Boost Bank is Malaysia’s third digital bank launched early this month. At the time of writing, the Boost Bank app only offers a savings account as it has yet to offer any spending options as it lacks DuitNow QR support or debit cards for the general public.

Unlike other digital banks such as GXBank and Aeon Bank, the Boost Bank experience seems overly complicated. Here’s our experience with Boost Bank after using it for close to three weeks.

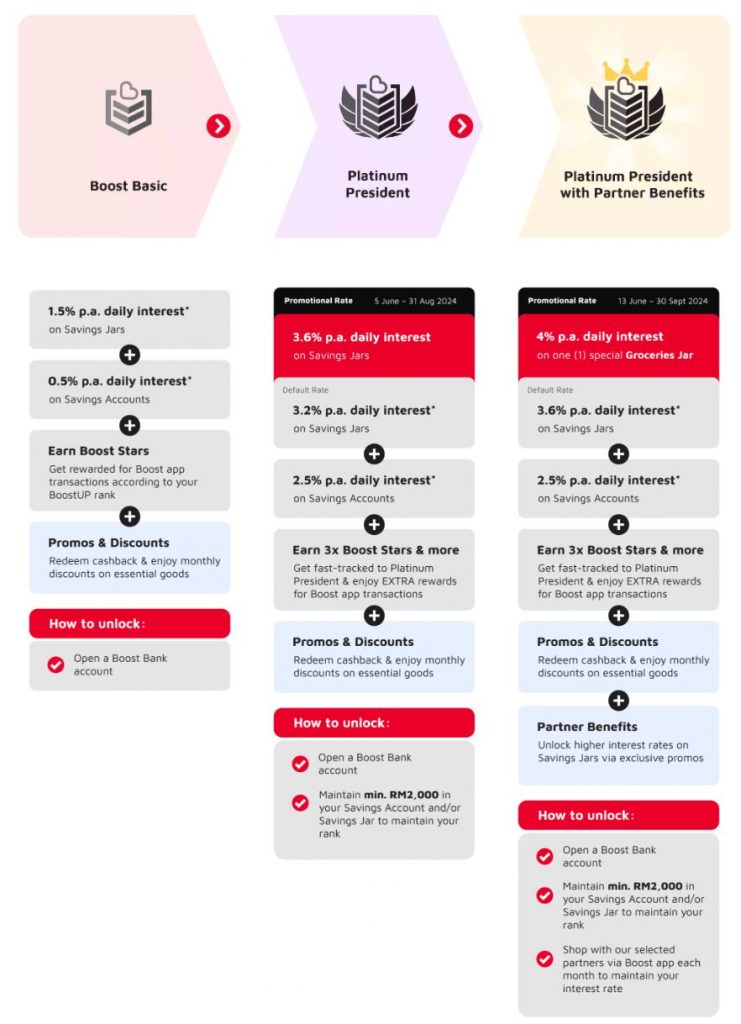

Convoluted tier system for interest rates

To attract new sign-ups and deposits, Boost Bank is offering attractive daily interest rates of up to 4% per annum (p.a.). However, there are extra tiers that you would need to unlock which involves keeping a minimum deposit and committing to a minimum spend at their partner stores.

On the base level, Boost Bank customers start with the Boost Basic tier which only offers a 0.5% p.a. daily interest for the Savings Account and 1.5% p.a. daily interest for the Savings Jar. The Savings Jar is a Savings-focused sub-account to help you achieve personal financial goals such as saving up for a holiday trip or back up funds for a rainy day.

