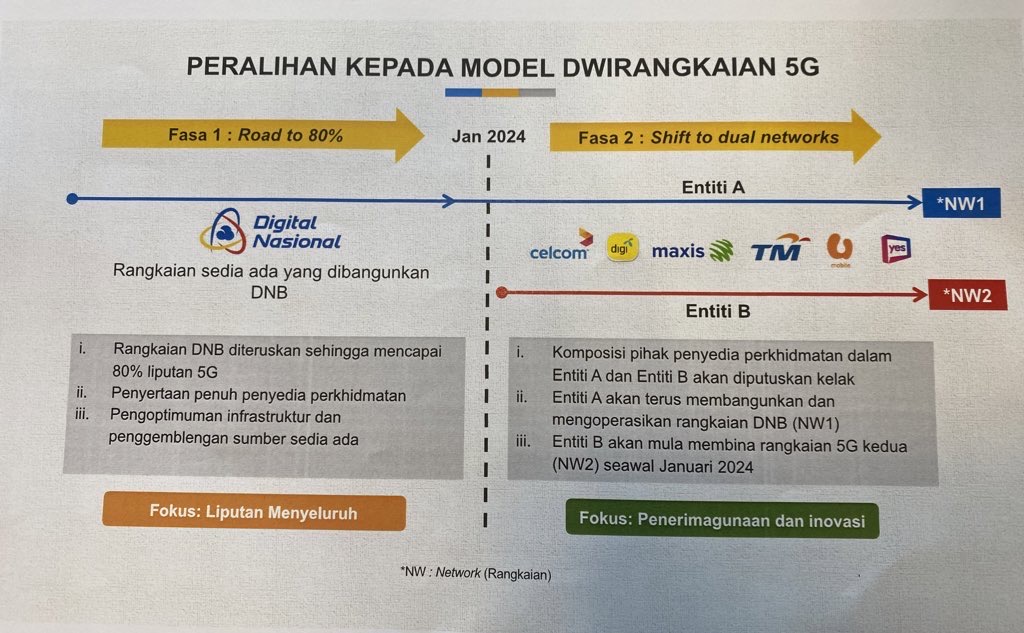

In May 2023, the Malaysian government announced that the country’s 5G deployment will transition from a Single Wholesale Network (SWN) to a Dual Network Model. The transition was supposed to start in January 2024 once Digital Nasional Berhad (DNB) achieves 80% 5G population coverage. However, two months after hitting its claimed coverage target, there is still no sign of the second 5G network which aims at establishing redundancy for 5G as well as ending DNB’s position as the sole 5G network in the country.

Malaysia to end DNB monopoly with Dual Network model

As announced by Communications Minister (Formerly known as Communications and Digital Minister) Fahmi Fadzil last year, DNB was tasked to continue its 5G deployment to achieve 80% 5G population coverage by the end of 2023. This was an expedited rollout as DNB originally planned to deliver 80% 5G population coverage with 7,509 sites by the end of 2024.

During the announcement, Fahmi said the Dual Network model will be implemented based on conditions which are consistent with global best practices which offer multiple networks not just for consumers but also for industries which are among the targeted segments for 5G technology adoption.

The minister added that the decision was made with a focus on increasing 5G adoption and innovation comprehensively. Fahmi said the Dual Network model takes into consideration the capacity of the current telecommunication industry in Malaysia and it will end Monopolistic elements associated with DNB.

He said the transition to Dual Network will manifest full inclusion of all telcos without affecting existing 5G subscriptions. DNB (Entity A) will continue to deploy and operate its 5G network and a second network (Entity B) will start building a new 5G network as early as January 2024. A 5G Task Force was formed to ensure a smooth transition towards a Dual Network model.

At the time, Fahmi said the details on the second network will be revealed once DNB has reached its coverage target. With two competing 5G networks, Malaysian can look forward to competitive pricing, greater innovation and ultimately, faster adoption.

Still no details on Second 5G Network two months after DNB achieved 5G target

As announced by Fahmi early last month, DNB has already achieved its 80% 5G coverage target. However, there’s still no clear indication of how the transition will take place.

Until today, the Malaysian Communications and Multimedia Commission (MCMC) has not issued any details or criteria on the formation of Entity B. Since DNB currently holds all available 700MHz, 3.5GHz and 28GHz spectrum for 5G, there should be a directive from MCMC to release half of its assigned spectrum for the upcoming second 5G network.

From what was revealed previously, DNB holds 40MHz block of 700MHz spectrum, 200MHz block of 3.5GHz spectrum, and 1600MHz block of 26/28GHz (mmWave) spectrum.

