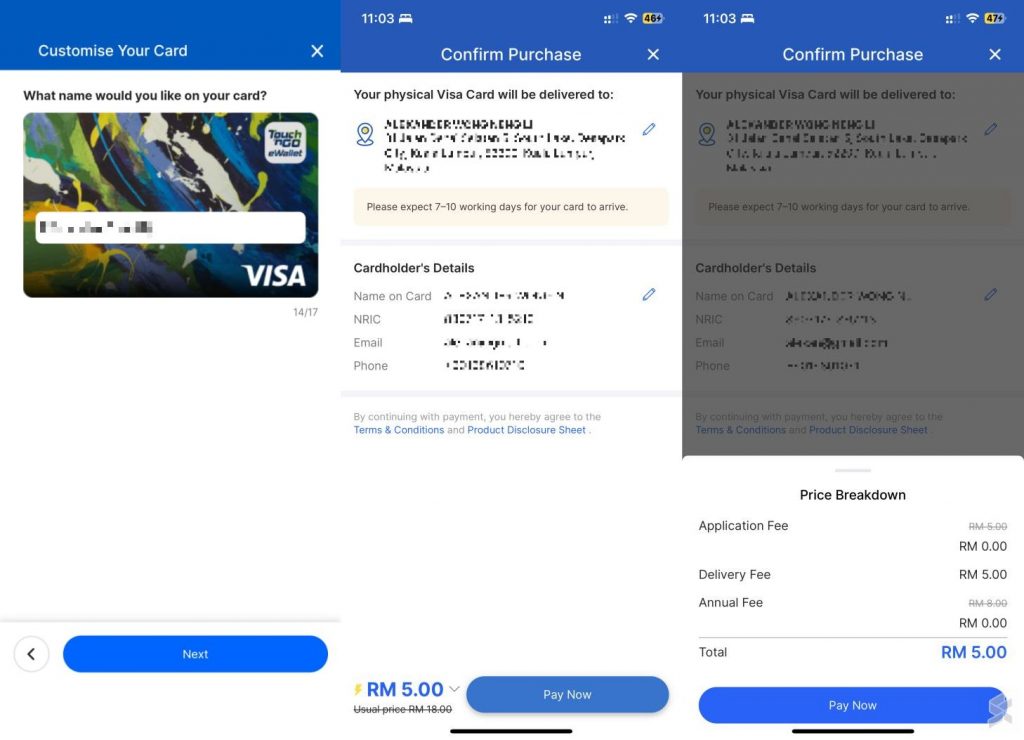

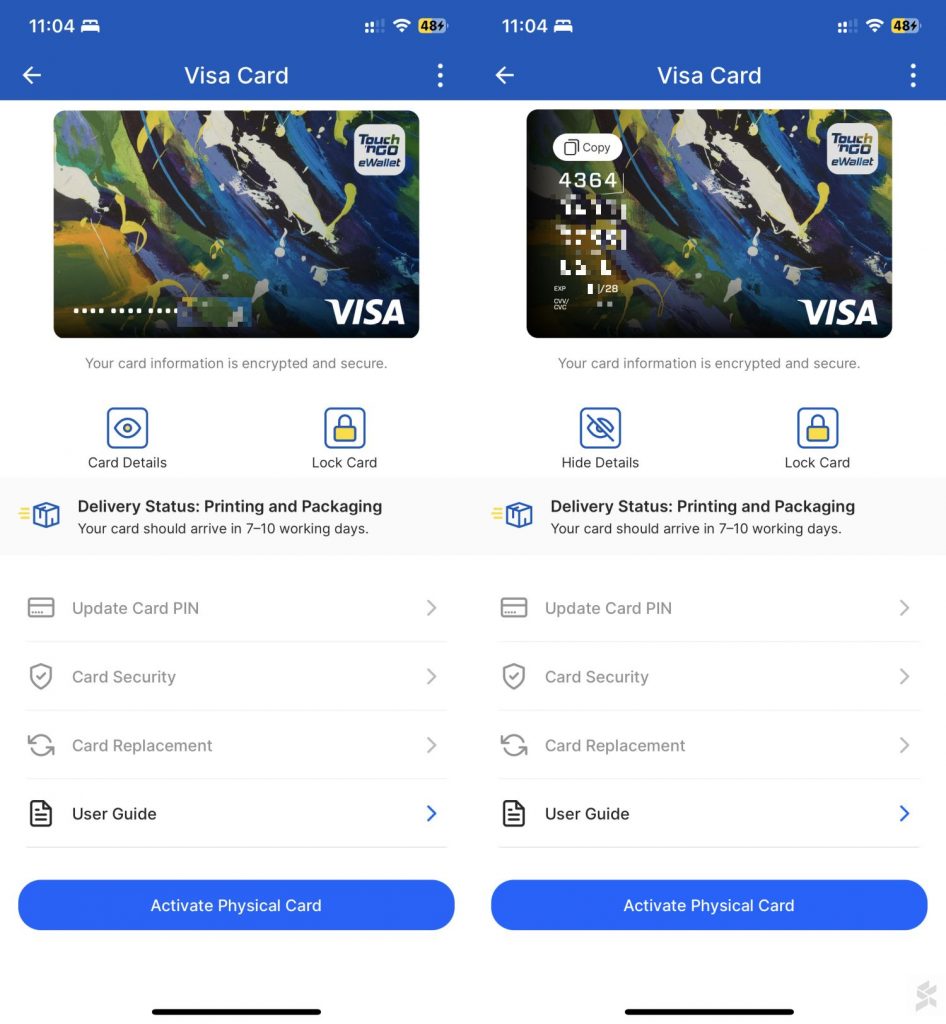

As seen previously, the Touch ‘n Go Visa is claimed to be Malaysia’s first numberless card which offers greater security and privacy. The card will only show the cardholder’s name and only you can view the important details such as card number, expiry and 3 digit CVV code through the Touch ‘n Go eWallet app.

Touch ‘n Go is currently waiving the application fee (RM5) and annual fee (RM8) for the card. However, you must pay the card’s delivery fee of RM5 which takes 7-10 working days to arrive. Touch ‘n Go allows you to customise the name on the card but up to a very limited 17 characters.

While waiting for the card to arrive, you can already start using the Visa card for online transactions and in-app payments. From the Visa card section in the Touch ‘n GO card, you can view your card details immediately after ordering the physical card. You also get the option to lock the card and change the card’s 6-digit PIN from the app.

Besides making card payments including paywave, the Visa card can be used to withdraw cash at ATMs under the Visa Plus network. Touch ‘n Go also claims to offer competitive foreign exchange rates for overseas transactions which can be a great alternative to BigPay and Wise.

