As teased earlier, Touch ‘n Go eWallet has finally introduced its digital personal loan product called GoPinjam. Eligible users can apply for a personal loan of up to RM10,000 with flexible instalments from 1 week to 12 months.

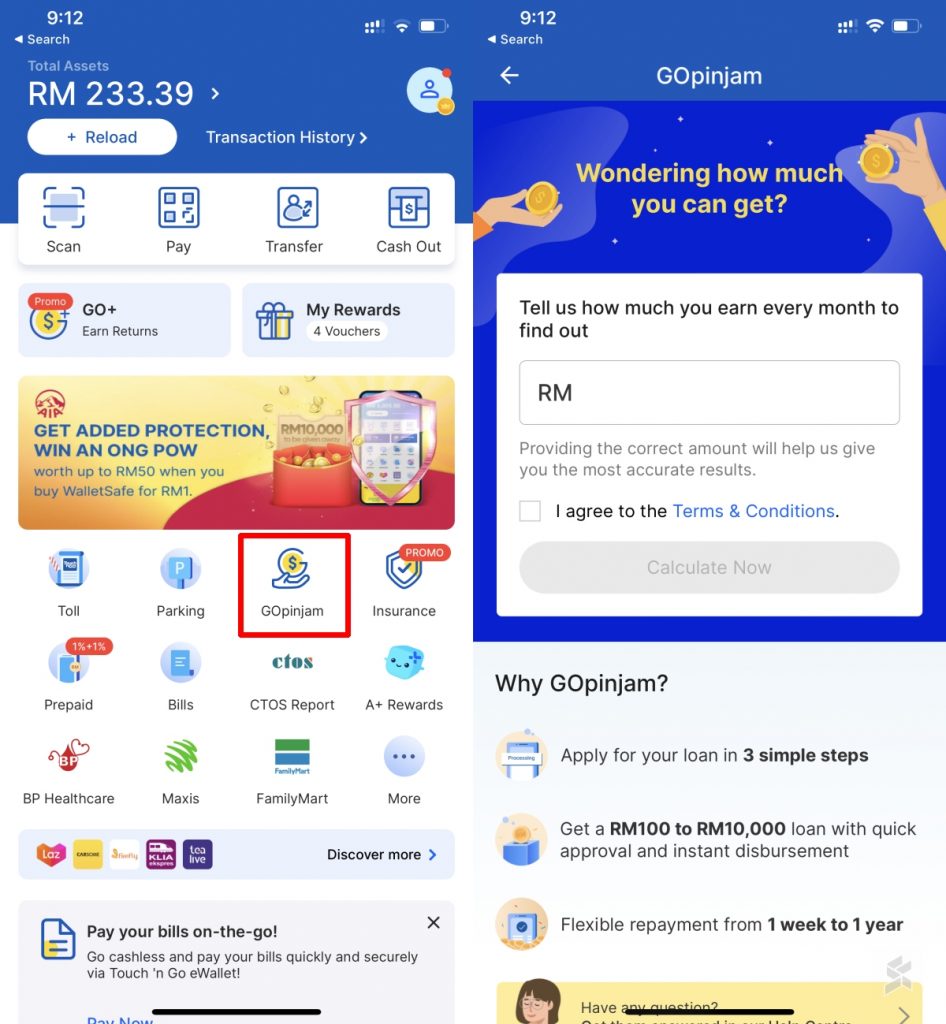

The new Touch ‘n Go loan feature is offered in partnership with CIMB and it is financed under their e-Zi Tunai product. It offers fixed interest rates ranging from 8% to 36% per annum depending on the loan tenure. You can find GoPinjam on the home screen of the TNG eWallet app and you can try it out by entering your monthly income amount and following the rest of the instructions.

The personal loan product is open to Malaysian TNG eWallet users aged 21 to 63 years old with a minimum monthly gross income of RM800.

