Alliance Bank has announced that its Visa credit card holders can now add their cards to Samsung Pay and Google Pay. This includes its Visa Platinum Virtual Credit Card which boasts a unique Dynamic Card Number feature that offers enhanced security for online transactions.

With Samsung Pay and Google Pay integration, Alliance Bank Visa card holders can make convenient and secure contactless transactions via their smartphones using NFC technology.

Launched in April 2023, Alliance Bank is the first bank in Malaysia to offer dynamic virtual card numbers which enables users to create different 16-digit credit card numbers for various subscriptions and online platforms as well as one-time use numbers for eCommerce transactions. Today, they announced that they are the first to integrate their virtual credit cards with Samsung Wallet.

To add your Alliance Bank virtual card to Samsung Pay is quite straight forward. On the Alliance Bank app, there’s a prominent Samsung Pay logo. Just tap on it and then tap to add the card to Samsung Wallet and you’re done.

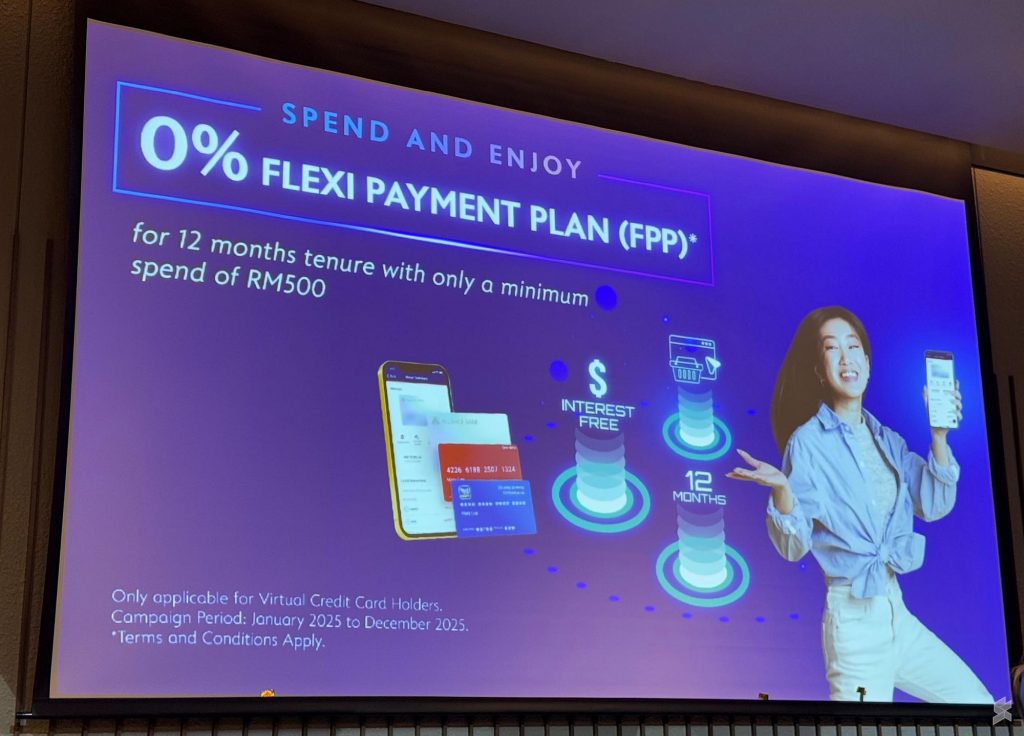

Alliance Bank also has a 0% flexi payment plan (FPP) for its virtual card holders where you can convert recently transacted amounts into 12 month 0% interest instalments with a minimum spend of RM500. This offer is available from January until December 2025.

