While Samsung continues to slug it out with Apple in the global smartphone sales stakes, the latter has had a lockout on the flagship segment since time immemorial. That’s not surprising given its smaller lineup, the vast majority of which is priced over the USD 500 (around RM2,308) mark—only the iPhone SE starts below it.

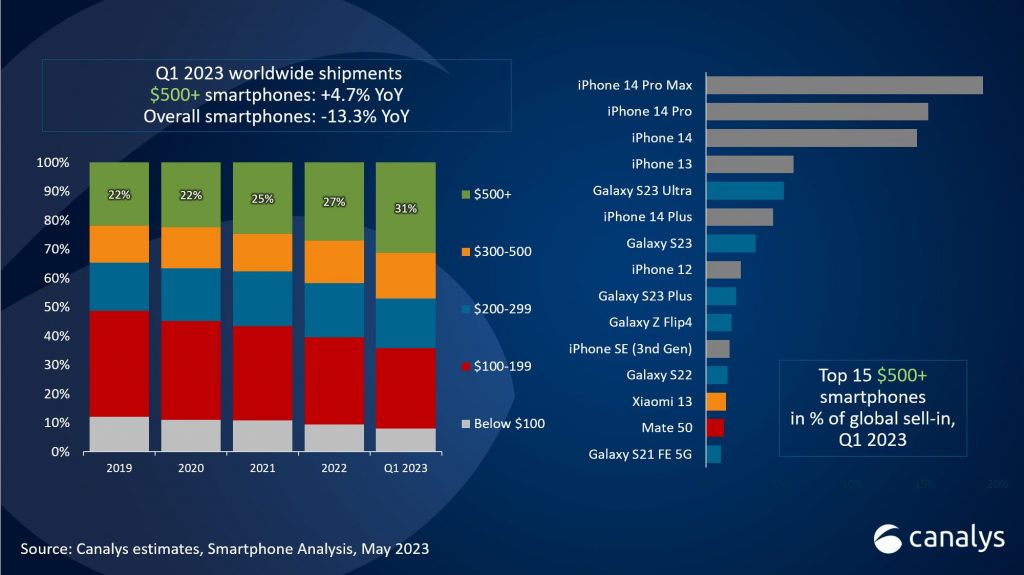

As such, the other smartphone makers have to fight for scraps in the lucrative premium phone market, but there are hints they may be making inroads. Data released by Canelys for the first quarter of 2023 show that the entire Samsung Galaxy S23 series has made it to the top ten list, with the most expensive of them, the S23 Ultra, cracking the top five.

However, it still ranks below four iPhone models—the 14 Pro Max, the 14 Pro, the 14 and last year’s 13—although it did beat the underperforming iPhone 14 Plus. Next up were the vanilla S23, the iPhone 12 and S23 Plus, with the Z Flip 4 rounding off this list, the latter showing that foldables are quickly gaining acceptance among the buying public.

The news comes as the market share of premium smartphones costing more than USD 500 rose to 31% in the first quarter of the year, even as cumulative smartphone sales fell by 13.3% to 269.8 million units during this period. Much of that growth will have been driven by Apple, sales of which increased by three per cent to 58 million units. Cupertino’s global market share is also up three per cent to 21%, meaning that it’s now nipping at the heels of Samsung (which sold 60.3 million smartphones in Q1 2023) at 22%.

Looking at more regional data, Canelys reports that smartphone sales in Southeast Asia fell 21% to 20.9 million units in the first quarter of the year due to continued weak demand. Samsung got hit particularly hard, recording 20% lower sales; despite this, it remains the top smartphone vendor in the region, selling 5.6 million phones. Its market share also grew by a single percentage point to 27%.

Hanging on to second place is Oppo, sales of which fell by just 7% to four million units thanks to the dominance of its midrange A series, claiming a 19% market share (up from 16% during the same period last year). By contrast, Xiaomi’s sales sunk a whopping 37% to 2.5 million units; it barely edged out Vivo (itself down 30%), with both holding a 12% share of the market. Realme brought up the rear of the top five, its sales down 17% to 2.2 million units, although its market share grew marginally to 11%.