This post is brought to you by PayNet.

Let’s talk about something that’s been quietly changing the way we live – going cashless. Have you noticed how often we reach for our phones or cards instead of digging around for coins and notes?

It’s not just us; the world is embracing this shift, and honestly, it’s exciting. Let us break it down for you.

The Rise of Cashless Payments

Think about it: how often do you even carry cash anymore? Whether splitting a bill with friends or paying for groceries, apps and digital wallets are making life a whole lot easier. This trend has been fueled by technology – from contactless cards to apps like Samsung Pay and Touch n’ Go eWallet.

Let’s not forget how the pandemic gave it a massive push. Nobody wanted to touch cash when we were all sanitizing everything, right?

Closer to home, DuitNow QR has played a massive role in making cashless transactions seamless across Malaysia. Whether buying a cup of kopi at the mamak or paying for a haircut, all you need is a quick scan.

Plus, with the Malaysian government pushing its digitalisation agenda through initiatives like MyDigital, we’re seeing an even stronger push towards a cashless society.

Why Go Cashless? Here’s Why It’s Awesome

Convenience That Can’t Be Beat

First off, cashless payments are just faster. No more fumbling for exact change or waiting for the cashier to count your money. You just tap, scan, or click, and you’re good to go.

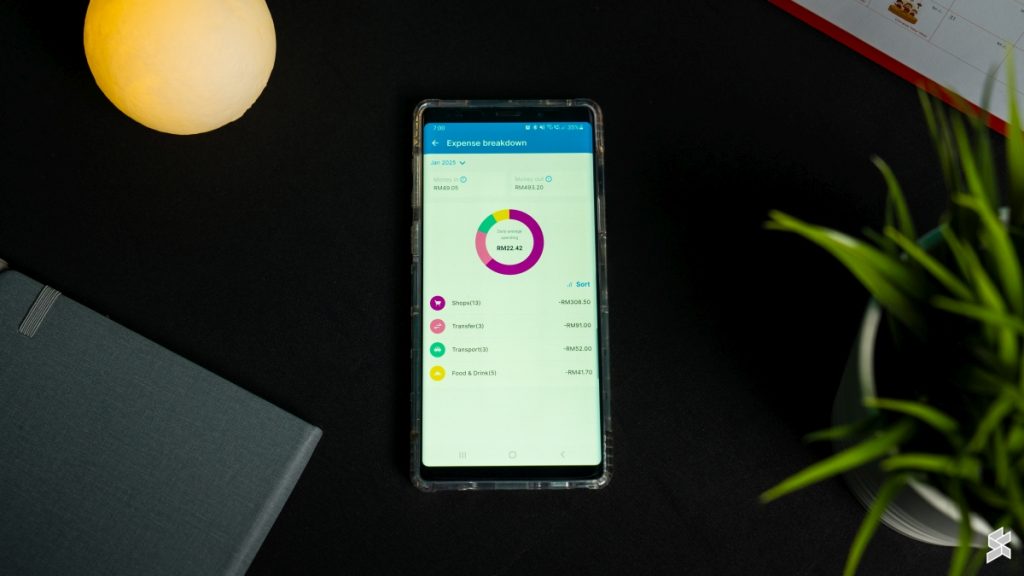

Plus, it’s super easy to track your spending because every transaction leaves a digital trail. It’s like having a personal financial assistant, helping you see exactly where your money is going.

Whether it’s tracking monthly subscriptions or spotting overspending on takeout, these digital trails make budgeting and financial planning so much easier. Goodbye, mystery expenses!

