There’s a recent commentary which claimed that expired Touch ‘n Go cards are a RM270 million a year scam and it prevents payment systems from progressing to something more superior which can help reduce jams and toll booths. In the same article, it was implied that both highway concessionaire PLUS and payment provider Touch ‘n Go are in cahoots with operating an archaic and monopolistic payment system. But is PLUS really responsible for Touch ‘n Go? Let’s break it down.

Who owns Touch ‘n Go and PLUS?

Touch ‘n Go Sdn Bhd (TNG) is currently wholly-owned by CIMB Group. Meanwhile, TNG Digital Sdn Bhd, the company behind the TNG eWallet, was started as a joint venture between TNG and China’s Ant Group. It currently has more investors on board including AIA Malaysia, Bow Wave Capital Management (via ASP Malaysia LP) and Lazada.

PLUS, the highway concessionaire which manages the North-South Expressway is currently 51% owned by Khazanah Nasional via UEM Group Berhad, while the Employees Provident Fund (EPF) holds the remaining 49%. PLUS used to hold a 20% stake in Touch ‘n Go but CIMB bought their stake in October 2019.

The only thin link between the two companies is Khazanah, which currently owns 24.7% of CIMB Group as well as a 51% stake in PLUS via UEM. This shouldn’t come as a surprise as Khazanah is the sovereign wealth fund of the country and they have shareholdings and interest in various corporations including Astro, Axiata, Telekom Malaysia, Time, Farm Fresh, Bank Muamalat, Malaysia Airlines, Malaysia Airports, and Tenaga Nasional.

Touch ‘n Go is the sole electronic payment system for toll collections in Malaysia

PLUS has clarified that it isn’t an equity owner of Touch ‘n Go Sdn Bhd. It added that the highway industry is strictly regulated by the Malaysian Highway Authority (LLM – Lembaga Lebuhraya Malaysia). PLUS along with other highway concessionaires is subjected to the rules and regulations stipulated by the authority.

PLUS also explained that Touch ‘n Go is the sole government-approved electronic payment system provider for toll collections in the country and they are responsible for its stored-value Touch ‘n Go cards. Therefore, the issuance and the expiry of the card are not within PLUS’ purview. In addition, the current TNG RFID tag as well as the TNG eWallet are products under the Touch ‘n Go Group, not PLUS.

