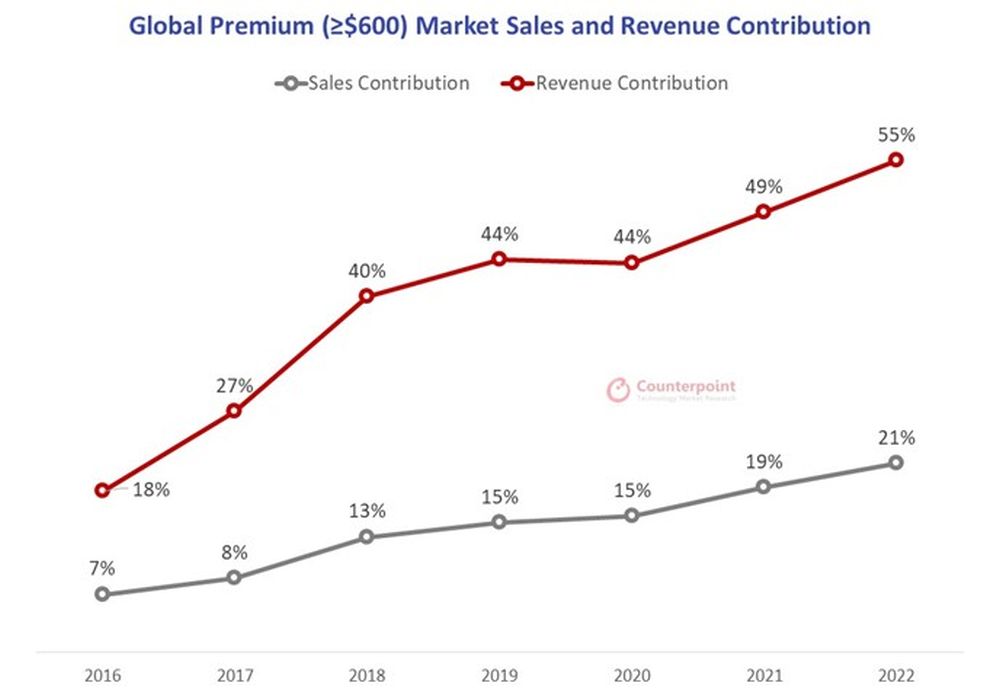

Last year, global smartphone sales have seen a significant decline of 12% year-on-year as the world braces for possible inflation and financial challenges. However, Counterpoint Research has revealed that premium flagship smartphones have been doing very well, contributing not just higher sales but also posting a record contribution of 55% of the total global smartphone market revenue for the first time ever.

Typically, cheaper entry-level and mid-range phones are the biggest revenue generator for smartphone makers. Despite smaller margins, budget devices are a strong volume driver. As illustrated by Counterpoint, premium devices priced more than USD 600 (about RM2,650) used to contribute to less than 10% of smartphone sales while bringing about 18-27% of total revenue contribution. After the pandemic, the sales share of premium phones has risen beyond 15% and contributed well above 44% of total revenue.

In 2022, one out of five smartphones sold is a premium flagship smartphone and these devices contribute more than half (55%) of total global smartphone revenue.

