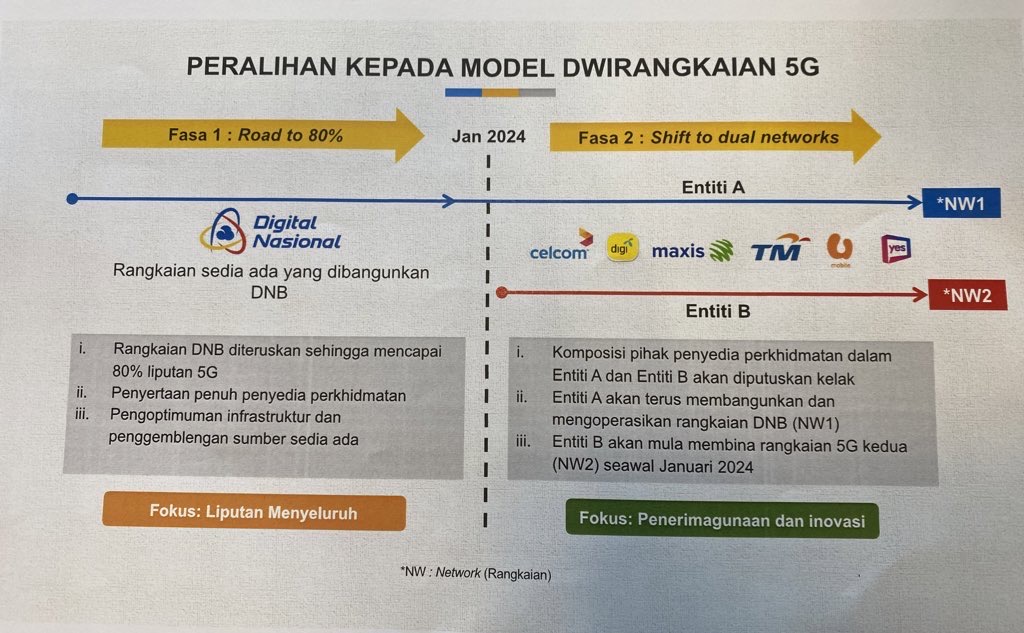

MCMC dropped a surprise last Friday when it announced U Mobile as the winner of Malaysia’s second 5G network tender. To recap, the transition to a dual 5G network was announced last year to ensure competition for 5G network deployment and establish redundancy for 5G infrastructure in Malaysia.

A total of four bids were submitted by CelcomDigi, Maxis, U Mobile and TM, and it was expected that one of the two biggest telcos would have the highest chance of winning. To ensure a sustainable dual network model, the winner is expected to be strong in financial, experience and network infrastructure to roll out 5G effectively to match and exceed Digital Nasional Berhad’s (DNB) 5G coverage in the shortest time possible. Similarly, DNB should be able to sustain and continue the 5G rollout with the remaining telcos on board.

How big is U Mobile versus CelcomDigi and Maxis?

U Mobile was launched in 2007 as Malaysia’s fourth-largest telco (before CelcomDigi merger). At the moment, its 4G network has over 9,000 sites nationwide and is said to have over 9 million subscribers in 2023.

As a comparison, Malaysia’s largest mobile telco, CelcomDigi, currently has nearly 25,000 sites post-merger. The telco is currently undergoing an integration and modernisation exercise aimed at providing a combined 18,000 5G-ready sites by the end of 2025. CelcomDigi currently has 20.2 million subscribers based on its Q2 2024 report.

Meanwhile, Maxis recently revealed it has over 11,000 sites as mentioned in its response to the second 5G network bid. The green telco currently has the second most mobile users in Malaysia with over 12.7 million subscribers according to their Q2 2024 report.

According to a recent report by Macquarie Research, CelcomDigi and Maxis dominate when it comes to revenue share for the Malaysian mobile market. Among the trio, CelcomDigi holds an estimated 50%, followed by Maxis at 37% and U Mobile at 13%.

