Ahead of the 2022 Hangzhou Asian Games, Ant Group welcomes seven new Asian-based eWallet and payment apps to its cross-border mobile payment ecosystem in mainland China. Introduced as “Alipay+ in China” (A+China Program), visitors from Malaysia, Mongolia, Singapore, South Korea, Thailand, Hong Kong SAR and Macao SAR can use their home wallets to pay at merchant touchpoints where Alipay is accepted.

10 eWallets accepted at over 10 million Alipay merchants in China

The new supported eWallet and payment apps include mPay (Macao SAR, China), Hipay (Mongolia), Changi Pay (Singapore), OCBC (Singapore), Naver Pay (South Korea), Toss Pay (South Korea) and TrueMoney (Thailand). This brings the total number of supported eWallets to 10. Kakao Pay (South Korea), AlipayHK (Hong Kong SAR, China) and Malaysia’s very own Touch ‘n Go eWallet, were supported earlier as part of a pilot in late 2022.

According to Ant Group, these additional payment methods reach a population of over 175 million in Southeast and East Asia.

During the cross-border pilot with Kakao Pay, Touch ‘n Go eWallet and AlipayHK, the total number of payments made in China grew 47 times in 6 months between March and August 2023. Shanghai, Guangzhou and Shenzhen are the favourite cities of travellers from South Korea, Malaysia and Hong Kong SAR. The majority of these transactions cover food and beverage, retail and transportation.

With the new cross-border agreement via the Alipay+ network, visitors can use their local payment app at over 10 million Alipay merchants throughout mainland China while enjoying a secure, smooth and cashless payment experience. Users will also enjoy transparent and competitive exchange rates when making cashless transactions in China. They will also enjoy deals and promotions via Alipay+ Rewards, a digital cross-border marketing hub integrated into selected eWallet apps.

Ant Group added that the A+China program is a major initiative to help China internationalise mobile payments through collaboration with eWallet partners, NetsUnion Clearing Corporation, eWallet players, financial institutions and major international card organisations.

Senior Vice President of Ant Group and Head of Alipay+ Cross-border Mobile Payment Services, Douglas Feagin said expanding partners and merchant network, and enhancing digital operational capabilities of SMEs are key to Alipay+’s future strategy.

He added, “A growing variety of mobile payment providers are joining this ecosystem of cross-border digital commerce, from mobile wallets, to banking apps, independent merchant apps and super-apps. We will invest faster and deeper in payment and digital marketing technologies to help our partners and merchants achieve robust, omnichannel growth.”

Chairman and CEO of Ant Group, Eric Jing, said “It is incredibly inspiring to see such regional multi-party partnership help travelers enjoy greater choice and convenience, and small businesses thrive in cross-border commence with unprecedented innovations. We look forward to building wider and deeper collaboration to fulfil our shared mission to make the world a better place with the power of digital technologies.”

Worldwide reach beyond China via Alipay+ global merchant network

Besides enabling seamless payment support in China, the new mobile payment payments such as Hipay, Changi Pay, OCBC, Naver Pay and Toss Pay are now onboard with Alipay+ global merchant network. With its suite of cross-border mobile payment, marketing and digitalisation solutions developed by the International Business Group of Ant Group, Alipay+ enables its payment partners to connect global and local merchants to cross-border consumers.

Outside of China, Alipay+ currently covers 5 million merchants in 56 markets and it works with over 20 mobile payment partners across Asia which collectively serve more than 1.4 billion consumer accounts.

Tourists to China can bind their credit cards via Alipay International app

As an alternative, travellers without an eWallet can also bind their local credit, debit and prepaid cards on the international version of Alipay (Google Play Store, Apple App Store) and enjoy seamless payments and digital services in mainland China. The International Alipay app also provides users access to China’s mini apps which include metro cards and eHailing services.

Unlike the previous Alipay Tour Pass, there’s no need to reload a virtual China-issued prepaid card before making a transaction. The Alipay international app will only charge your bind card for each transaction made.

Raising awareness of supported eWallet acceptance on ground

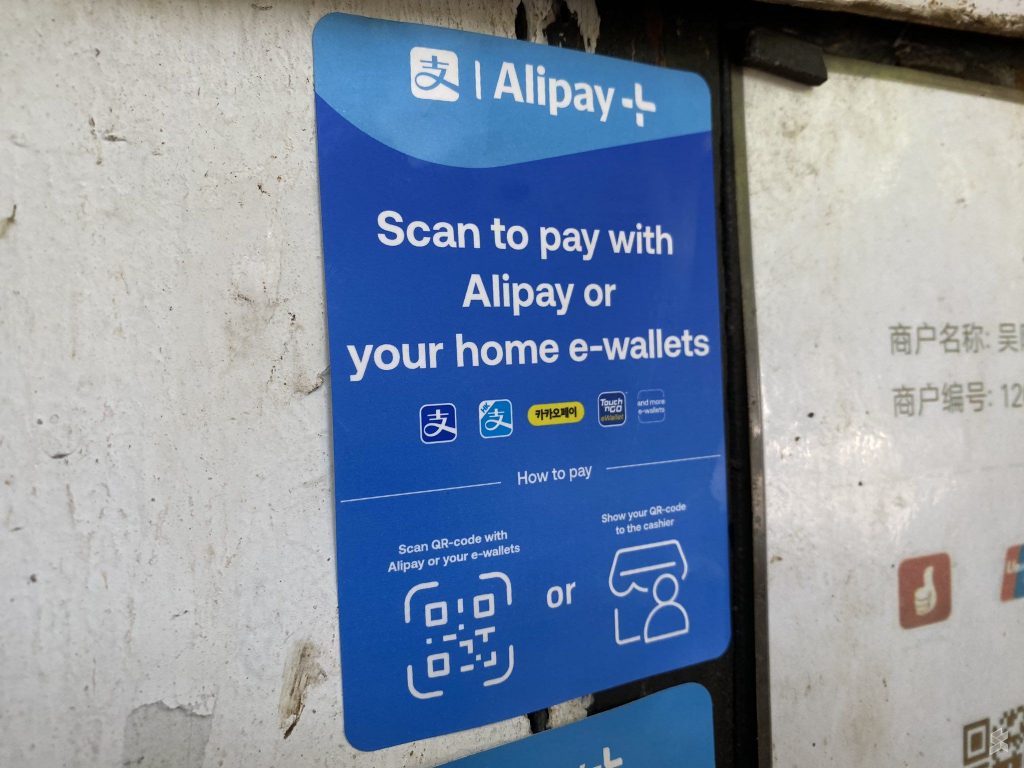

As China anticipates more visitors for the upcoming Asian Games, Ant Group is rolling out extensive merchant education and marketing campaigns across the Chinese mainland, especially in top tourist cities. To raise awareness of foreign eWallet acceptance, several merchants ranging from small businesses to large retail chains will carry Alipay+ new stickers and standees which display supported wallets including Touch ‘n Go eWallet and more.

Users can pay by scanning the merchant’s QR code or by presenting their Alipay+ QR code to the merchant. The experience of using Touch ‘n Go eWallet in mainland China is similar to making a QR code payment in Malaysia.

Last month, Alipay+ and PayNet signed an MoU to expand cross-border payment acceptance. Under the arrangement, merchants with DuitNow QR will soon be able to support more foreign wallets, while more Malaysian eWallets can expand their reach worldwide via the Alipay+ network.