If you’re using Touch ‘n Go eWallet, there’s a Go+ investment feature which allows you to earn daily interest using your eWallet balance. However, it is hard to maintain your Go+ balance for higher returns as it tends to be used for all eWallet transactions including paying for tolls, parking and merchant payments. Finally, Touch ‘n Go has a fix to ensure that your Go+ maintains sufficient balance.

Touch ‘n Go has rolled out a Quick Cash In feature which allows you to transfer future reloads, transfers and cashback into your Go+ account. This is applicable for reloads or transfers amounting more than RM10.

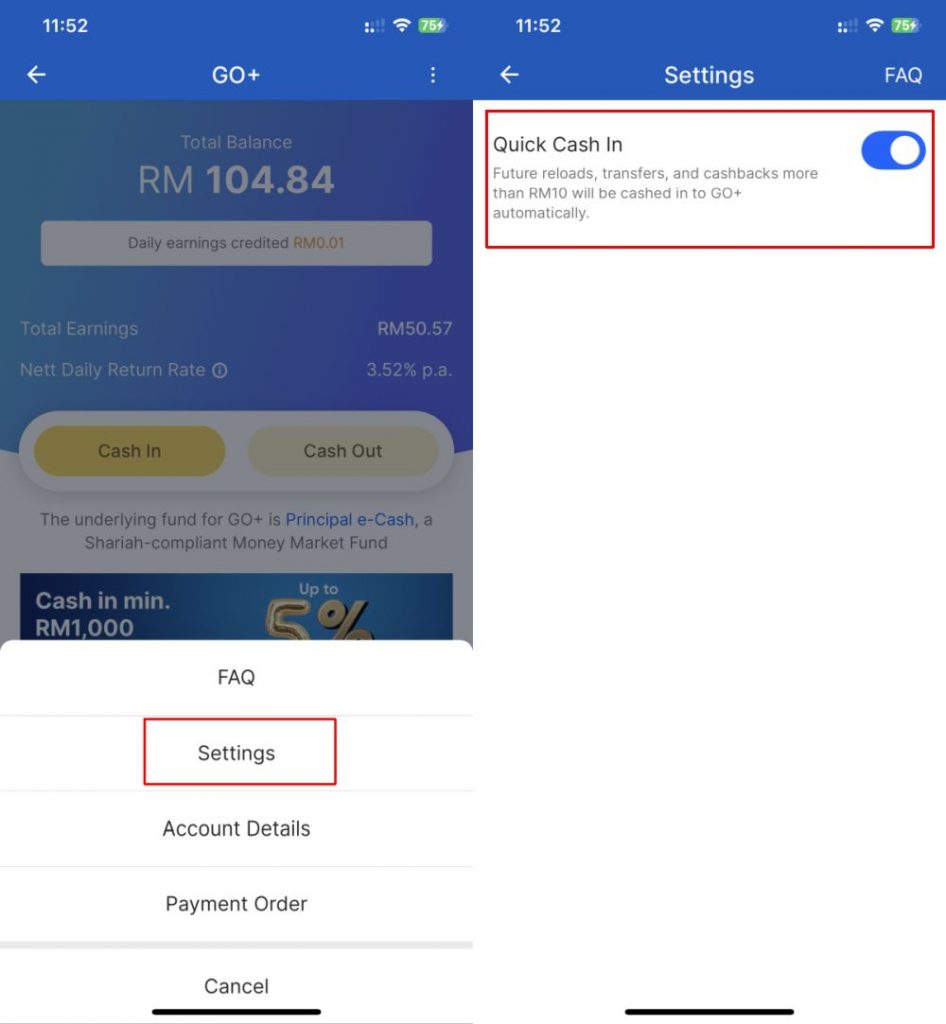

To enable the Quick Cash In feature for Go+, just go to your Go+ settings and then enable “Quick Cash In”. Quick Cash In works for reloads made with Debit card, Credit Card and online banking (FPX or RTP). According to TNG, if your eWallet has RM8 balance and you make a reload of RM100, the feature will automatically transfer RM108 to your Go+ account.

If you use a credit card to reload your eWallet, take note that it will only work if you’ve not exceeded your monthly credit card quota limit. Touch ‘n Go eWallet has a monthly credit card reload quota of RM5,000 for Premium users. The FAQ also states that if you cashed out from Go+ to your eWallet, the amount won’t be transferred back to your Go+ account until a new reload of more than RM10 is performed.

At the time of writing, Go offers 3.52% p.a., and the interest is credited on a daily basis.

In case you missed it, Touch ‘n Go has started offering its physical Visa prepaid card to selected users. It claims to be the first numberless card in Malaysia and this eWallet-linked card works with any merchants that accept Visa payment including Paywave worldwide.