PLUS introduced RFID that’s linked to credit cards but CIMB took them to court

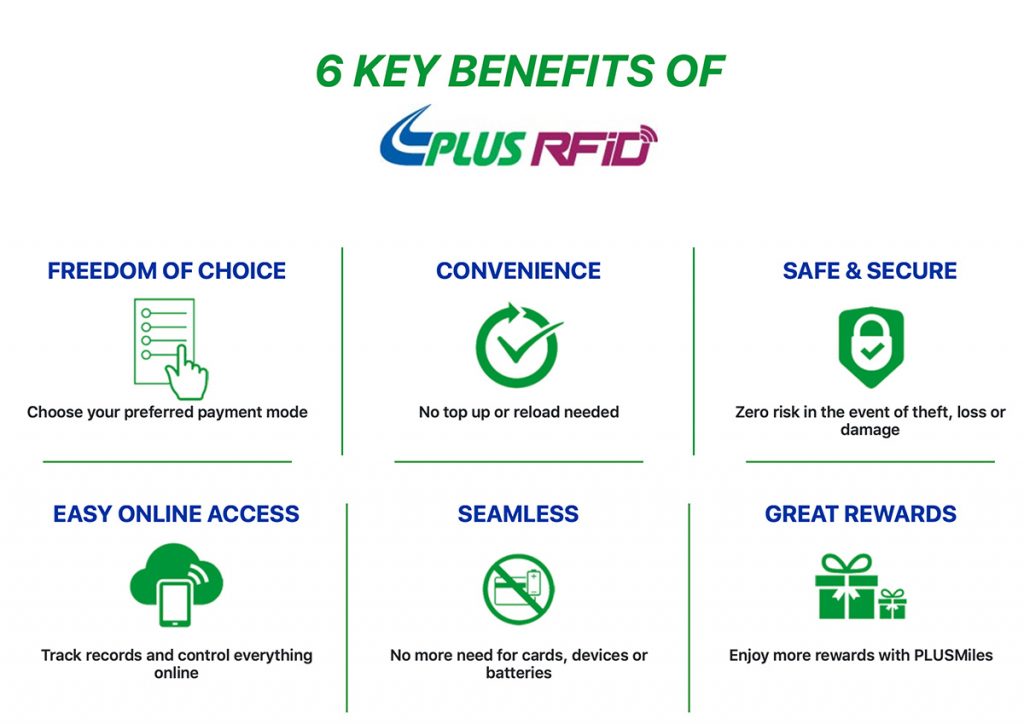

In case you didn’t know, PLUS introduced its own PLUS RFID system back in 2018 which was based on an open payment system. Instead of being tied to a single eWallet which you’ll need to top up regularly, users of PLUS RFID can link the tag directly to their Visa or Mastercard.

The PLUS RFID pilot was initially started on the Penang Bridge and they gave out 10,000 RFID tags for free. At the time, it was seen as a game-changer as users were given the freedom to choose their preferred payment mode and there was no need to top-up or reload.

Shortly after that, CIMB were not too happy and they took legal action against PLUS. It claimed that PLUS RFID was in violation of a joint venture agreement on toll payment collection that was signed two decades ago. CIMB served a Notice of Arbitration on PLUS Malaysia Berhad on 17 December 2018 and was seeking an injunction to stop PLUS from engaging further business of PLUS RFID system together with damages, interests and costs.

Initially, PLUS denied breaching any agreements as it believes that the PLUS RFID pilot program will promote choices to the rakyat as it offers options and convenience for customers to pay as you use via credit and debit cards. It added that PLUS RFID will be an additional payment option to existing eWallet and prepaid mode of payments provided by Touch ‘n Go.

CIMB was supposed to introduce an open-payment system for RFID

Eventually, both PLUS settled the dispute with CIMB by supporting TNG RFID for its highway. As part of the new collaboration to support a single TNG RFID system, CIMB and TNG were supposed to introduce an open payment facility where users can choose to link the RFID tag to several cashless payment options such as bank accounts, credit and debit cards.

Former CIMB Group CEO Tengku Zafrul said “We’re extremely pleased to have been able to work with PLUS to lead this landmark initiative. The democratisation in toll payments is something we fully champion and the CIMB teams, together with the teams at our subsidiary TNG, are committed to collaborating with PLUS and, in time, other highway concessionaires to make open payments an accessible reality for all Malaysians.”

Meanwhile, PLUS Managing Director Datuk Azman Ismail said “RFID transactions will be real-time, as our highway customers will receive an immediate notification of their balance and CIMB—TNG have given their commitment to this high standard of service delivery.”

Originally, the plan to allow acceptance of other eWallet, credit and debit cards was supposed to take place by the end of 2019. It’s now coming to the end of 2022 and Touch ‘n Go remains the only payment channel allowed by the government for toll collections.

Works Minister Datuk Seri Fadillah Yusof recently renewed calls to implement Multi-Lane Free Flow (MLFF) by 2025. This would enable highway users to pay for tolls electronically without the need to slow down for physical toll booths and barriers. Besides phasing out TNG cards and SmartTAG, the government has several things to sort out which include allowing more payment options and a stronger legal framework to handle fraud and toll evaders.

Related reading

- Malaysia wants to remove toll barriers by 2025 but 3 things need to be sorted out first

- PSA: Own several TNG cards? Here’s how to avoid penalty toll charges on PLUS highway

- KPDNHEP finally takes action against Enhanced TNG NFC card scalpers

- Tap Touch ‘n Go card but eWallet gets deducted? TNG eWallet finally fixes its PayDirect confusion