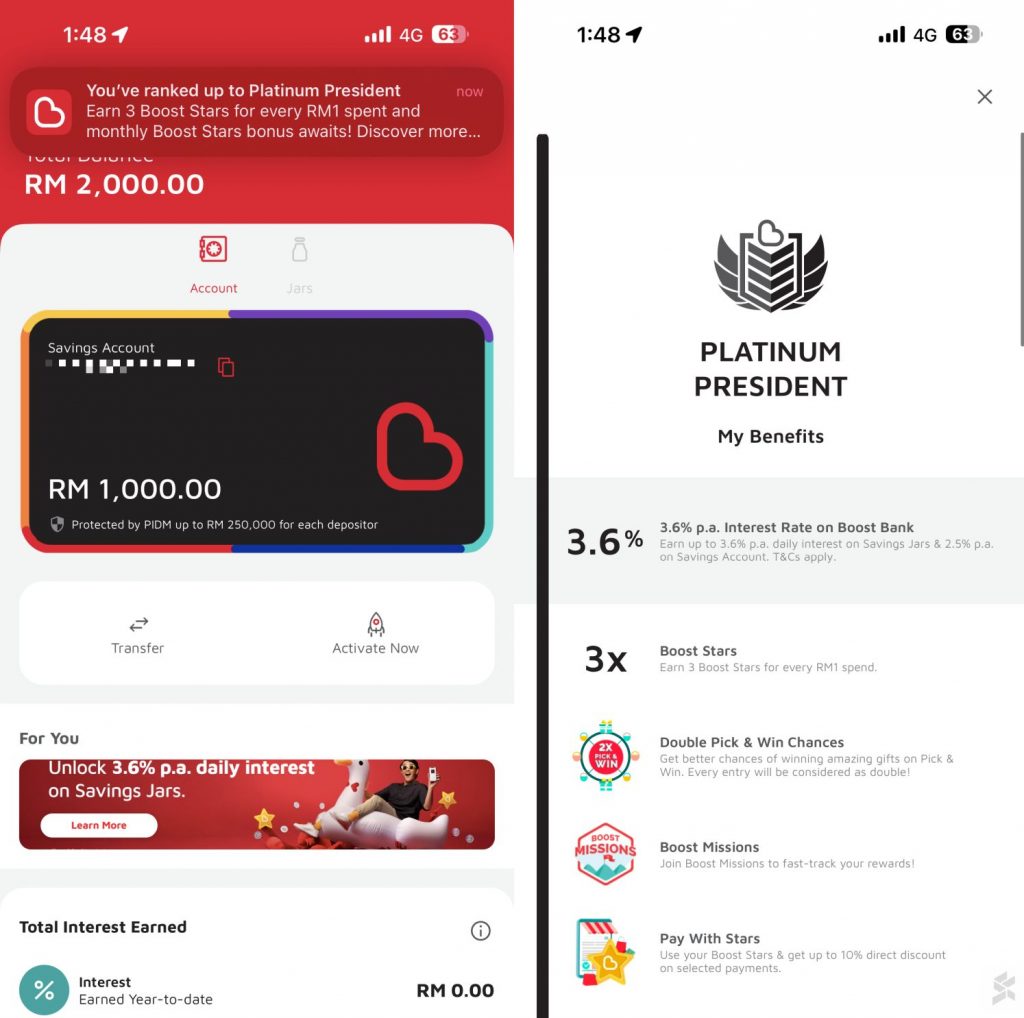

To enjoy a higher interest rate, you can unlock the Platinum President tier by making a minimum deposit of RM2,000. Once upgraded, you’ll get a higher 2.5% p.a. daily interest on the Savings Account and 3.2% p.a. daily interest for the Savings Jar. As part of Boost Bank’s introductory promotion, they are offering a higher 3.6% p.a. daily interest for the Savings Jar until 31st August 2024.

However, do note that you’ll need to maintain a minimum of RM2,000 balance for at least 25 days within the current calendar month to retain the Platinum President tier for the subsequent months. If you fail to meet the requirement, your account status will be downgraded back to Boost Basic.

The interest for the Savings Accounts and Savings Jars is calculated daily, but it is credited weekly on the anniversary of the Savings Account opening date and each Saving Jar’s opening date.