Assuming DNB has utilised more than half of its allocated spectrum for 5G, MCMC would need to issue a notice and provide a grace period for the state-owned 5G network to surrender the spectrum. Any delay of spectrum reassignment could delay the rollout of the second 5G network.

SSA with DNB still ongoing

Last December, five telcos (CelcomDigi, Maxis, U Mobile, TM and YTL Communications) have signed a Share Subscription Agreement (SSA) to collectively acquire a 70% stake in DNB. Each telco had to fork out RM233 million for a 14% stake each. While the SSA is pending the required due diligence process, the funds are utilised to meet DNB’s funding requirements.

The due diligence process is said to be ongoing and the SSAs are expected to be completed between February and April 2024. It is worth pointing out that this is the government’s second attempt to get telcos to acquire a stake in DNB.

Back in October 2022, four telcos – Celcom, Digi, YTL Communications and Telekom Malaysia have signed a conditional Share Subscription Agreement with DNB to acquire a 65% equity stake while the Ministry of Finance will hold 35% stake as well as a golden share. The SSAs were terminated by Celcom, Digi and TM as long stop date to fulfill all the conditions precedent under the SSA has lapsed. Currently, five telcos including Maxis are able to offer 5G via a separate 5G access agreement.

Malaysia still lacks 5G enterprise adoption

While Malaysia is proud to shout about achieving 80% 5G population coverage, 5G adoption still remains low. According to Fahmi, there are now over 10,000,000 5G users which marks a 2400% increase from December 2022. However, it isn’t clear if the figures are based on users with 5G plans or actual users who are actively using 5G on 5G devices and within 5G coverage areas.

For the most part, majority of 5G services in Malaysia are essentially consumer data plans and wireless broadband. The game changer for 5G is in the enterprise sector. Unfortunately, there are very few examples of enterprise 5G adoption in Malaysia including private 5G network.

As highlighted by GSMA, the success of 5G deployment should be on innovation and not just chasing after population coverage. The organisation representing the telecommunications industry has mentioned in their report that the propensity to innovate is reduced in an SWN environment where no infrastructure competition exists. GSMA believes infrastructure competition is a key underpinning for innovation, whether in private networks, edge compute or Open RAN and has gained momentum in many countries as a means to reduce cost, increase agility and drive vendor competition.

5G is non-existent indoors. Where’s 5G SA?

While DNB’s accelerated deployment to achieve 80% population coverage is something to be proud of, the 5G network mainly focuses on outdoor coverage. The reality is that indoor 5G coverage is practically non-existent right now and we couldn’t even get 5G reception in most popular malls including The Exchange Mall, the latest shopping destination located next door to DNB’s headquarters. Simple tasks such as making an ewallet payment would be painful if your telco doesn’t have extensive 4G coverage for both outdoor and indoor.

In case you didn’t know, Malaysia’s 5G is still based on Non-Standalone (NSA) architecture which relies on a 4G core as an anchor. 5G Standalone (SA) is considered as the real 5G with a 5G core, to deliver the promise of ultra-low single-digit latency. DNB has still not provided a clear roadmap to roll out 5G SA for its network.

