As announced by the Malaysian government, all eligible Malaysians will receive RM30 under the eTunai Rakyat program. The digital stimulus will be distributed via three popular eWallet platforms in the country and you can redeem it starting today, 15th January 2020.

When can you redeem?

The RM30 eWallet credit redemption will begin starting 8am on 15th January 2020. The eTunai Rakyat program will be running for two months and it will end on 14th March 2020.

Who is eligible?

The eTunai Rakyat program is applicable to all Malaysian citizens aged 18-years-old and above, and has an annual income of less than RM100,000. Each Malaysian can only redeem the RM30 credit once regardless of how many eWallets you have.

How can you redeem the RM30?

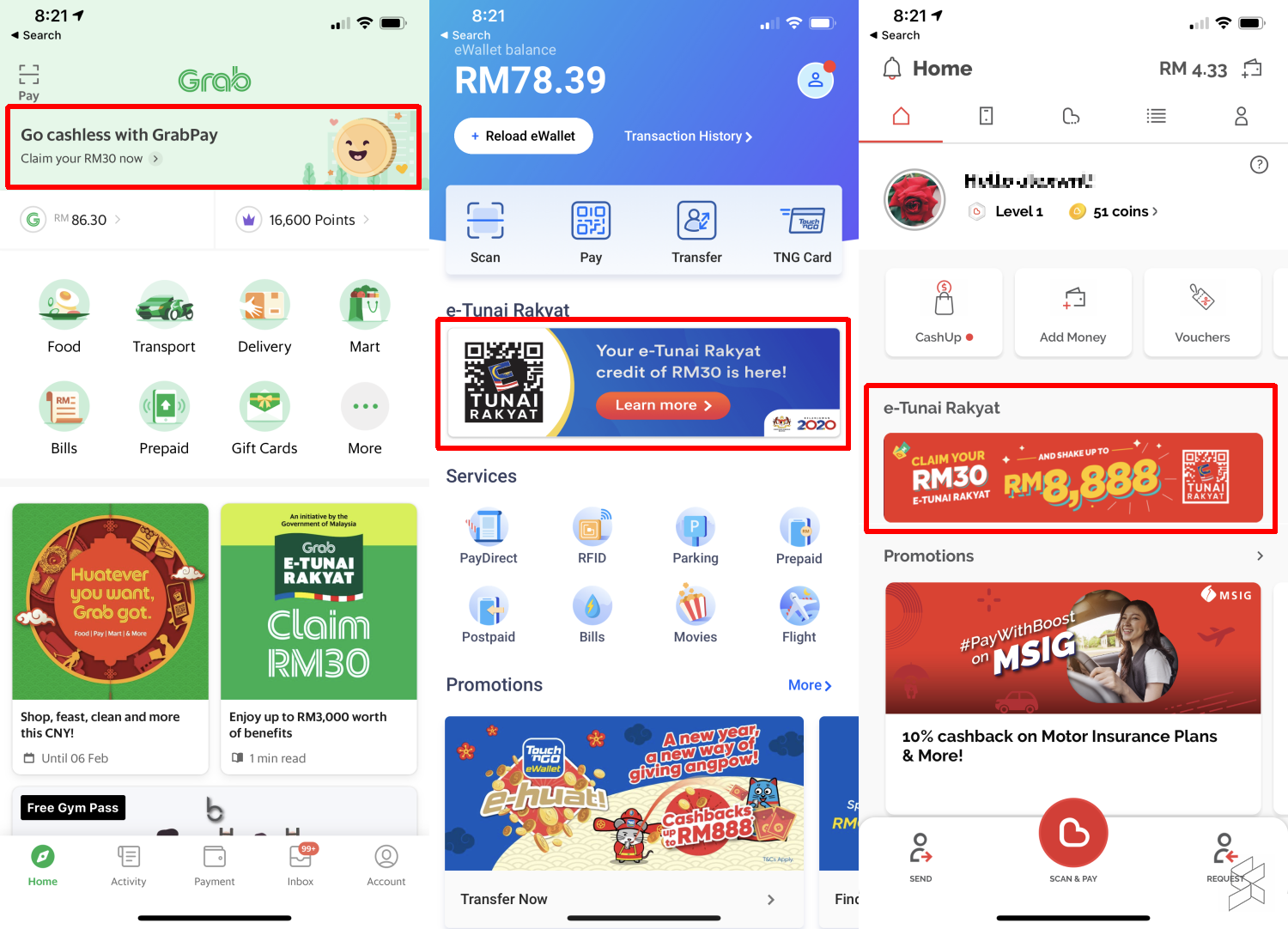

First, you must have one of the following eWallets:

Boost – Android, iOS

Grab – Android, iOS

Touch ‘n Go eWallet – Android, iOS

Then, you’ll need to verify your eWallet using your IC. The eWallet placement will also require a facial verification in the form of a selfie.

Once that’s done, there should be a link in the app which allows you to claim the RM30 incentive. You can start spending the credit once you’ve redeemed it successfully.

What can you use it for?

You can use the RM30 to spend at any supported eWallet merchants or use it for in-app services in the respective platforms such as GrabCar, GrabFood, RFID toll payments or book movie tickets. If you still don’t know which eWallet to get, you can check out our comparison.

The RM30 credit is only valid until the 14th of March 2020. Any leftover balance will be forfeited on 15th March 2020. Take note that you can’t transfer the RM30 credit to other eWallets and it must be spent from the same account.

Why is the Government doing this?

As announced during the last budget tabling, the eTunai Rakyat aims to promote the use of cashless transactions for both consumer and small businesses. They have allocated RM450 million for this initiative which will benefit 15 million Malaysians.

The government has appointed Khazanah Nasional Berhad to facilitate the initiative and they are working closely with the National Registration Department and the Inland Revenue Board.