[ UPDATE 29/09/2023 23:30 ] BNM announced that the DuitNow QR transaction fee will be waived for micro and small businesses.

===

CIMB is retaining its zero transaction fees policy for merchants who wish to accept DuitNow QR (DNQR) payments at their premises. This was confirmed through a brief announcement on the bank’s official website.

In general, CIMB is among the first bank that has openly addressed the issue of DNQR transaction fees on merchants. This is quite a surprise given that this matter made its way into the headlines due to an e-mail from another local bank.

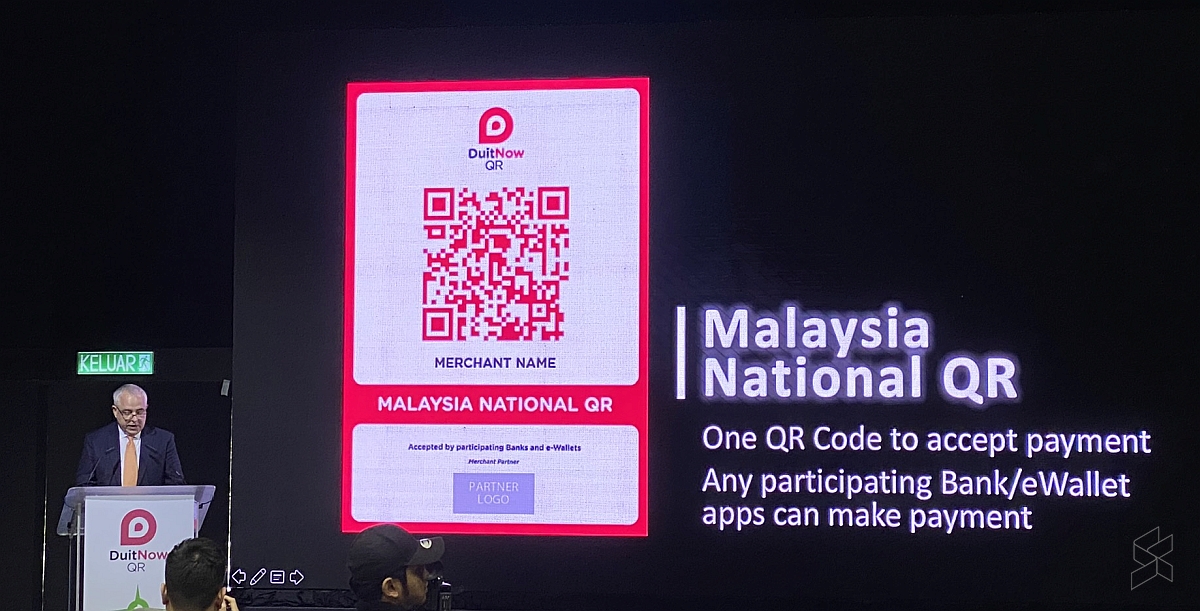

The e-mail stated that merchants have to pay 0.25% of the DNQR transaction value starting from 1 November 2023 and applicable to all banks. The fee would be increased to 0.5% if the DNQR transaction is performed using a credit card.

However, this zero transaction fee policy will not last forever though. The bank, who referred to the policy as the “CIMB Static QR – 0% Promotional Rate”, said that it is valid until 31 December 2023.

Hence, it seems that the DuitNow QR transaction fees will be eventually put into place. Even though this policy only applies to merchants, it could still trigger a domino effect on consumers as businesses look for ways to offset the cost.