Touch ‘n Go Visa card limits and fees

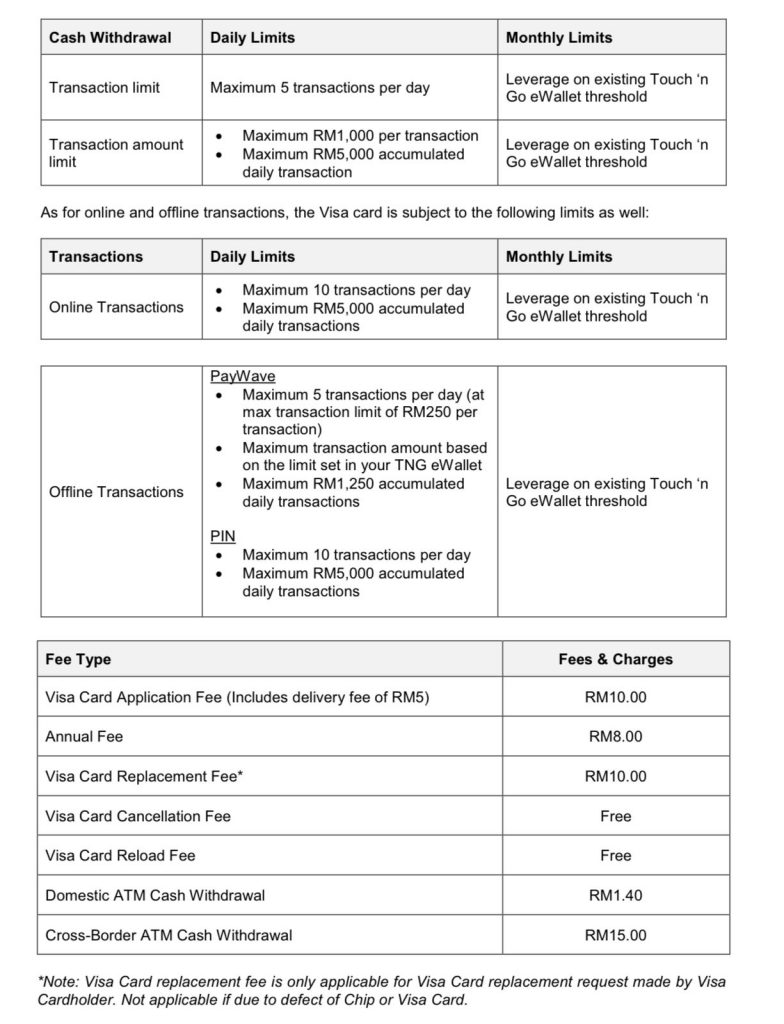

According to the product disclosure sheet, the Visa card has a cash withdrawal limit of 5 transactions per day and there’s a limit of RM1,000 per transaction up to a maximum limit of RM5,000 for accumulative daily transactions. For online transactions, there’s a maximum limit of 10 transactions per day and a maximum limit of RM5,000 for accumulative daily transactions.

For offline transactions, the card has a maximum of 5 paywave transactions per day with a maximum limit of RM250 per transaction, and you can set the max transaction amount in the TNG eWallet app. There’s also a total maximum accumulative daily transaction limit of RM1,250 for paywave.

Meanwhile, users can perform chip and PIN transactions up to a maximum of 10 transactions per day and with a maximum accumulative daily transaction limit of RM5,000. So despite Touch ‘n Go eWallet having a maximum size of up to RM20,000, there’s a RM5,000 per day spend limit for the TNG Visa card.

If you plan to withdraw cash using the TNG Visa card, it will cost you RM1.40 for domestic ATM withdrawal and RM15 for cross-border ATM withdrawal. As a comparison, BigPay currently charges a fee of RM6 per ATM withdrawal in Malaysia and RM10 if you perform the ATM withdrawal overseas.

Touch ‘n Go Visa card vs Touch ‘n Go card

Despite having the Touch ‘n Go branding, this physical Visa prepaid card is not the same as your typical physical Touch ‘n Go card that you use to tap on TNG terminals for tolls, public transport and parking. This is essentially a Visa prepaid card that’s linked to your eWallet, which is similar to BigPay and GoPayz.

The Visa card expands the Touch ‘n Go eWallet’s usability as you can now use it worldwide where DuitNow QR or TNG eWallet payments are not accepted. This can be great for travel especially for withdrawing foreign currency but it all depends on the foreign exchange rates offered by Touch ‘n Go. Even if you don’t travel, having a prepaid card is great to avoid exposure of your debit and credit cards when you save your card details for online payments and transactions. In the event of a data breach at a particular platform, you can easily replace your Visa prepaid card instead of changing your credit cards which can be a hassle.

Related reading

- Touch ‘n Go’s eWallet-linked Visa card is Malaysia’s first numberless card?

- Enhanced Touch ‘n Go card with NFC: “Mission GreenPossible” edition card now available online for pre-order

- TNG eWallet finally solves the biggest problem of its Go+ investment feature

- RFID Malaysia: Here’s what these 3 ministers need do to enable seamless toll payments