Complicated steps to unlock slightly higher interest rates

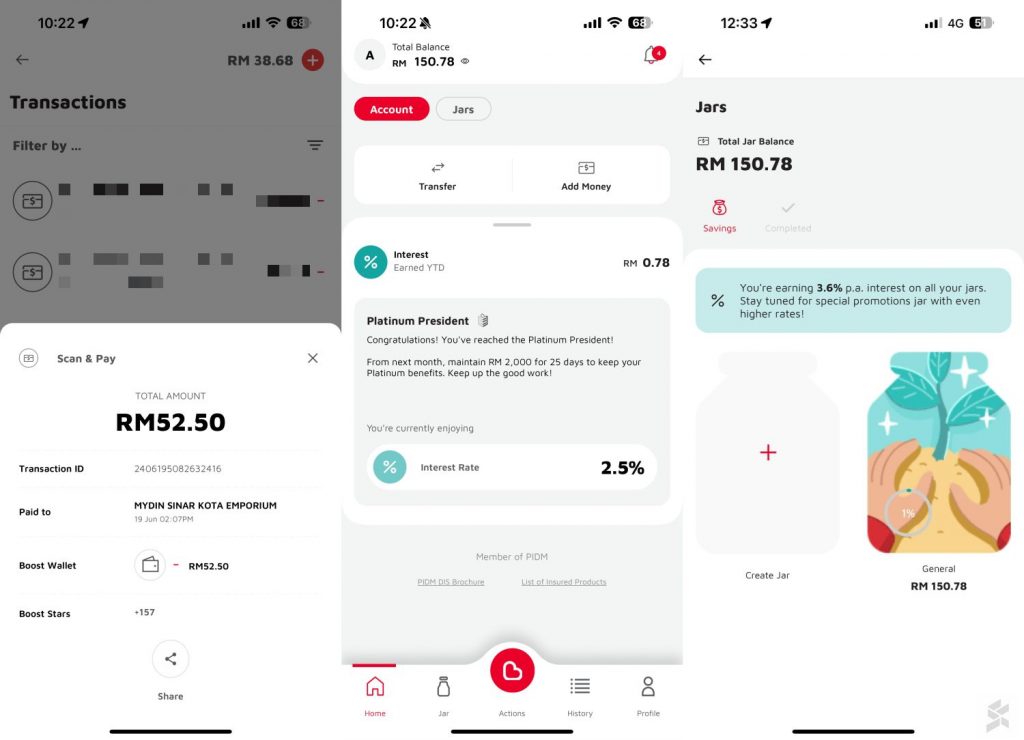

If you want to enjoy an even higher interest rate, Boost Bank has a Platinum President with Partner Benefits tier which offers 4.0% p.a. daily interest for the Savings Jar. To unlock this promo, you’ll need to spend a minimum of RM50 with Boost eWallet (not Boost Bank app) on a single receipt each month with a participating merchant partner.

For now, there’s only Mydin as their participating partner and other partners such as CelcomDigi, Servay, Bataras, CKS, Farley and Boulevard are listed as coming soon. The promo runs from 13th June until 30th September 2024.

To find out how easy it is to unlock the 4.0% p.a. daily interest for Savings Jar, we spent RM52.50 at Mydin Sinar Kota in Kuala Lumpur using our Boost eWallet.

The payment experience using Boost eWallet wasn’t as seamless as expected. When we told the cashier that we were paying with Boost after all items were scanned, the cashier had to call her supervisor to cancel all items and rescan all items again. Apparently, we were supposed to inform the cashier that we are paying with Boost before she started scanning the items.

We’ve not used Boost eWallet since the pandemic but the experience was very weird indeed.

According to Boost, a special Jar labeled “Groceries Jar” will automatically appear on our Jars page within one working day. However, it is nearly a week (19th June) since our transaction, but we still didn’t get the extra jar to enjoy the 4.0% p.a. daily interest. We’ve contacted Boost Bank customer service on Monday (24th June) but we have yet to hear from them.

As far as we can tell, we have fulfilled all criteria which includes activating the Platinum President Tier level, linking the Boost eWallet and spending a minimum of RM50 at Mydin. In total, we lost almost 7 days worth of “higher” daily interest.

