Despite the rollout of 5G, fibre broadband remains a crucial mode of connectivity for most Malaysians. With more fibre-passed premises accelerated under JENDELA, Malaysia has recorded an increase of at least 91,000 fibre subscriptions from three major broadband providers – CelcomDigi, Maxis and TM, between January to March 2023.

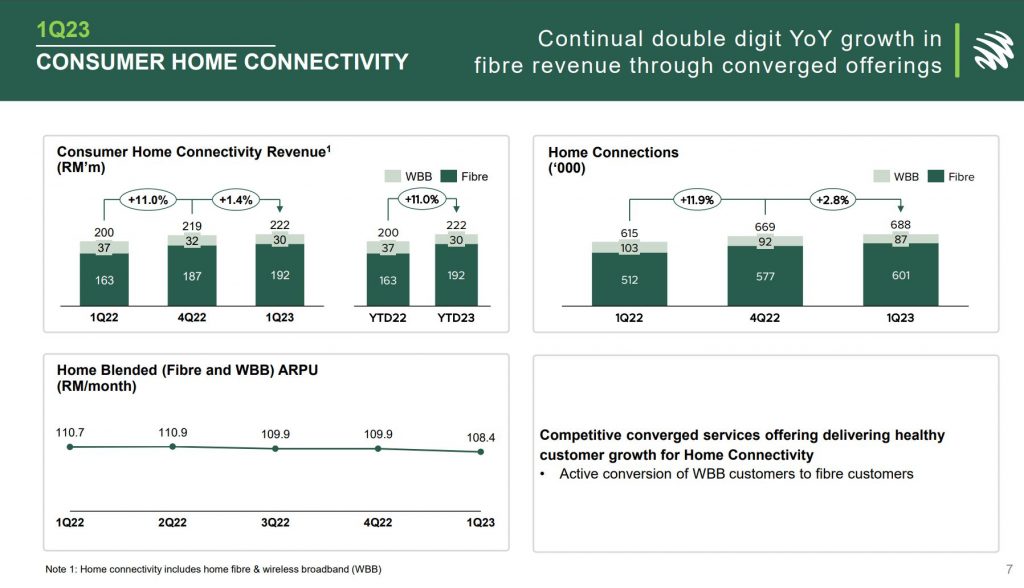

Maxis has over 600,000 home fibre connections

According to Maxis’s Q1 2023 report, it has a total of 688,000 home broadband connections. This includes 601,000 on fibre broadband and 87,000 from wireless broadband. This is an increase of 24,000 fibre connections between Q4 2022 to Q1 2023, and an increase of 89,000 fibre connections between Q1 2022 to Q1 2023.

In the last quarter, the home connectivity business which includes both fibre and wireless broadband generated RM222 million in revenue with an average revenue per user (ARPU) of RM108.44/month. From the report, Maxis says they are actively converting its wireless broadband customers to fibre which helps to deliver customer growth for home connectivity. Besides tapping on various fibre networks such as TM HSBB, Allo, Sacora and Celcom Timur, Maxis also has its own fibre-build areas which can offer higher speeds of 1Gbps.

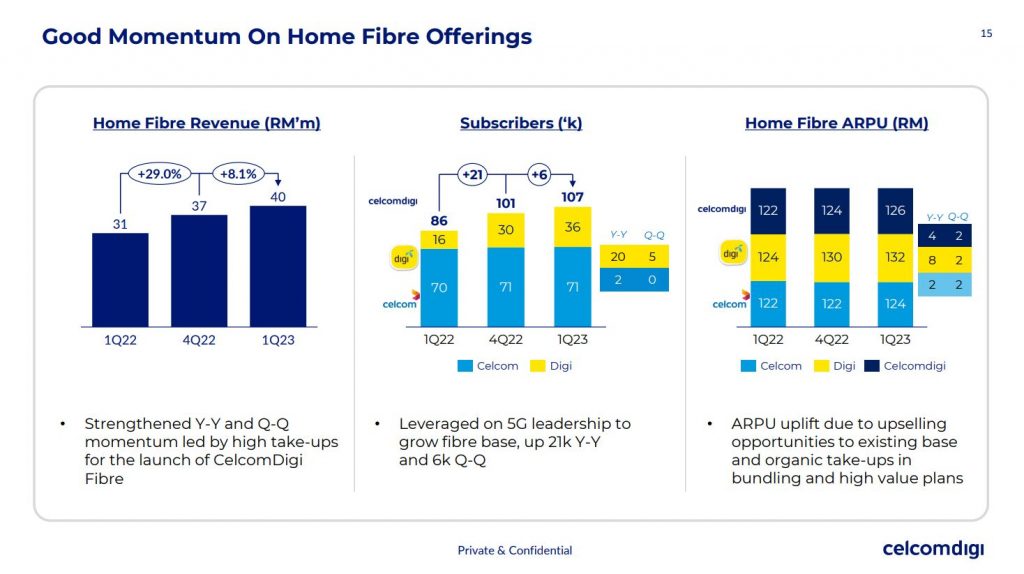

CelcomDigi now has 107,000 fibre customers

Meanwhile, CelcomDigi’s Q1 2023 reported stated that they have increased its fibre broadband subscriptions to 107,000 which includes 71,000 from Celcom and 36,000 from Digi. CelcomDigi collectively added 6,000 fibre connections quarter on quarter and 21,000 fibre connections year on year.

