Aeon Bank, Malaysia’s first Islamic digital bank, is now open for public registration. It is also the second digital bank to launch commercially after GXBank.

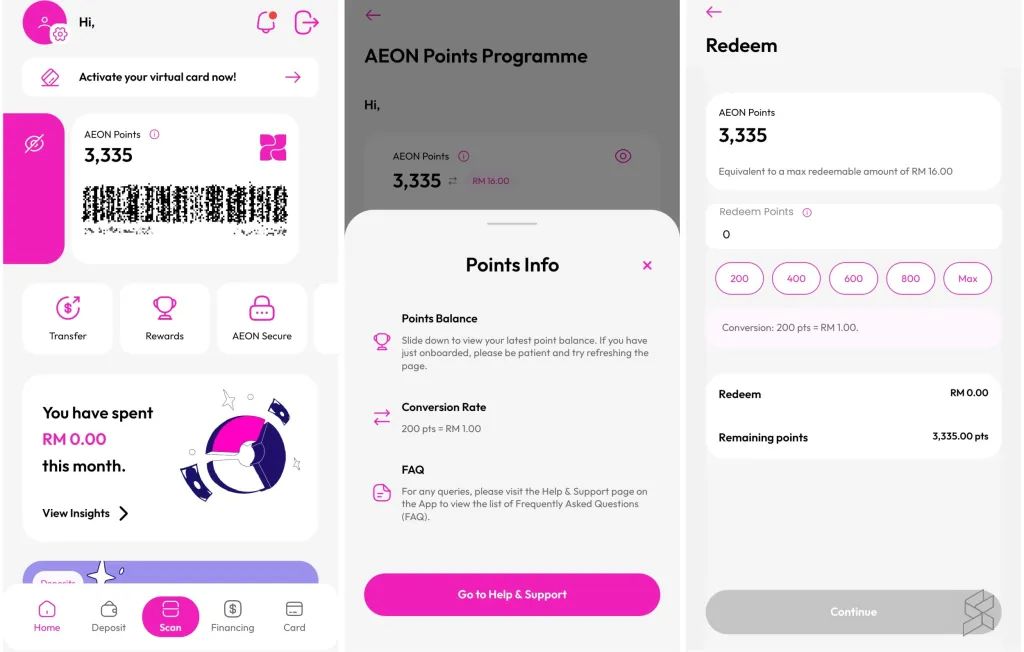

As part of its introductory offer, Aeon Bank is running several promotions including 3,000 Aeon Points upon sign up and 3X Aeon Points when you spend using the Aeon Bank Debit Card-i. In addition, Aeon Bank account holders can enjoy a 3.88% p.a. profit rate during the promo period.

How to sign up for Aeon Bank?

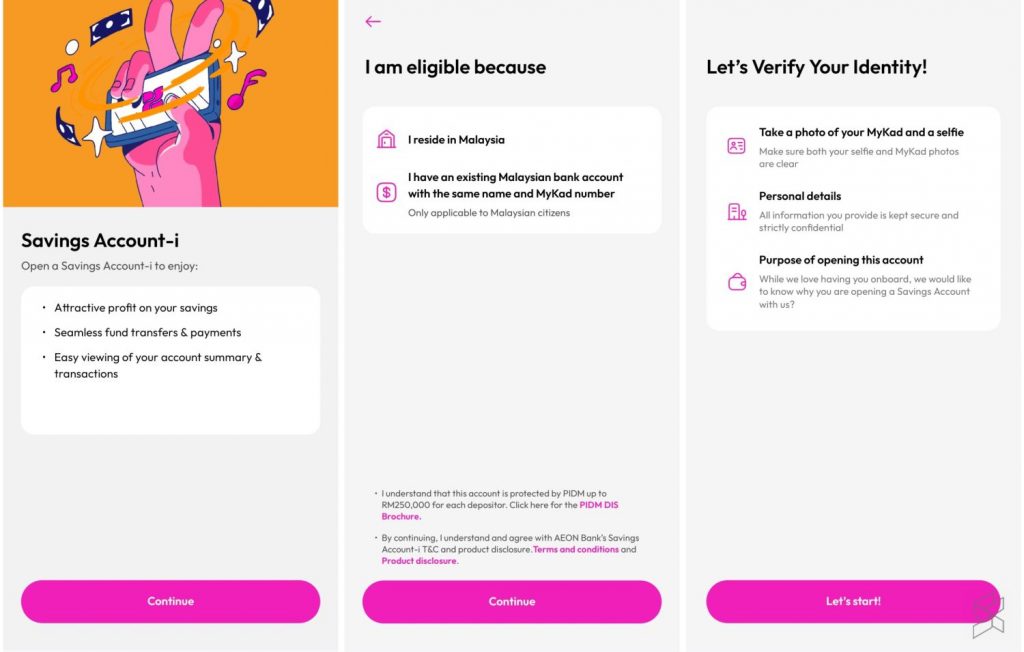

Since Aeon Bank is a digital bank, there are no physical branches and the entire user experience starts from the app. The Aeon Bank app can be downloaded via the Apple AppStore and Google PlayStore.