Boost Bank integration with Boost eWallet is broken

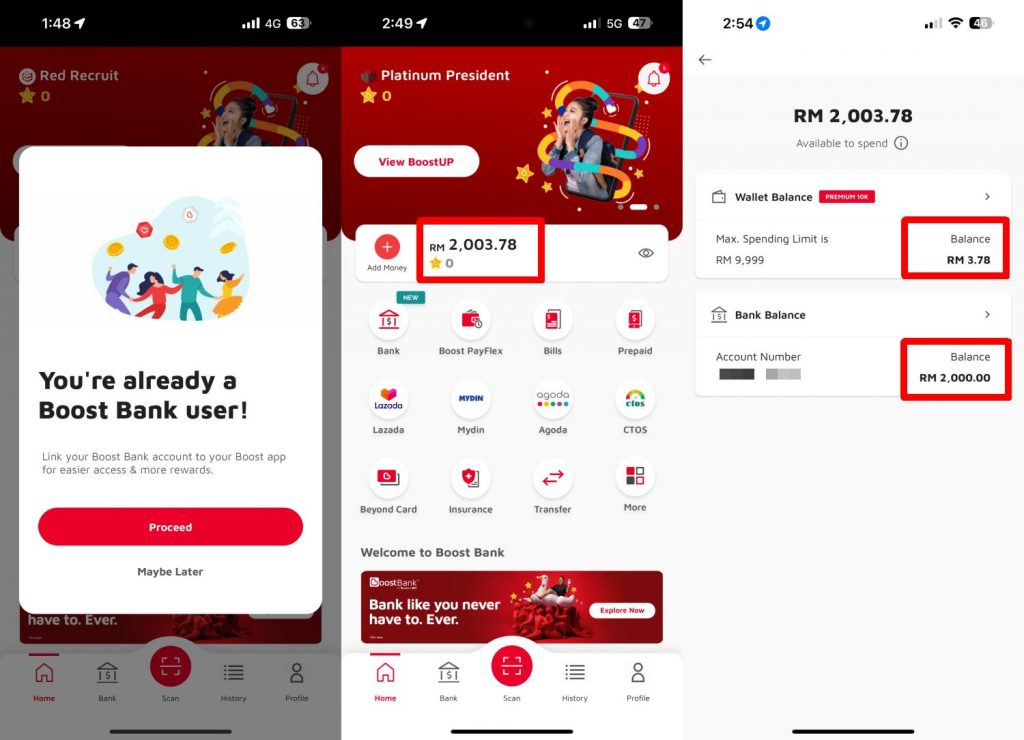

During the launch of Boost Bank, its CEO Fozia Amanulla told us that users can link their Boost Bank account to their Boost eWallet account, and then use the Boost eWallet app to make DuitNow QR payments. This supposedly offers a seamless and integrated experience which is something Boost Bank is proud of. The idea is to have users earn interest with a Boost Bank savings account and then make QR payments using the Boost eWallet app.