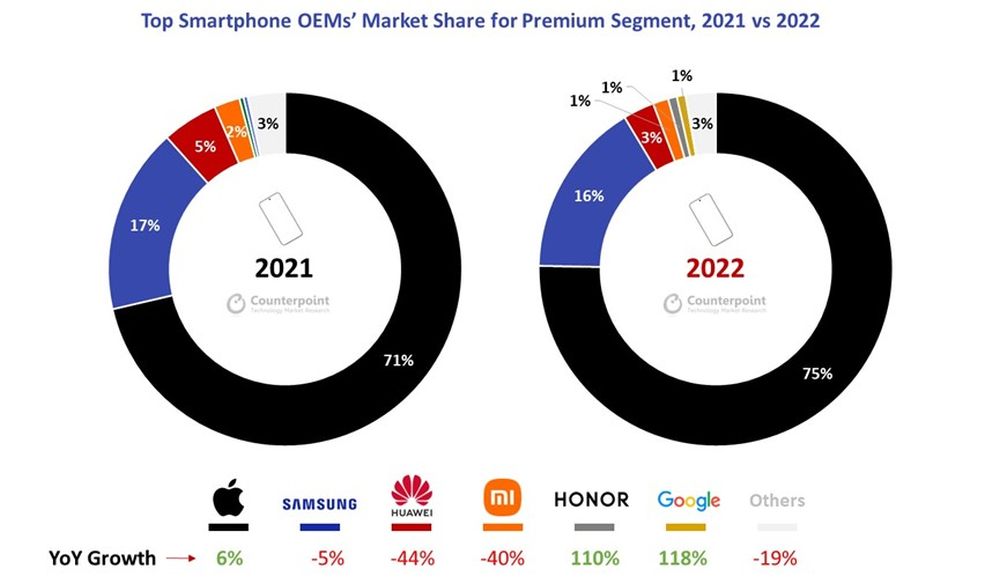

Looking at the breakdown for 2022, Apple has the biggest market share for premium devices at 75%, followed by Samsung at 16%. The brands that have shown growth for flagship devices are Apple at 6%, Honor at 110% and Google at 118%.

According to Counterpoint, consumers are ready to spend more on their devices and hold on to them for a longer period. They say this is one of the reasons why the USD 1,000 and above price segment was the fastest growing (38% YoY) in 2022. Taking notice of the trend, most smartphone makers have been making more commitments to boost longevity for their devices promising security updates of up to 5 years and major OS updates of up to 4 years.

Counterpoint also added that another key factor for growth has been “premiumisation” trend across regions where people are looking to upgrade to their last device. This trend is also evident not only in mature markets but also in emerging economies where consumers on their third or fourth devices are starting to look at premium devices.

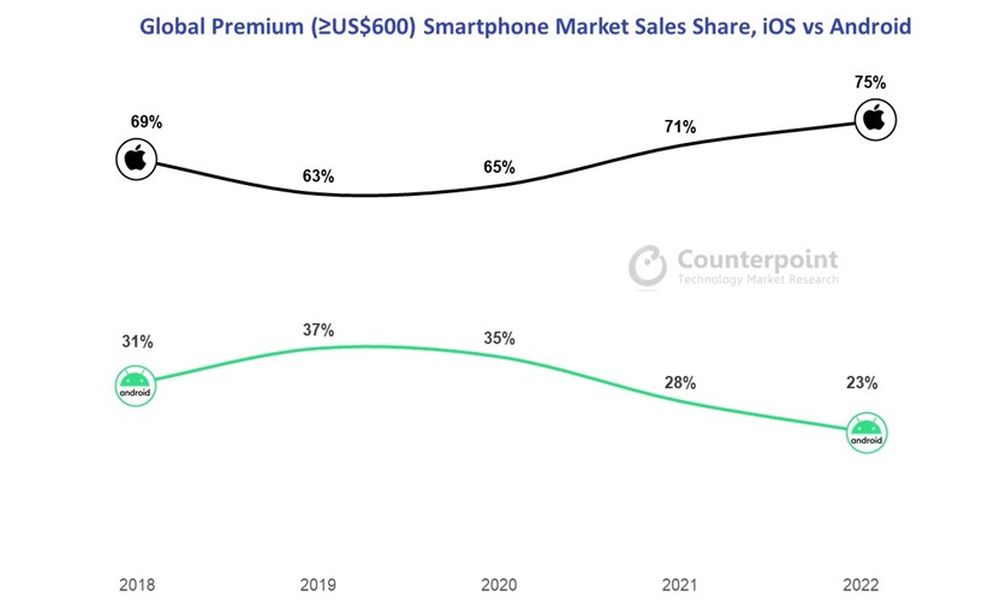

In terms of operating systems, Apple leads the premium segment as iOS commands 75% market share while Android has dropped from 37% in 2019 to just 23% in 2022. This is also evident from the recent Top 10 list where iPhone models dominate 8 out of 10 smartphone models sold worldwide. It is also worth highlighting that most top-tier premium smartphone models including from Chinese manufacturers are now priced at around RM4,000-5,000 which is a huge jump even for Android devices. Not only it leads to higher revenue but Android flagships these days are almost as expensive as the iPhone.