[ UPDATE 3/12/2020 11:00 ]: EPF has revealed full details for the i-Sinar program. Find out how to apply here.

===

As announced yesterday, the government is expanding the coverage of the i-Sinar program to cover more members affected by the COVID-19 pandemic. Contributing Employees Provident Fund (EPF) members who have lost their job or suffered reduced income are eligible to take out up to RM60,000.

Following the revision, the EPF has announced that they will reveal more details about the i-Sinar program early next week and eligible members that fulfil the criteria can begin to apply from mid-December 2020. The first payout will begin a month after their application is approved. This means if your application is submitted and approved in December 2020, you’ll receive the first payment in January 2021.

With the latest revision, the i-Sinar program will benefit a total of 8 million affected members instead of the earlier announced 2 million members. The maximum amount that you can take out from Account 1 depends on your current balance. From the earlier announcement, eligible members with savings of RM90,000 and below can withdraw up to RM9,000 as an advance provided there’s RM100 remaining in Account 1 at all times. For this lower eligibility, members will be able to take out a maximum of RM10,000.

For those with more than RM90,000 in Account 1 are able to withdraw a maximum of 10% of their Account 1 savings with a maximum cap of RM60,000. Do note that the i-Sinar disbursement will be staggered across 6 months but the members will receive a larger payout in the first month. In the previous announcement, members with RM90,000 and below in Account 1 can receive up to RM4,000 in the first month, while members with more than RM90,000 can get up to RM10,000 in the first month.

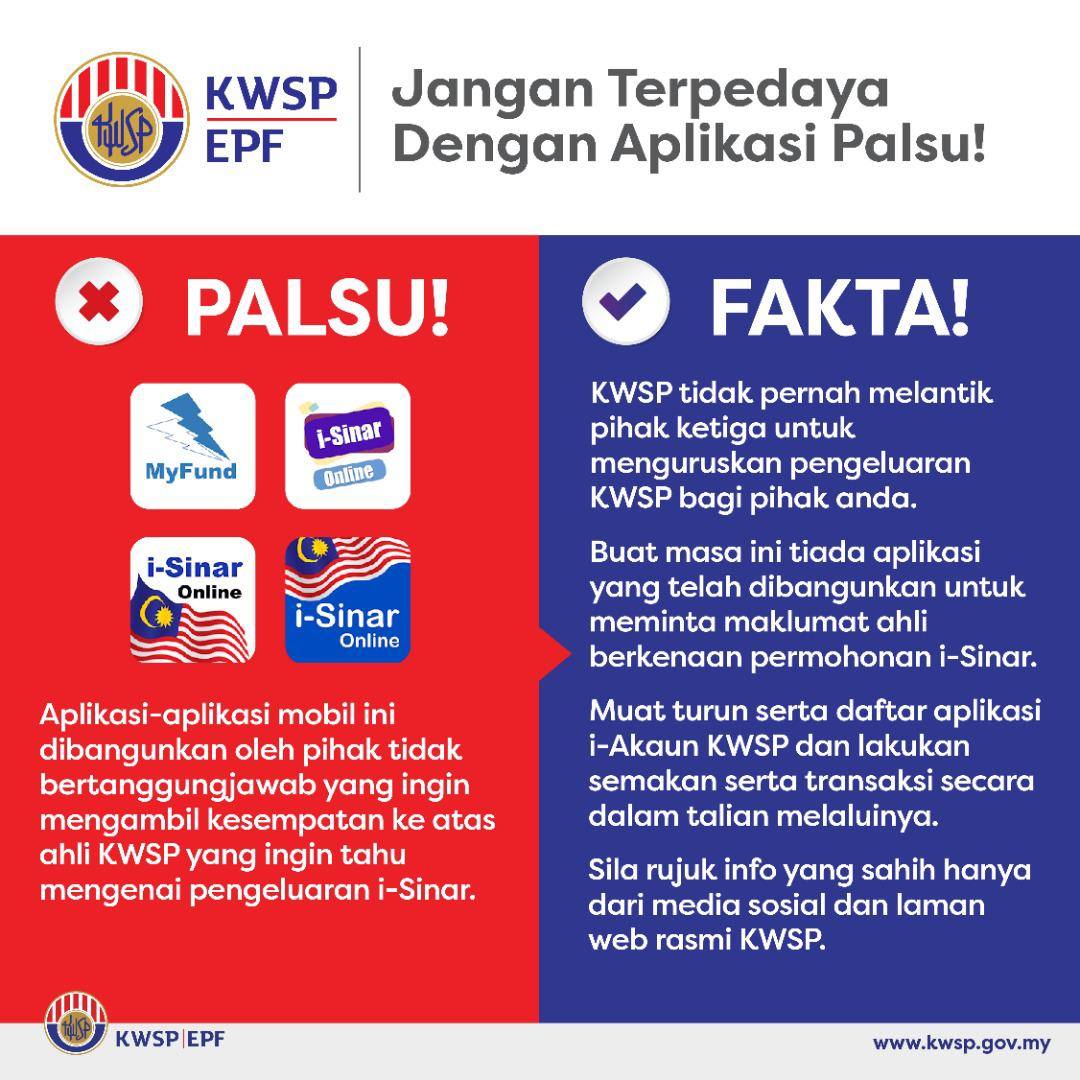

As warned earlier, there are fake i-Sinar apps being circulated online. Members are advised not to download these scam apps other than the official i-Akaun KWSP app. The EPF does not appoint any third party to handle KWSP withdrawals and all online applications must be made directly through their app or portal.

If you plan to apply for the i-Sinar program, do stay tuned to the official announcement by EPF on their website and follow them on Facebook.

The EPF added that the i-Sinar program will complement other existing assistance programs that were introduced by the government. This includes reduction of the employee statutory contribution rate from 11% to 7%, i-Lestari and the Employer COVID-19 Assistance Programme (e-CAP).

[ SOURCE, IMAGE SOURCE ]