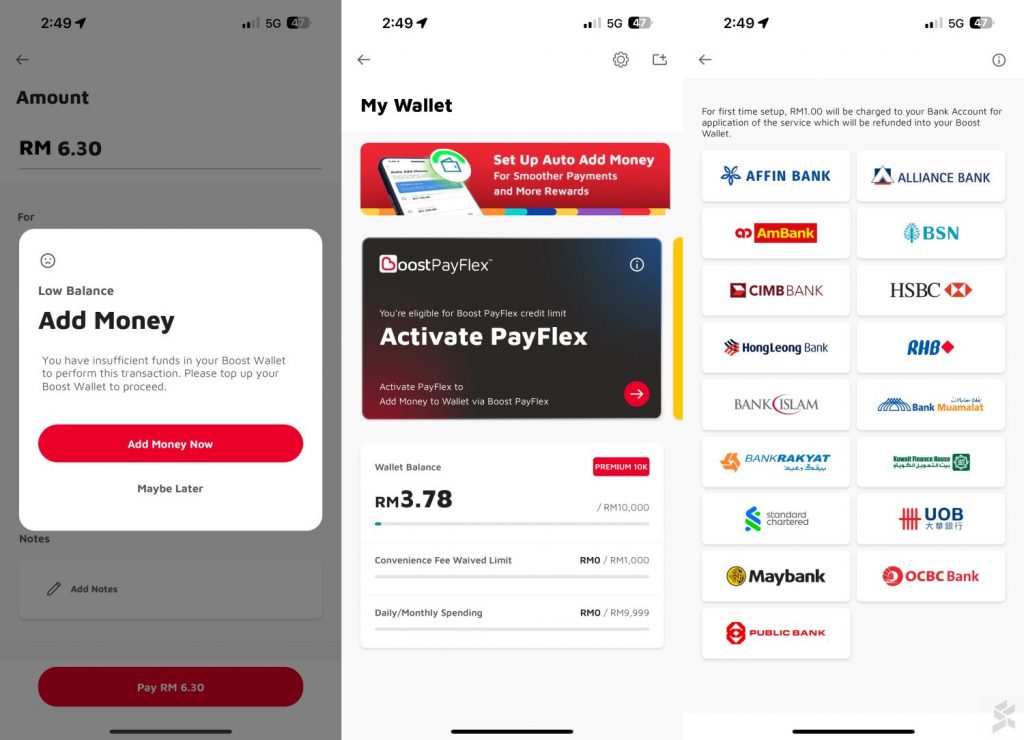

On the surface, it looks integrated as your Boost Bank balance is combined with your Boost eWallet balance once both accounts are linked. As shown above, the Boost eWallet shows RM2,003.78 balance available which consists of RM3.78 from the eWallet and RM2,000 from the Boost Bank Balance.

From a glance, it gives the impression that you can now use Boost eWallet to spend funds from your Boost Bank account balance, but in reality, that’s not the case.

When we tried to make a QR payment, it insisted on using Boost eWallet funds and there’s no option to use your Boost Bank Savings account. This clearly shows that the eWallet app is not integrated with the Bank and the combined balance is just an illusion of integration. So what’s the point of showing the Boost Bank balance when you can’t use it?

To make matters worse, there’s no option to perform a one-time top-up of your Boost eWallet via Boost Bank. If you tap on add money, you can top up from other competing banks such as Maybank, CIMB, RHB and Ambank, but Boost Bank is not even an option which is a huge surprise.

There is one method to top up your Boost eWallet from Boost Bank, but that requires you to set your DuitNow ID (Mobile number) to your Boost eWallet, and then use Boost Bank to perform a DuitNow ID transfer using your phone number. That’s just overly complicated and most people would typically set their DuitNow ID for their preferred primary and active bank account.

Boost Bank needs to cut the clutter

Digital banks are supposed to offer a seamless and frictionless experience for underbanked and unbanked users. With its convoluted tier structure and requirement to maintain RM2,000 balance, we wonder who its main target audience is.

From what we’ve seen so far, it looks like Boost Bank is trying very hard to keep Boost eWallet relevant by cross-promoting usage to unlock extra perks for the Savings Jar. Before they think of that, the very least they could do is to allow its eWallet users to seamlessly top-up or quick pay from their Boost Bank savings account.

In its current state, the whole experience is just messy and it looks less attractive than traditional banks with digital platforms. The 4% p.a. interest promo is just a hassle to activate and maintain, and for us, they have failed to deliver on their promise to enable the 4% p.a. Savings Jar after almost a week. On top of that, their customer service has yet to resolve our complaint after 24 hours, which is another disappointment.

Hopefully, Boost Bank will resolve these issues and rethink how it wants to position itself in the market. Perhaps, Boost Bank should just cut the clutter and focus on what matters to consumers – ease of use, competitive rates with fewer barriers and a seamless payment experience. Boost Bank aims to launch its debit card next month, so hopefully that would address the pain points for spending.