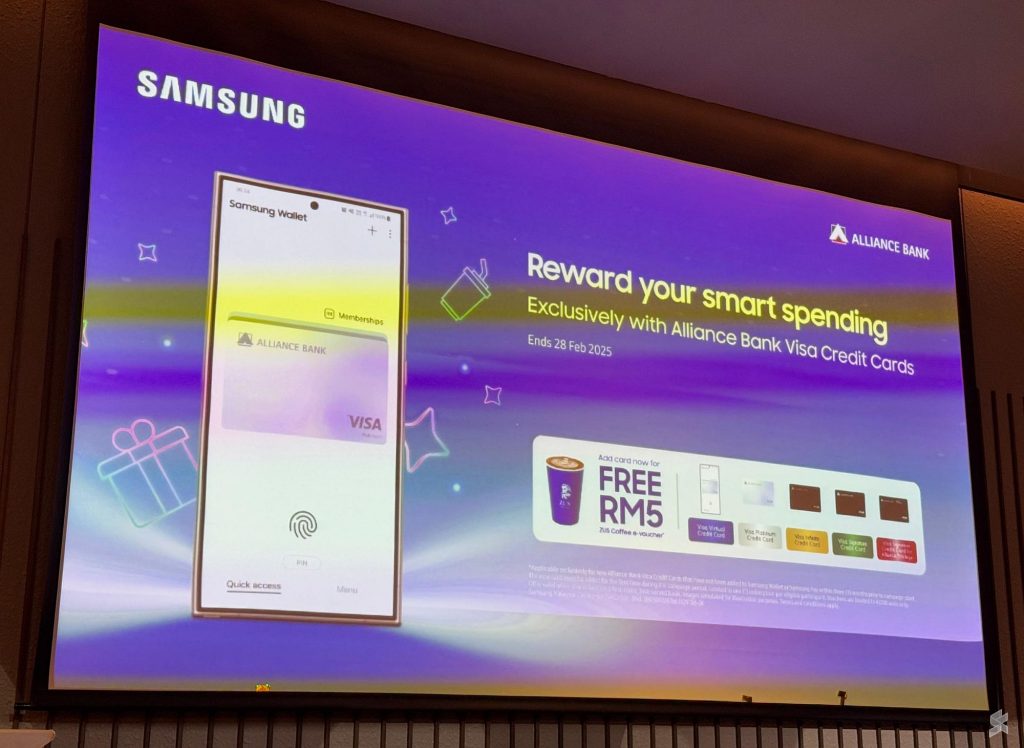

From 9th January to 28th February 2025, users who add Alliance Bank cards to Samsung Wallet will receive a RM5 eVoucher at selected merchants. On top of that, the top 15 Alliance Bank card spenders using Samsung Pay during the campaign period will stand a chance to win attractive Samsung prizes which include a Samsung Galaxy Z Fold 6 (256GB), Samsung Galaxy Z Flip 6 (256GB), Galaxy Watch 7 (40mm) and more.

Alliance Bank Visa Credit Card users will also enjoy Buy 1 Free 1 ice cream scoop offer when they pay using Samsung Pay or Google Pay at Inside Scoop stores, until March 2025. Users can also get extra rewards for spending including a free RM5 Zus voucher.

Commenting on the integration, Alliance Bank Group CEO Kellee Kam said, “We continuously innovate our customer-centric propositions to deliver greater value and convenience. In today’s fast-paced world, security and ease of transaction are paramount when transacting digitally.

With Samsung Pay and Google Pay integrated across all our Visa credit card products, including the Visa Platinum Virtual Credit Card with its unique card number generation, customers can now enjoy the same level of high security and flexibility for in-store payments as they do for online transactions. This further strengthens our position as a trusted partner for our customers throughout their financial journey, in line with our brand purpose of being The Bank For Life.”

Meanwhile, Samsung Malaysia Electronics President Charles Kim said, “Samsung is dedicated to revolutionising the future of mobile

technology. Through this dynamic partnership with Alliance Bank, users are able to conduct transactions effortlessly and securely with Samsung Wallet. Samsung seeks to eliminate the trade-off between convenience and security, creating an ecosystem where intuitive mobile experiences coexist with cutting-edge safeguards.”