During sign-up, you’ll need to perform verifications for both your email as well as your mobile number.

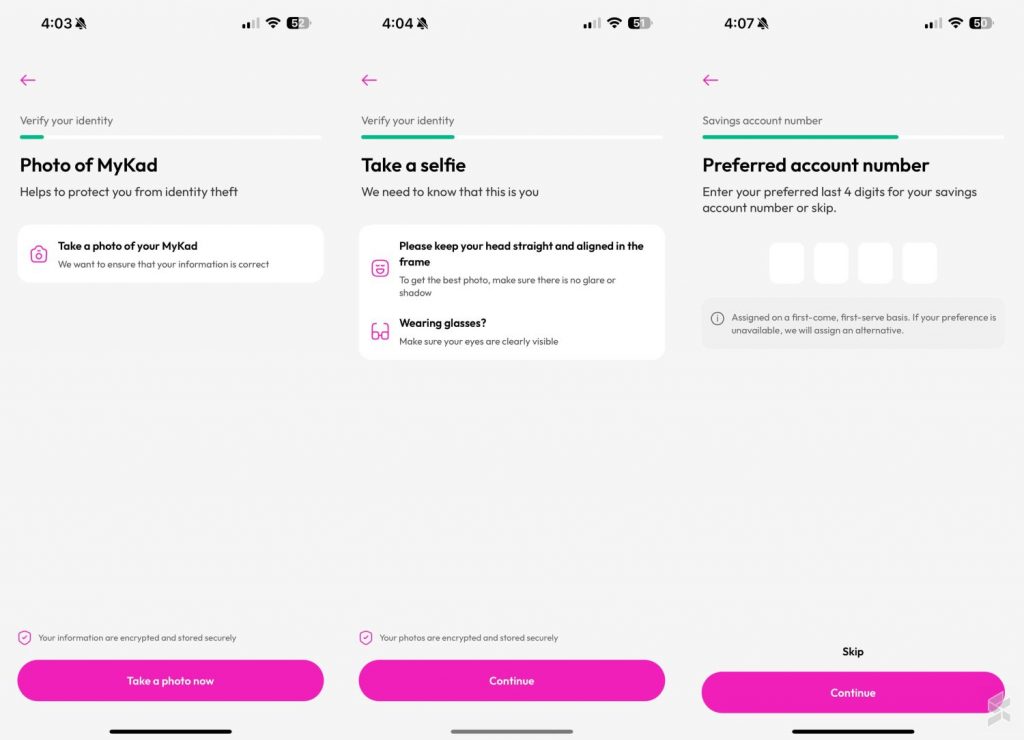

At the moment, Aeon Bank is offered only to Malaysian citizens aged 18 years old and above. To sign up, you’ll need to conduct an e-KYC (electronic know your customer) process which requires you to snap both sides of your MyKad (NRIC) and take a selfie.

Interestingly, Aeon Bank provides the option to request a preferred number for your Aeon Bank Savings Account-i, which is somewhat similar to picking a phone number for telco services. However, the preferred last four digits preference is assigned on a first-come, first-serve basis and are subject to availability.

