The Touch ‘n Go Visa Prepaid card (TNG Visa) is finally here but there’s a lot of misunderstanding and misconception about the card due to its brand. Is this TNG Visa a replacement for your existing Touch ‘n Go card (TNG Card)? Can you use it for tolls and public transport? Read on to learn more.

What is a Touch ‘n Go Visa Card?

The TNG Visa is essentially a Visa Prepaid card that’s linked to your TNG eWallet. Other similar cards in the market include BigPay, MAE, GoPayz and Wise. The card is aimed at increasing Touch ‘n Go eWallet usage beyond just QR payments as you can now use it at over 80 million Visa merchants worldwide. You can even use it to withdraw cash at any ATM under the Visa network (Visa Plus). Just look out for the Visa or Visa Plus logo on the machine.

The TNG Visa card is Malaysia’s first numberless card as it doesn’t have the card number, expiry and CVV printed on it. Over at the back, it has the cardholder’s name that’s limited to 17 characters. Touch ‘n Go is currently offering the card for free but take note that a RM5.00 delivery fee applies. The whole application, activation and management process of the card is fully digital on the Touch ‘n Go eWallet app.

Where can you use the TNG Visa Card?

Just like any Visa Prepaid card, TNG Visa allows you to make contactless payments via Visa Paywave or your usual Chip and Pin, and magnetic stripe payments (where it is supported). All payments are deducted from your eWallet directly and you’ll receive a notification and be able to view your history immediately similar to a QR code transaction. Before using the card, make sure you have a sufficient balance in your eWallet which you can top up via online banking or credit card. For greater convenience, you can also enable auto-reload for the eWallet as well.

One of the perks of TNG Visa is lower foreign exchange rates for overseas transactions, which sounds similar to BigPay. This is great when you’re travelling overseas and you can manage and track your spending better with real-time transaction history.

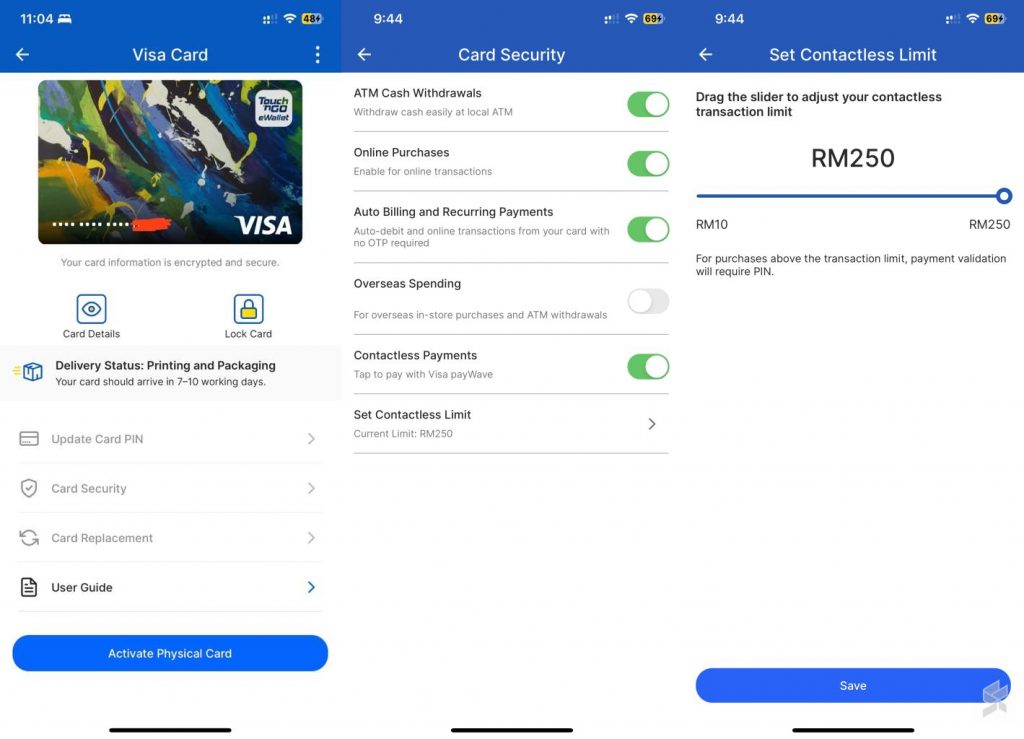

To manage your card usage, the Visa Card section in Touch ‘n Go eWallet allows you to view card details (number, expiry, CVV) if you need to use the card for online payment. You can also lock the card immediately if your card is missing or stolen.

The eWallet app also allows you to change your card’s PIN and manage specific features of the card. You can choose to enable or disable ATM withdrawals, paywave, overseas spending, online purchase, auto billing and renewal, and set limits for paywave transactions before requiring a PIN. Take note that there are limits and charges that apply for the TNG Visa such as a daily RM5,000 transaction limit and a RM15 fee for ATM withdrawals conducted overseas.

Despite having the “Touch ‘n Go” name, it won’t work when you tap the card on old-school Touch ‘n Go terminals for highway tolls, car parks, vending machines and public transport. However, it will work for car park payments if the terminal can accept Visa as shown above.

