UnionPay has officially announced its partnership with Boost and U Mobile which will enable more cashless touchpoints for eWallet users in Malaysia. The UnionPay QR payment feature is now available on both Boost and GoPayz eWallet.

Boost eWallet

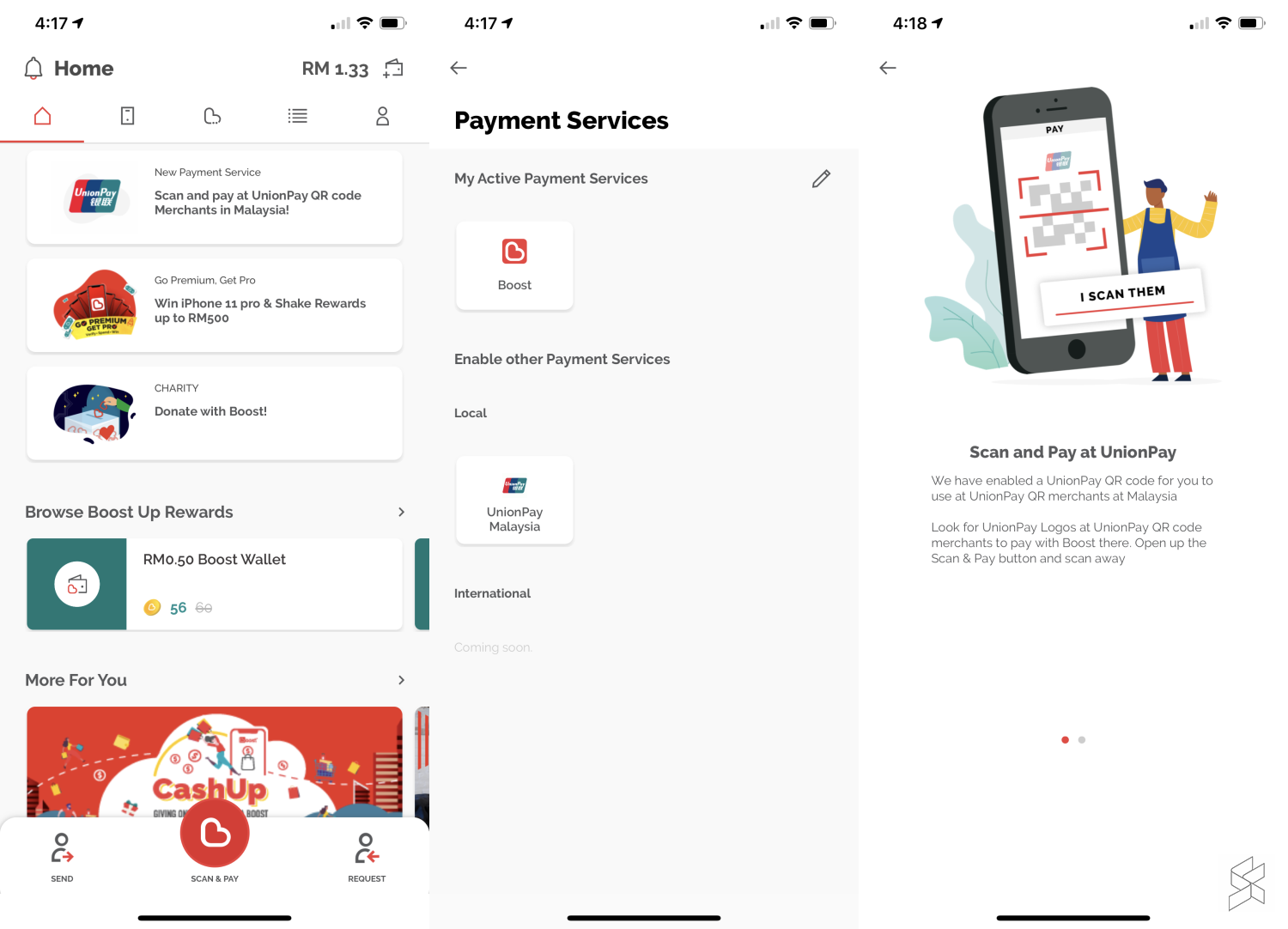

For Boost, you’ll have to activate UnionPay via the app by adding it under Payment Services which is accessible from app’s home page. Once enabled, you can Scan and Pay at UnionPay merchants using your Boost eWallet balance.

According to UnionPay International (UPI), Boost users can use their eWallet at several merchants nationwide which include Old Town White Coffee, Putien, GNC, be Duty Free, Colours & Fragrances, Dimensi Eksklusif, Orange Convenience Store and more. As an introductory offer, the first 180,000 users that activate UnionPay QR payment on Boost by 31st December 2019 will get an instant RM3 cashback. If you spend at least RM300 at selected UnionPay merchants such as Dimensi Eksklusif, be Duty Free and Colours and Fragrances, you’ll receive an instant RM30 cashback.

Boost eWallet users will be able to pay at UnionPay QR merchants overseas in the future as part of the UPI-Boost partnership roadmap. This will allow Boost users to pay over 16 million UnionPay QR merchants in 32 countries with their eWallet.

GoPayz eWallet and NFC payment

GoPayz, the eWallet by U Mobile went live a few weeks ago and it comes with a UnionPay virtual card for every user. By default, GoPayz users can already start making payments at UnionPay QR touchpoints by using the built-in Scan & Pay feature that’s linked to the Virtual Card number.

GoPayz is also looking at enabling NFC payments on the app and this will allow users to make local and international transactions via their smartphones at over 19 million UnionPay mobile contactless merchants in 38 countries and regions.

As part of their current promo, GoPayz users that top up a minimum of RM30 will be able to request for a physical GoPayz card worth RM16 for free. UPI claims that over 90% of merchants in Malaysia are now accepting UnionPay cards and the number of UnionPay cards issued in Malaysia has more than doubled in 2019. They added that mobile transactions have increased rapidly in 2019 due to wide-scale deployment of QR code terminals in the market which covers retail, airport duty-free, F&B, convenience stores and more.