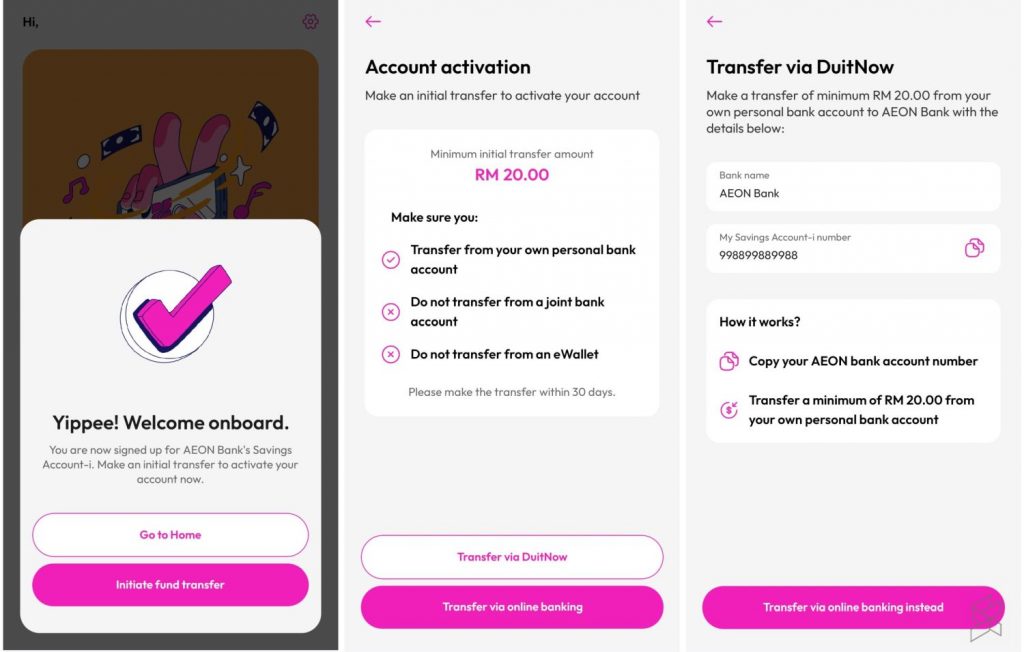

As part of the verification process, you must have an existing Malaysian bank account registered under your name. To activate the account, you will need to perform a bank transfer from your existing bank account to Aeon Bank with a minimum transfer value of RM20.

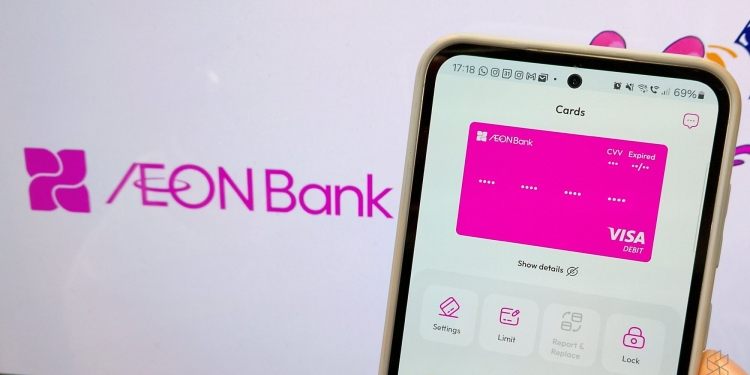

Aeon Bank Debit Card-i

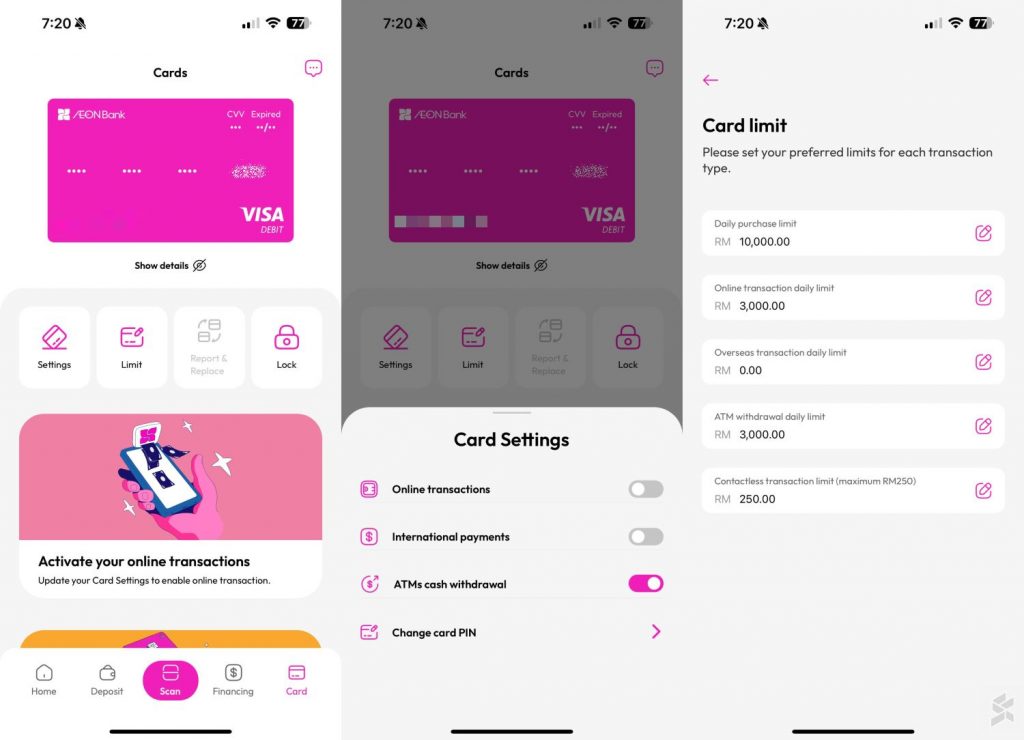

To make payments, you can apply to get the Aeon Bank Debit Card-i after you have successfully opened the Savings account. At the moment, the physical card is offered for free as Aeon Bank is waiving the issuance fee. Unlike the Savings account number, the Visa Debit card number is generated randomly.