As mentioned earlier, this is a Visa Prepaid and it doesn’t contain the traditional TNG chip that has a stored value. According to Touch ‘n Go, it was a technical challenge to include PayWave and TNG chips. They have tried to integrate both contactless payment technologies but it causes interference.

What is a Touch ‘n Go card (now enhanced with NFC)?

The Touch ‘n Go card which was first introduced in the late 90s is a stored value card and it is the default payment method accepted for highway toll payments and public transport. Previously, the TNG card must be reloaded manually at participating stores or self-service kiosks but now there’s the new Enhanced TNG Card with NFC feature. If you have Touch ‘n Go eWallet and an NFC-compatible smartphone, your phone is now your personal TNG reload kiosk and you can top up the Enhanced TNG card instantly with zero fees.

Where can you use the TNG card?

The TNG card works only with TNG payment terminals that you see on TNG lanes at highway toll plazas, vending machines and major car parks. In the past few years, TNG introduced PayDirect, a feature that allows you to tap your TNG card and the toll charges are deducted from your eWallet. PayDirect is supported at selected carparks and also most major highways except for PLUS. For PayDirect to be supported, the TNG terminals must be updated and connected to the internet for it to work.

Touch ‘n Go Visa card does not replace your normal Touch ‘n Go Card

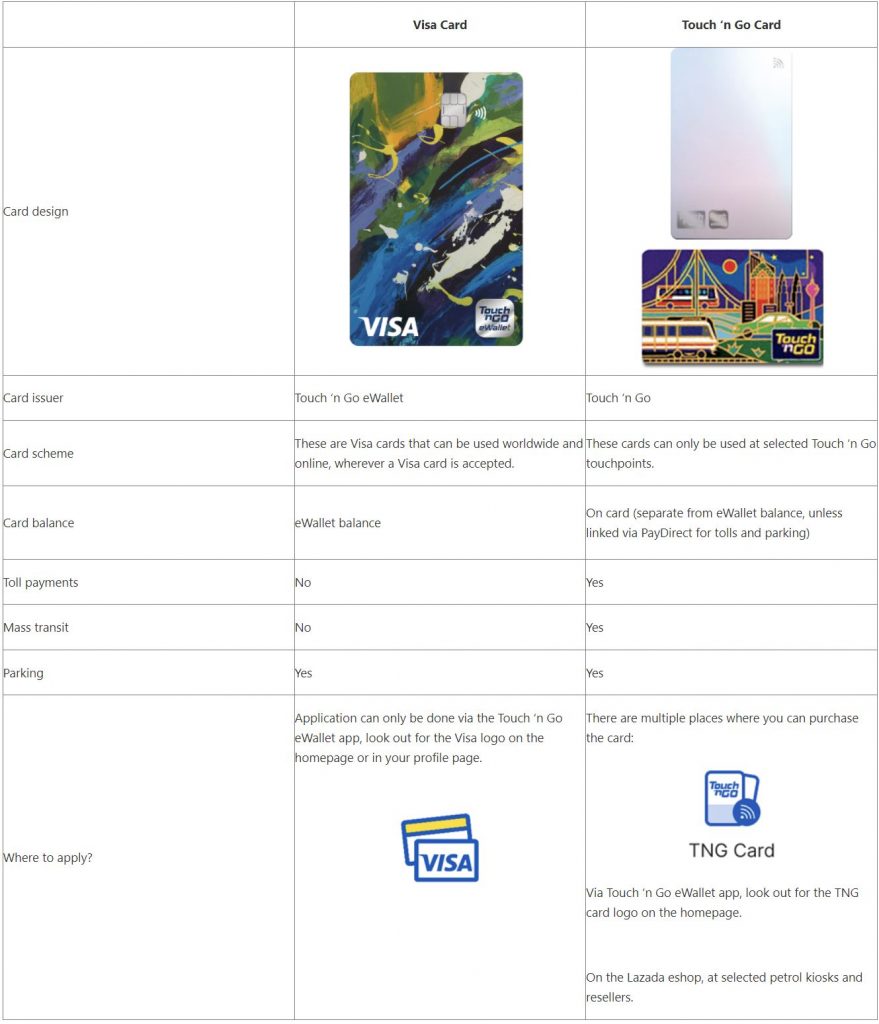

The TNG Visa card is only a complementary card to expand the eWallet usage and it doesn’t replace your TNG card. Touch ‘n Go has added an FAQ to highlight the differences between the two products. In a nutshell, the Visa card only works where Visa is accepted, while the Touch ‘n Go card only works with terminals that accept Touch ‘n Go payments.

Related reading

- Touch ‘n Go Visa card can’t be used for tolls and public transport, but the real problem is the brand

- Touch ‘n Go Visa card now available to all eWallet users, accepted worldwide where Visa is accepted

- TNG eWallet Money Packet: This is probably the coolest way to distribute Ang Pow this CNY

- Touch ‘n Go Visa Prepaid card rolling out to more eWallet users, no application or renewal fees for now