[ UPDATE 01:00 1/04/2022 ] Touch ‘n Go’s new financial product is GoPinjam and it’s financed under CIMB E-Zi Tunai. Users can apply up to RM10,000 with instalment duration of 1 week to 12 months.

===

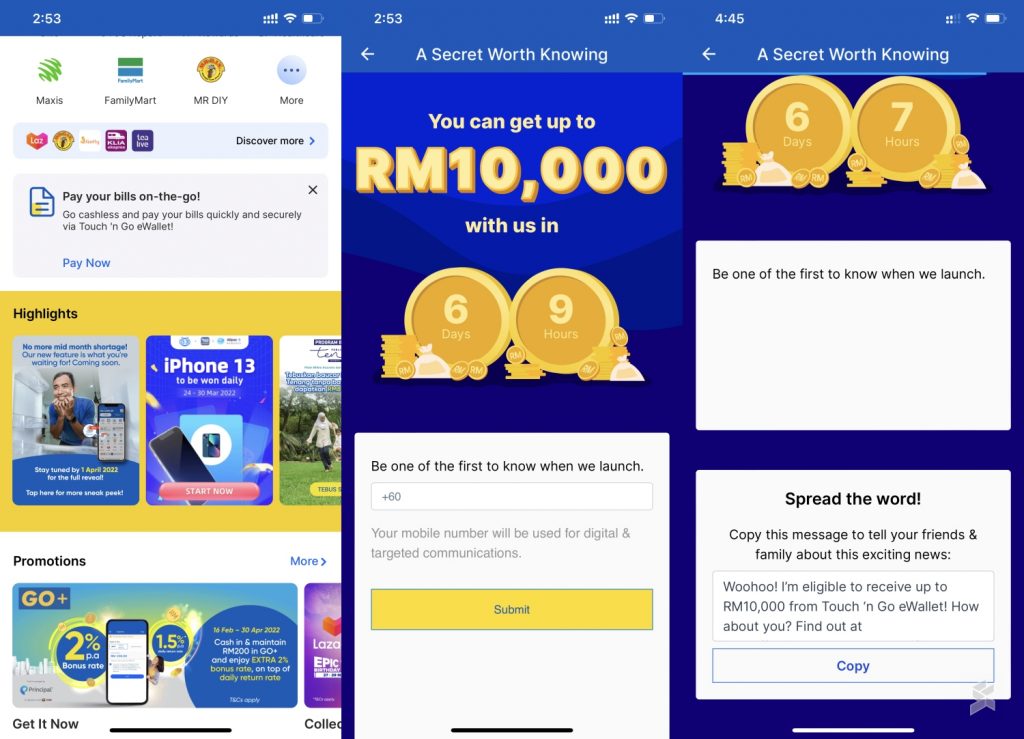

Touch ‘n Go Digital, the company behind the TNG eWallet, appears to be launching a new financial product very soon. From the looks of it, this could be a personal loan or possibly a Buy Now Pay Later (BNPL) feature.

The teaser image shows a man looking at what appears to be an empty fridge, along with the text “No more mid-month shortage! Our new feature is what you’re waiting for! Coming soon”. According to TNG eWallet, the feature will be revealed on Friday, 1st April 2022.

If you want to be the first to know, you can register your mobile number with TNG Digital. Interestingly, there’s a social share box that mentions “Woohoo! I’m eligible to receive up to RM10,000 from Touch ‘n Go eWallet!”, which probably hints that individuals can apply for loans up to RM10,000. We’ll have to wait until next Friday to find out more about this new offering.

Earlier this month, BigPay has launched what it claims to be the first fully digital personal loan product in Malaysia. At the moment, the BigPay personal loan service isn’t officially rolled out to everyone but interested customers can drop their name on a waiting list. From our sneak preview, BigPay is offering unsecured loans amounting to RM1,000 to RM5,000, with an interest rate of 8% p.a. Customers can choose a repayment period of 6, 9 or 12 months.

Lately, we are seeing a rise in BNPL and Personal Loan offerings from FinTech and eWallet players. Grab has been offering BNPL for quite some time now, while Boost has announced plans to offer BNPL as well as micro-financing for small businesses. The feature is useful for customers without access to credit cards as it enables them to split payments across 3 or 4 month instalments with no additional interest.

Meanwhile, digital personal loans can be useful for the unbanked community as they can now gain access to credit with instant approval. Such facilities can be used for medical emergencies or home repairs by users who are tight on cash before payday.

In case you missed it, TNG eWallet has recently introduced new restrictions to curb credit card cash-outs and transfers. They have implemented a transferable and non-transferable eWallet balance which restricts certain funds from being transferred to other eWallets or bank accounts if you’ve hit your monthly quota.

[ SOURCE ]