While waiting for the card to arrive, you will get a virtual card number which you can use for online or in-app transactions such as eHailing, online shopping and more. The physical card will take 6-10 business days for delivery.

The Aeon Bank app allows you to manage your card usage including setting the card PIN and transaction limits for daily purchase, online transaction, overseas, Visa Paywave and ATM withdrawal limits. If you lose the card, you can block transactions by locking the card from the app. By default, the card is disabled for online and international transactions, but you can change these settings from the app itself.

For now, Aeon Bank Debit Card-i still doesn’t support Apple Pay, Google Wallet or Samsung Pay.

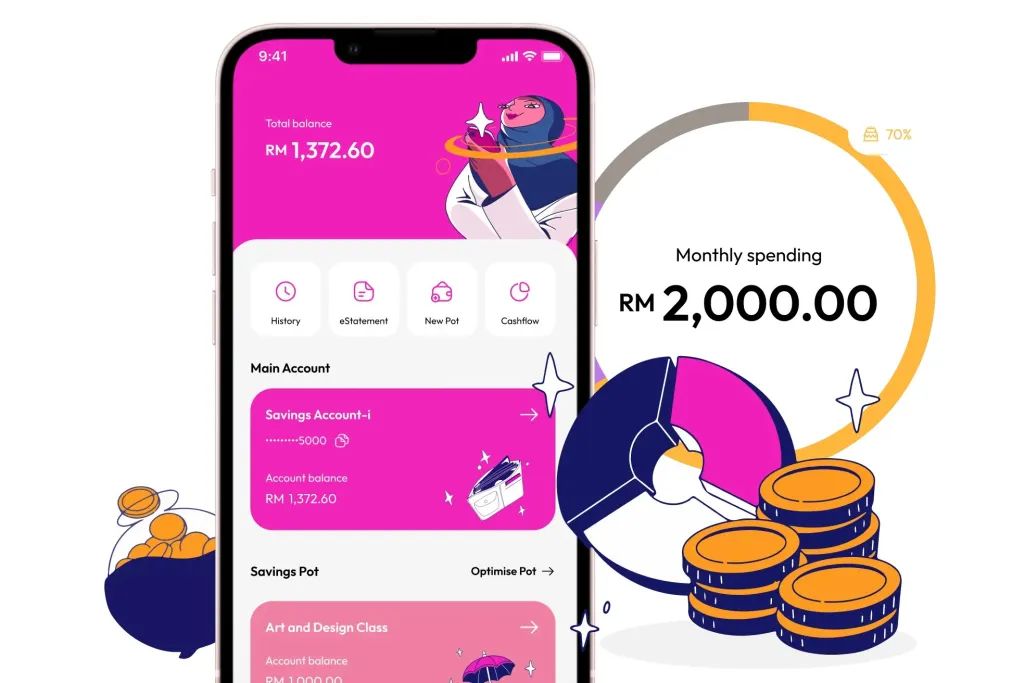

DuitNow QR supported

Besides having a physical and virtual Visa card, Aeon Bank also supports DuitNow QR. This allows you to use your Savings account balance at small merchants that carry the pink DuitNow QR code.

However, do note that you must ensure a minimum balance of RM20 in your account. This means if you have a RM100 balance, you can only spend RM80.

Current Aeon Bank promotion

From now until 31st August 2024, all new Aeon Bank customers will receive 3,000 Aeon Points which can be converted to RM15. This amount will be credited to your Savings Account-i which you can utilise for your spending. The conversion rate is 200 points = RM1.

The second promotion is the 3x Aeon Points promo. Typically, RM1 spent will provide you with 1 points but you can earn 3 points instead when you use the debit card.

The third promotion is its 3.88% p.a. profit rate for your savings account. This rate is applicable for both savings and Savings Pot. The profit rate is added to your account monthly if the amount is at least RM0.01 accumulated.

The fourth promotion is the waiver for the annual Aeon points membership program. Under the campaign, you’ll enjoy the annual RM12 waiver for the first year.

The last promotion is the fee waiver for the debit card which normally costs RM12.

Besides being the first Shariah-compliant digital bank in Malaysia, Aeon Bank is also a member of PIDM which provides protection of up to RM250,000 for each depositor.

For more info, you can visit Aeon Bank’s website and refer to their official FAQ.