Earlier this month, Alex wrote about a new mobile money transfer service called DuitNow — the service allows users to transfer funds just by using the recipient’s mobile number as a reference, with no bank account numbers required. The service is not yet available but banks have already started enrolling customers into the system automatically. Today, we find out that the service will be available for the public by this December.

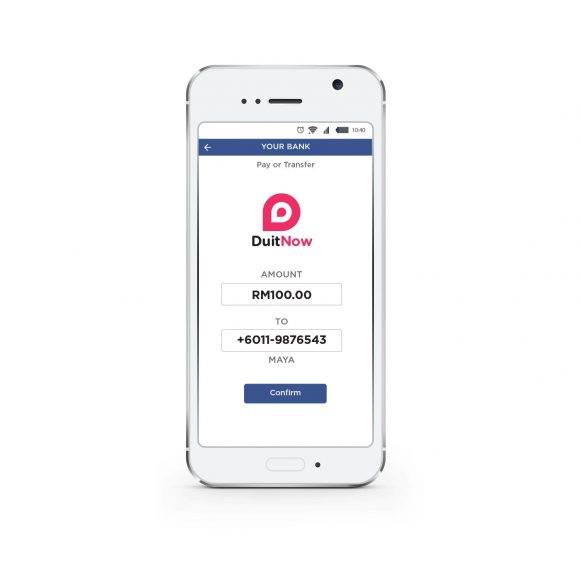

DuitNow is an interbank fund transfer service that allows customers to transfer money securely and instantly using a recipient’s personal information that is easy to memorise, like a mobile number. Instead of using your bank account number, DuitNow uses other means of identification. In this case, it could be your mobile phone number, your IC number or passport number. The idea behind this is that DuitNow makes transfers easy and quick as you don’t have to pull our your bank account number everytime you need to do a transfer.

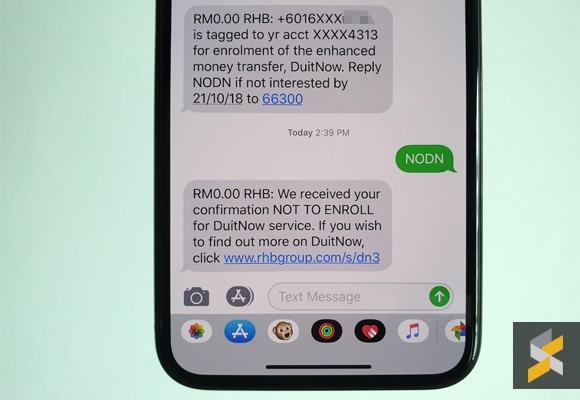

According to PayNet’s Group Chief Executive Officer Peter Schiesser (PayNet is the company developing the service under Bank Negara Malaysia), a few banks in Malaysia has already started opting-in their customers for the DuitNow service as part of a pre-registration registration exercise. Currently, there are two ways in which customers can choose to enroll to the service — either an “opt-in” or “opt-out” approach. “Opt-in” approach indicates that customers indicate that they would like to register for the service while an “opt-out” approach means the banks automatically enrolled customers into the service.

If your bank is taking an “opt-in” approach, you will see a registration screen after you login to the Internet Banking or Mobile Banking portal of your bank. You will also receive notifications via SMS and/or email inviting you to register for the service. If your bank is taking an “opt-out” approach, you will receive notifications via SMS and/or email indicating that your bank account will automatically be linked with any of your personal ID to receive incoming DuitNow payments and if you do not want to be enrolled for the service you will have to explicitly indicate that you are opting out. However, if you do not respond to the “opt-out” message, you will be deemed as agreeing to be registered for the service. Once the registration is successful, your bank will notify you. At the moment, only one bank account can be linked to one mobile number.

DuitNow is expected to be available to the public in December this year. To make transactions, customers can access DuitNow under ‘fund transfer’ menu from their respective banks Internet and mobile banking portals. Transfers of up to RM5,000 is free for consumers and Small and Medium Enterprises. For big businesses, banks may introduce fees in the future.

To learn more about DuitNow, you can read our detailed post here.

[SOURCE]