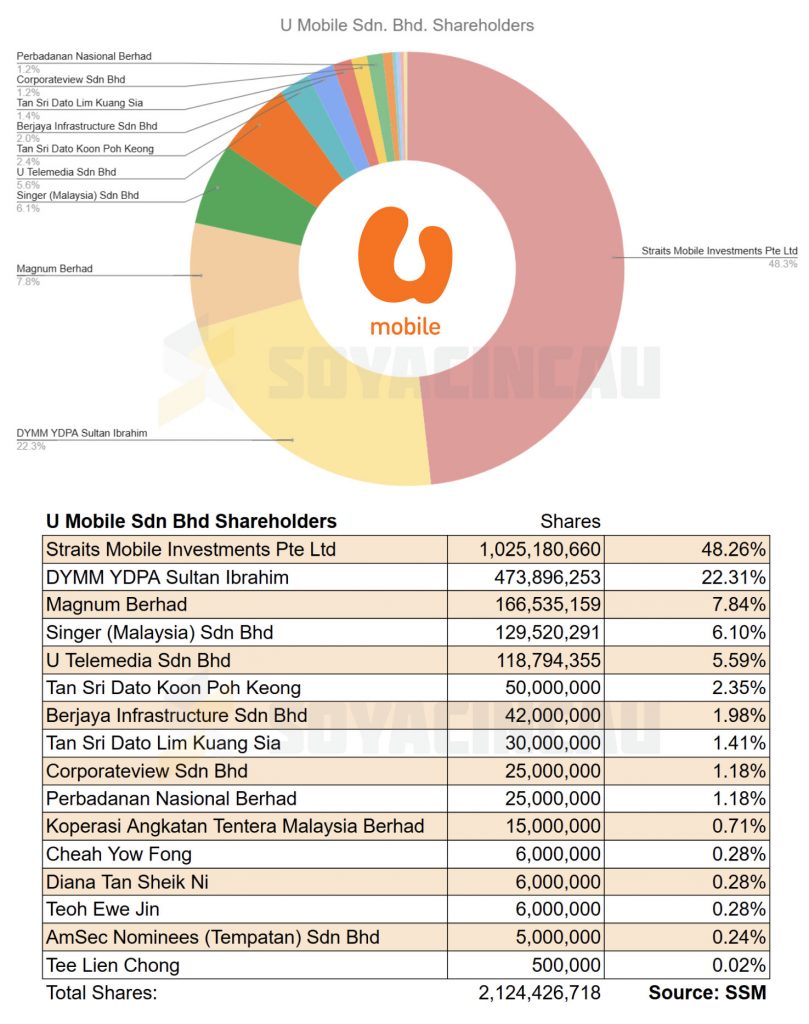

Who owns U Mobile?

According to the latest SSM data, U Mobile is effectively half-owned by a single Singaporean shareholder. Straits Mobile Investments Pte Ltd which is linked to Singapore’s Temasek Holdings currently holds 48.26%. This is followed by DYMM Yang di-Pertuan Agong Sultan Ibrahim with 22.31%, Magnum Berhad at 7.84%, Singer (Malaysia) Sdn Bhd at 6.10%, U Telemedia Sdn Bhd at 5.59% and Tan Sri Dato Koon Poh Keong at 2.35%.

There are other shareholders including Perbandanan Nasional Berhad, Koperasi Angkatan Tentera Malaysia Berhad and individuals who collectively own less than 10% of the telco.

In a statement issued on Saturday, U Mobile said it will reduce its majority foreign shareholding to 20% to ensure greater Malaysian control and invite participation from local investors.

This isn’t the first time a telco in Malaysia had to reduce its foreign shareholding but the sequence of events is different. Back in 2007, Digi, which was 61% owned by Norway-based Telenor reduced their stake to 49% before it could roll out 3G services. Besides reducing Telenor’s interest, Digi was also required to have at least 30% Bumiputra equity shareholding by the then Ministry of Energy, Communications and Multimedia.

Eventually, Digi obtained the 3G spectrum licence in May 2008 (transferred from Time dotCom). Digi launched 3G services in March 2009, four years after Celcom and Maxis, and almost two years after U Mobile.

Questions were raised about MCMC’s selection for the second 5G network

Since U Mobile is the third-largest mobile telco in terms of sites, subscribers and revenue, many questions were raised about MCMC’s selection. Critics also called upon the regulator to clarify how the second 5G winner was picked. The regulator released the Application Information Package (AIP) on 1st July 2024 to invite telcos to submit their proposal for the second 5G network, however, the details were not made public.

CelcomDigi and Maxis were seen as forerunners in the second 5G network race as both telcos have invested heavily to modernise their existing 4G network to be 5G-ready in the past few years. All they needed was the 700MHz and 3500MHz spectrum to provide 5G coverage using its existing infrastructure.

MCMC also announced that U Mobile can collaborate with other mobile network operators (MNOs) for the implementation of the second 5G network. This line was interesting as the regulator seems to imply that U Mobile would need help from other telcos to compete with DNB.

U Mobile mentioned previously that it is well-positioned to roll out the second 5G network, if needed, solely, to help the government realise its ambition of having two networks.

However, in their latest response, U Mobile said it is excited to work with CelcomDigi and TM to implement the second 5G network. So far, we have not seen any indication that CelcomDigi and TM will be onboard directly with U Mobile for the new network.

In addition, there’s also a huge question mark on TM’s equity deal with DNB. Initially, the government wanted full participation of all telcos in DNB before the transition to a dual 5G network could take place. However, TM has failed to complete the share subscription agreement with DNB as it couldn’t secure its shareholders’ approval on time.

Does this mean MCMC is giving TM a free pass to remain solely as an access seeker without owning equity or will it continue to require TM to take a stake in a 5G network?

Ultimately, the biggest question is how will MCMC ensure a sustainable dual 5G network model to achieve the government’s objective to accelerate 5G coverage and increase adoption?

If U Mobile were to roll out 5G alone on the second network, it would be a David vs Goliath situation as they would need to compete with CelcomDigi, Maxis, YTL and TM who will remain with DNB. CelcomDigi and Maxis combined would have over 29,000 sites which is already more than triple the number of sites U Mobile has at the moment.

Assuming U Mobile has its way with CelcomDigi and TM onboard with the second 5G network, that would create an imbalance as well. This leaves DNB with only Maxis and YTL, which won’t be fair and sustainable for the country’s first 5G network. As a regulator, it is MCMC’s responsibility to ensure fair and healthy competition in the local telecommunications industry.

Following the announcement by the MCMC, the other telcos issued responses to the latest development over the weekend. CelcomDigi insists that it has presented a compelling plan to build a new 5G network using its existing infrastructure and they are weighing their viable options forward. Meanwhile, TM says it will continue to support any 5G initiatives using its vast fibre network infrastructure.

Yesterday evening, Maxis issued a statement saying they are seeking clarity from the MCMC about its rationale for picking U Mobile for the second 5G network. The green telco emphasised they are a homegrown telco with 77% shares held by Malaysians and they are confident that they could roll out 5G to match DNB’s population coverage in far less time and resources including in-building 5G coverage.