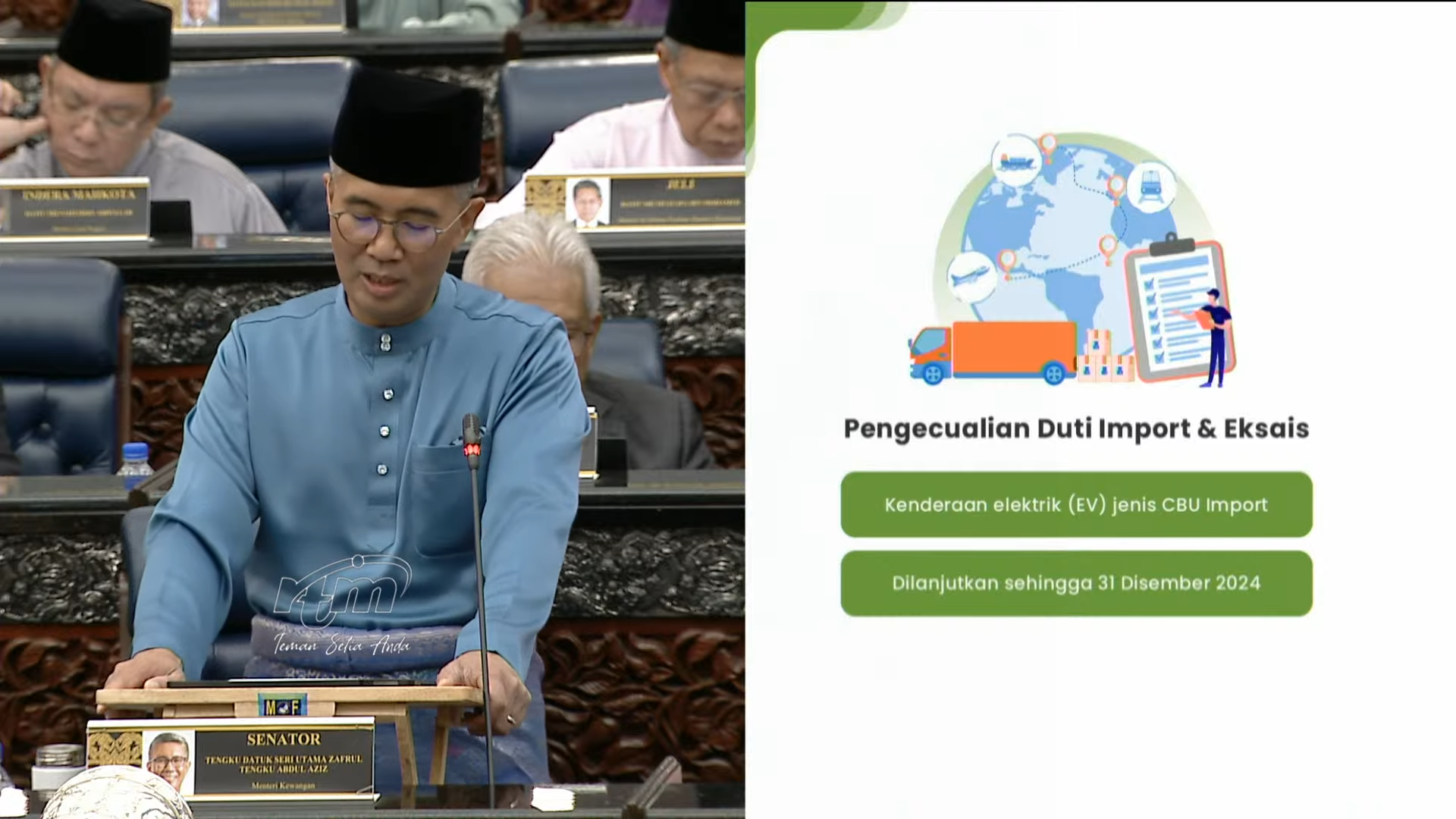

Malaysia’s import tax and excise duty exemptions for fully-imported (CBU) electric vehicles, originally set to to expire on 31 December 2023, has been extended to 2024. This was announced by Minister of Finance Tengku Zafrul Aziz during the tabling of Budget 2023 today.

This means that EVs will continue to be sold at a cheaper price for another year, hopefully spurring more car companies to bring in their electric models. However, there was no mention of a continued road tax exemption, meaning that the incentive will likely expire at the end of next year, as previously planned. Also not mentioned is any extension for locally-assembled EVs, but the deadline for those cars is still a long way ahead, at the end of 2025.

The news will be particularly beneficial to Smart, which will be imported and distributed by Proton Edar—the company is only set to launch the brand’s first electric model, the #1, in the fourth quarter of 2023. That would’ve left it with just a few months to enjoy the exemptions.

Announced during Budget 2022, the import tax, excise duty and road tax exemptions for electric cars immediately brought prices down at the start of the year. For instance, the starting cost of the BMW iX fell from RM419,630 to RM361,430, a reduction of RM58,200. The incentives also spurred companies like Hyundai, Kia and Mercedes-Benz to bring in their EVs, while other brands such as GWM, Toyota, BYD and Jaguar have plans to launch their models in the Malaysian market within the next two years.

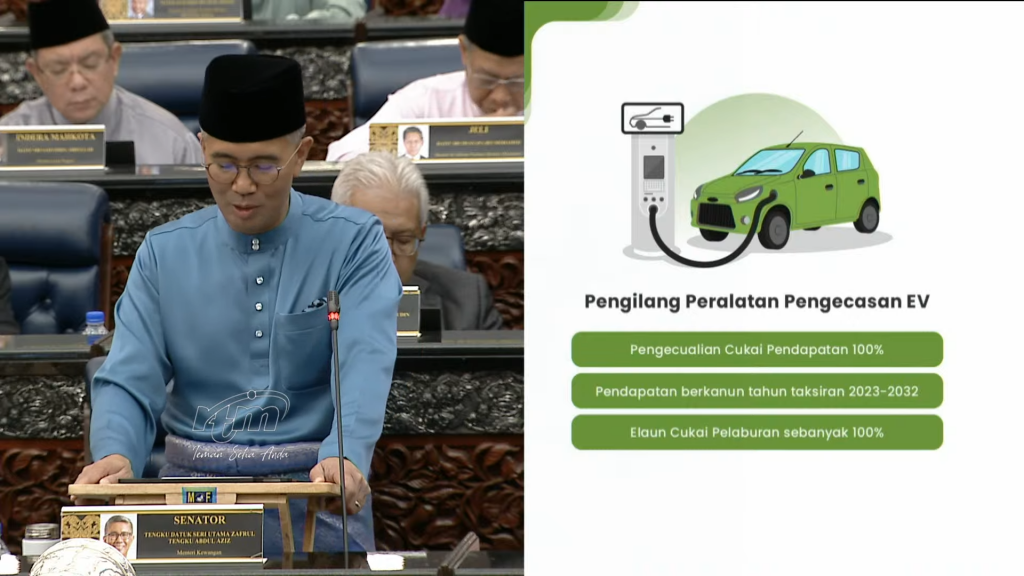

Additionally, the government is giving EV importers an exemption of Approved Permit (AP) fees until 31 December 2023, which should be especially good news for grey importers and may make electric cars even cheaper. As for charging equipment manufacturers, they will enjoy a 100% income tax exemption on their statutory income—valid from assessment years 2023 to 2032—as well as a 100% “investment tax allowance.”