Safer Than You Think

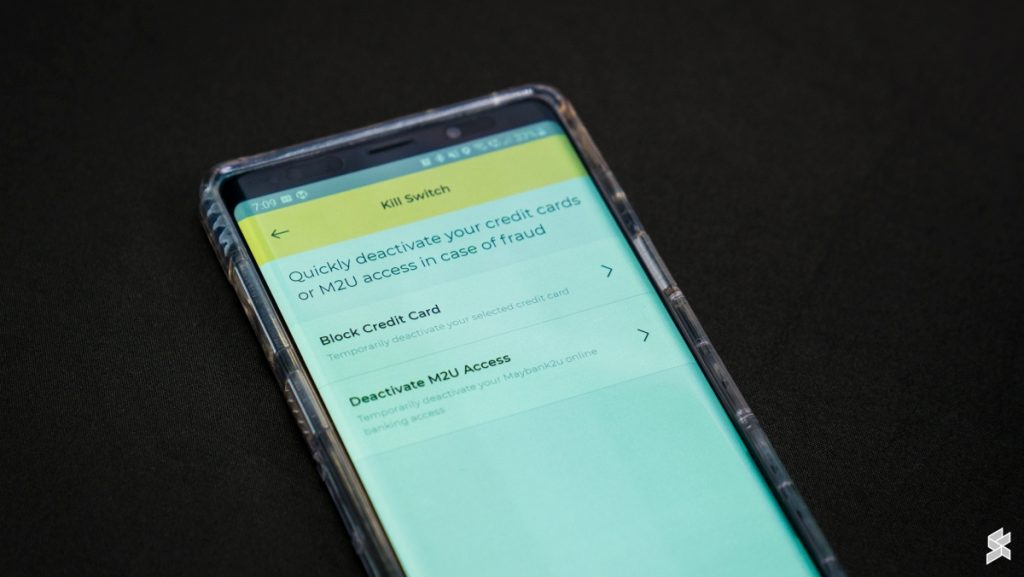

Carrying cash can be risky. With digital payments, there’s no fear of losing your wallet and with it, all your money. Most apps and cards come with built-in security features like PINs, biometrics, and fraud alerts.

It’s like having a digital bodyguard for your finances, offering a level of security that cash simply can’t match. While cash can be lost or stolen without a trace, digital payments often come with fraud detection, recovery mechanisms, and multi-layered protection.

And here’s a cool thing: cashless payments are great for public health. Less handling of cash means fewer germs being passed around. If you’ve ever cringed at the thought of how many hands a dollar bill has passed through, you know what we mean.

A Game Changer for the Unbanked

One of the biggest benefits of cashless payments is financial inclusion. In Malaysia, many in rural communities or from lower-income groups may not have access to traditional bank accounts, but eWallets like TnG eWallet provide them with a way to participate in the digital economy.

With just a smartphone, they can send and receive money, pay bills, and even access financial services that were previously out of reach.

More Profit Margin for Business!

Handling cash costs money. Businesses need to store it, transport it, and sometimes even pay fees to deposit it. Going cashless cuts down on these costs, and those savings can mean better deals or perks for us consumers. Win-win, right?

But wait, there’s more. Going cashless isn’t just about convenience and security. It’s also a boon for businesses. They can serve more customers faster, reduce errors in counting cash, and even encourage us to spend a little more – let’s face it, tapping a card feels less “real” than handing over cash.

Is It All Sunshine and Rainbows?

Of course, there are challenges. Not everyone has access to smartphones or bank accounts, which can leave some people behind. And then there’s the risk of cyberattacks. But with better technology and policies, these hurdles can be overcome.

One key aspect of making cashless payments truly inclusive is building digital literacy. While younger generations may find it second nature, seniors and those in rural areas may struggle with the transition. Education and outreach programs can help bridge this gap, ensuring that no one is left behind in the shift to a digital-first economy.

So, What’s the Verdict?

Going cashless is like stepping into the future. Imagine a world where payments are seamless across borders, where physical wallets are relics of the past, and every transaction is as simple as a tap on your smartwatch.

With innovations like blockchain and biometric authentication, the possibilities are endless – from faster global trade to entirely cash-free cities. It’s a future that’s not just convenient but also empowering. It’s convenient, secure, and just makes life easier.

Sure, we’ll still need cash now and then – like at that one hawker stall that doesn’t take anything but small change – but for most things, cashless is where it’s at.

Slim Down Your Wallet, Not Your Options

Embracing a cashless lifestyle doesn’t mean ditching your wallet entirely. It means carrying a compact version that holds just the essentials – your ID, a couple of cards, and maybe a few emergency bills. It’s all about being prepared while enjoying the perks of a cashless world.

The shift to cashless payments isn’t just a trend; it’s a lifestyle upgrade. It simplifies daily transactions, offers peace of mind with secure systems, and supports businesses and sustainability goals.

So next time you’re about to pay, why not give your digital wallet a try? You might just find yourself wondering why you didn’t switch sooner. With options like DuitNow QR and other seamless payment methods, the future is literally at your fingertips.