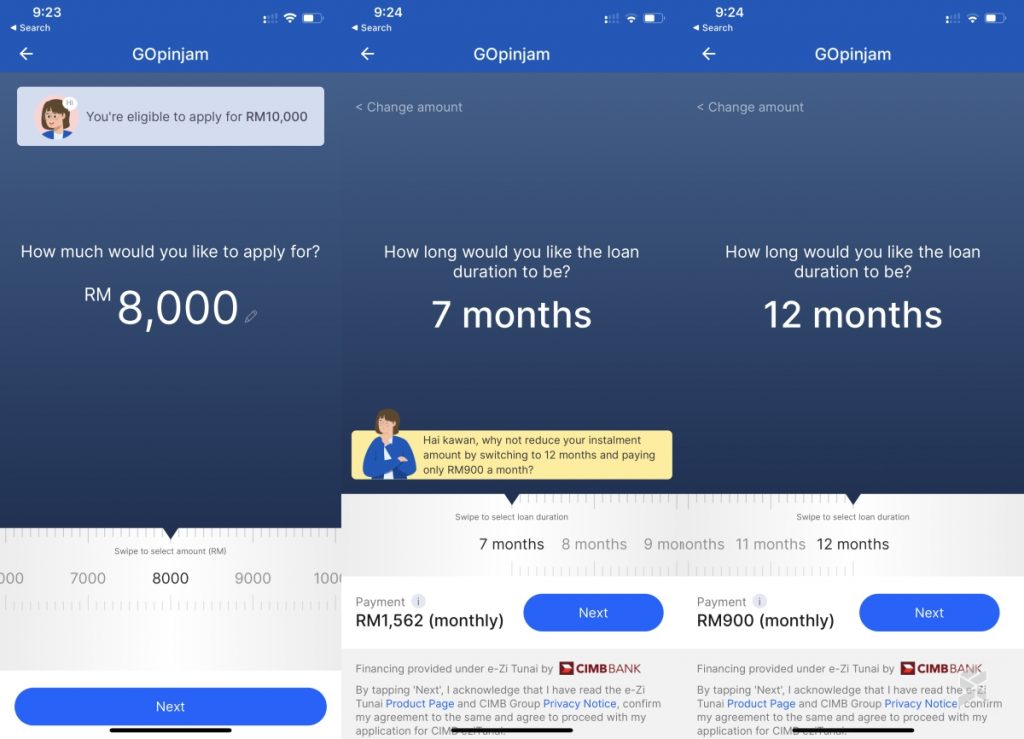

If your income is high enough, you would be eligible to apply up to RM10,000. For this amount, you can choose your preferred loan duration between 7 to 12 months. With a 12 month duration, the monthly repayment costs RM900/month which calculates to 8% p.a. Meanwhile, a shorter 7 months duration calculates to RM1,562/month.

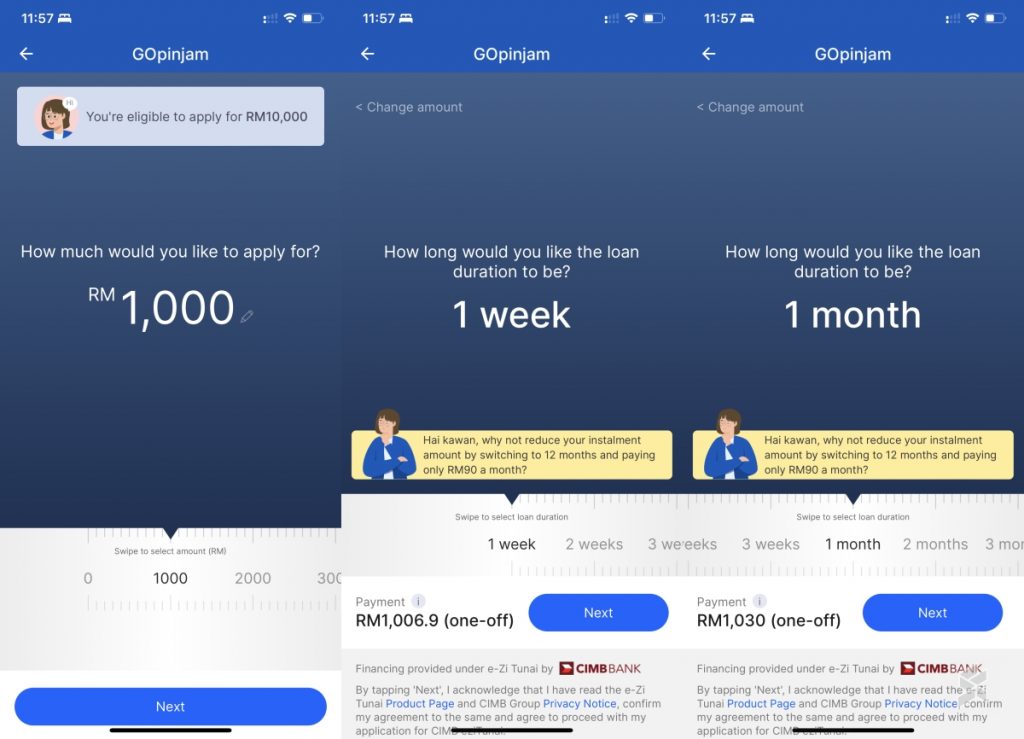

GoPinjam also provides a shorter loan duration as little as 1 week if you apply for a smaller amount like RM1000. For that amount, it will cost you a one-off RM1,006.90 repayment for a week or RM1,030 for a month. The minimum loan amount allowed is RM100 and you can pay a week later with a one-off RM100.69 or stretch the repayment to 6 months at RM19/month.

The GoPinjam loan application requires additional documents such as a month’s payslip from a company registered in Malaysia, a full EPF statement showing 3 months of contributions, and a B/BE form e-Filing acknowledgment receipt.

According to the FAQ, the approved loan amount can be disbursed through the TNG eWallet or a first-party CIMB/CIMB Islamic Bank account. If you don’t have a CIMB Bank account, you can transfer the funds from your TNG eWallet to other bank accounts via DuitNow with no processing fee. Interestingly, they are allowing each user to apply for more than one loan under GoPinjam as long as each loan amount requested is not more than RM10,000.

It is also stated that CIMB e-Zi Tunai is a conventional banking product and is non-Shariah compliant. However, they are looking at rolling out an Islamic-financing product via TNG eWallet. To learn more, you can check out TNG eWallet’s FAQ and T&C for GoPinjam.

Related reading

- BigPay introduces fully digital personal loans with instant approval. Here’s a quick preview

- Is TNG eWallet launching a personal loan product on 1st April?

- TNG eWallet imposes new restrictions to curb credit card cash-outs and transfers

- Vehicles entering Johor from Singapore are still required to tap Touch ‘n Go card despite RM20 Road Charge waiver