Release 700MHz spectrum to fix 4G coverage issues

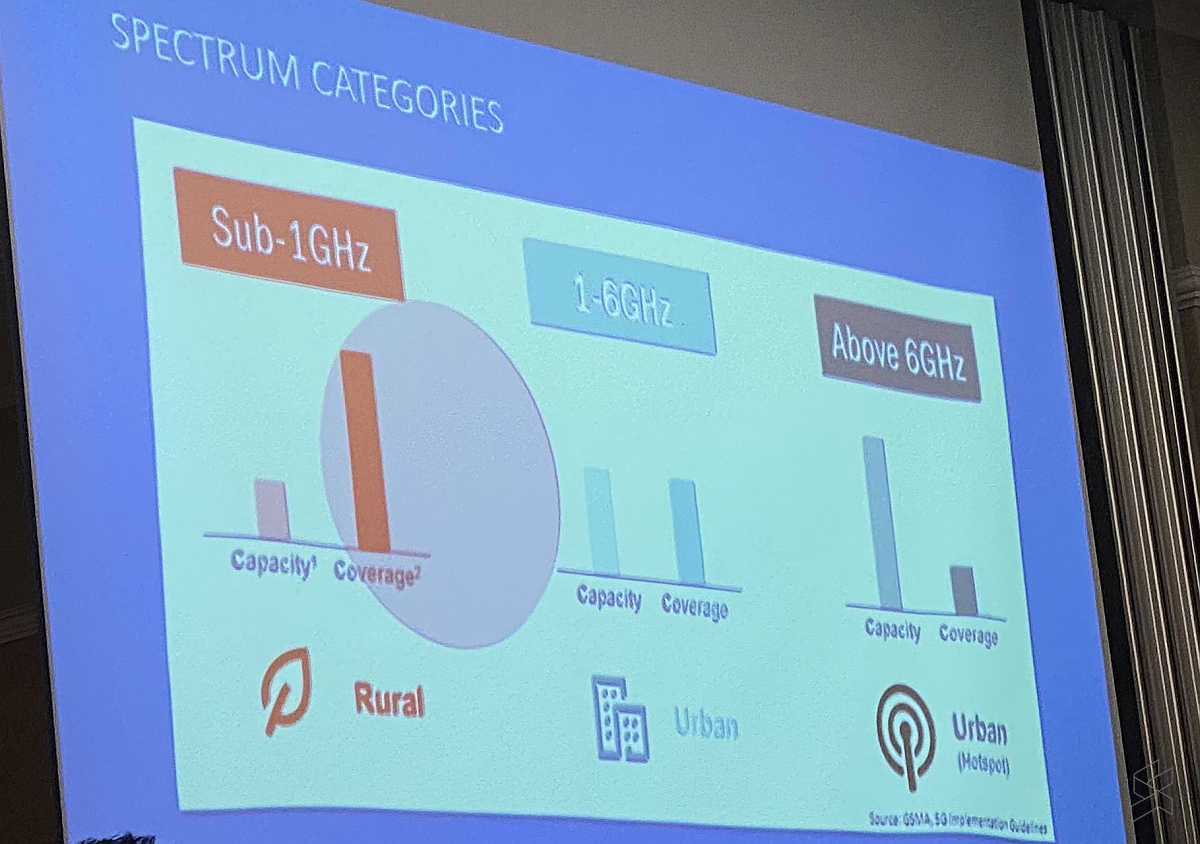

As mentioned earlier, the 700MHz spectrum is currently allocated to DNB. To immediately address connectivity issues in both rural and urban areas, the MCMC should release unused 700MHz spectrum directly to telcos or via Entity B which can be used for both 4G and 5G. With the lower frequency band, a single 700MHz tower offers a much wider coverage and it can better penetrate walls for improved reception indoors compared to 900MHz and 1800MHz. The network improvements via 700MHz for consumers can be realised immediate as majority of users are still using 4G devices at the moment.

As shared by TM during the 5G Demonstration Project in Langkawi back in 2020, 700MHz can provide high-speed wireless broadband in areas without fibre access with speeds of more than 200Mbps.

Time to reinstate spectrum neutrality

Since the government is transitioning to a Dual Network approach, telcos should be allowed to use their existing spectrum for 5G rollout. In 2021, the MCMC revoked spectrum neutrality for current spectrum assigned to telcos, preventing them from deploying 5G using existing resources.

The move was controversial as the telcos have paid for the spectrum on a basis of spectrum neutrality which enables them to use it for 5G, 6G and beyond. The restriction to limit telcos up to 4G was to ensure DNB as the only entity to offer 5G under the SWN model.

Since there’s no longer a need to protect DNB as a 5G monopoly, reinstating spectrum neutrality inline with global best practices can help speed up 5G deployment and spur CAPEX investments by the telcos.

Using existing 4G spectrum such as 2300MHz and 2600 for 5G isn’t new and it has been done in several countries. For example, Thailand is currently using 2600MHz for 5G while Australia is utilising 2300MHz spectrum for 5G. To ensure 4G users are not neglected, the existing spectrum assigned to the telcos can be used for both 4G and 5G optimally with Dynamic Spectrum Sharing (DSS).

According to GSMA’s Public Policy Position, 5G requires spectrum across low, mid, and high bands. It said the 2.3 GHz and 2.6GHz bands should also be licensed to operators for 5G use, and all existing and new licences should be technology-neutral to allow their evolution to 5G services.

Related reading

- Malaysia to transition to Dual 5G Networks in 2024 after DNB hits 80% population coverage

- Fahmi announces 5G Task Force to ensure smooth transition towards Dual Network model in Malaysia

- DNB: 5 telcos to take 70% stake in 5G network, each to inject RM233 mil

- 5G Malaysia: Fahmi says all 5 telcos are going all in with DNB, to finalise shareholding soon