CelcomDigi’s home fibre business generated RM40 million in revenue in Q1 2023 with an ARPU of RM126/month. After the recent merger, both Celcom and Digi have unified their fibre broadband offering with competitive offers for existing postpaid users.

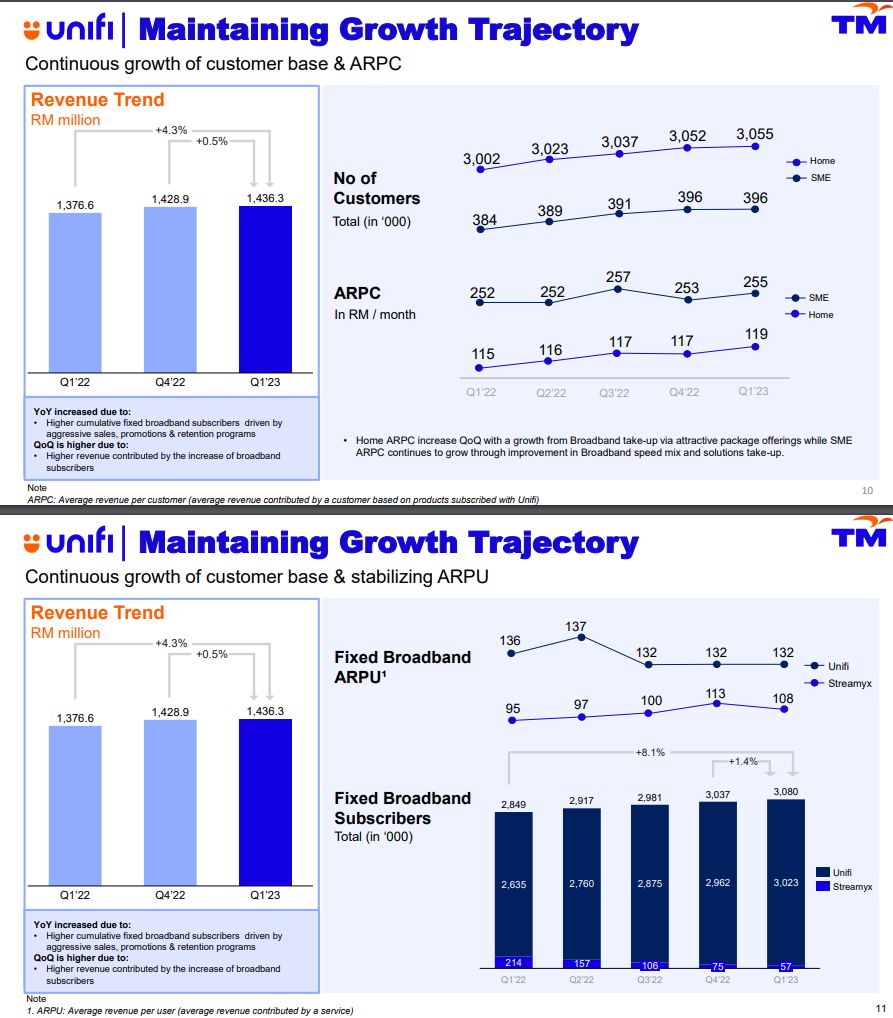

TM added 61,000 Unifi subscribers despite an increase of 3,000 new home customers in Q1 2023

TM which is still the dominant fibre broadband provider currently has 3,080,000 fixed broadband subscribers which include 3,023,000 on Unifi Fibre and 57,000 on Streamyx. Between Q1 2023 and Q4 2022, TM has added 61,000 fibre connections. Meanwhile, between Q1 2022 and Q1 2023, the broadband giant added 388,000 fibre connections.

According to TM’s Q1 2023 report, its Unifi business recorded revenue of RM1.436 billion with an ARPU of RM132/month for Unifi Fibre. Despite an increase of 61,000 fibre connections in the last quarter, the same report recorded a 3,000 increase for Home users (Total: 3,055,000) while the SME segment remains unchanged with 396,000 customers. TM has recently upgraded its Unifi offering with its 1Gbps and 2Gbps options, however, the 2Gbps offered is based on aggregated bandwidth.

Meanwhile, Time dotCom as a group has posted a revenue of RM417.2 million for Q1 2023. However, they don’t provide a clear breakdown of retail fibre broadband subscriptions including its ARPU.

With CelcomDigi, Maxis and TM combined, the three providers have a total of 3.73 million fibre subscriptions as of 31st March 2023.

Over 7.7 million premises passed by fibre in Malaysia

As announced by Communications and Digital Minister Fahmi Fadzil, Malaysia’s fibre coverage stands at 7.74 million premises passed as of 31st December 2022. The figure exceeds JENDELA Phase 1 target of 7.5 million premises passed by fibre. Based on MCMC’s definition, a premise is considered covered or passed when it is capable to connect the premise to the FTTP (Fibre to the Premise) in a service area, and a new service activation only requires the installation or connection of a drop cable from the premises passed point. This may include connection to a fibre distribution point on an aerial, pedestal, riser, MDF or utility pole. If a location is covered, a new service activation for any access seeker or user must be completed within 14 days.

If you’re looking for a fibre broadband plan for your home, you can check out our Best Fibre Broadband plans in Malaysia list.