The ever eccentric and divisive billionaire Elon Musk’s attempts to take over Twitter has been nothing short of eventful to say the least. Having temporarily halted his plans for a USD44 billion buyout of the social media platform, a class action lawsuit has been filed against Elon Musk in San Francisco by a Twitter investor by the name of William Heresniak, on behalf of himself and other Twitter shareholders too.

Specifically, Heresniak is complaining to the courts that Musk has manipulated the stock prices of Twitter downwards. As a refresher, Musk had tweeted out earlier this month about how he is putting the USD44 billion deal on hold, citing a news report from a couple of weeks prior that said Twitter estimated the total amount of spam and fake accounts to make up below 5% of their users. Musk though cast doubt on those figures, saying that he wanted to see more proof from the social media platform about it.

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of usershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

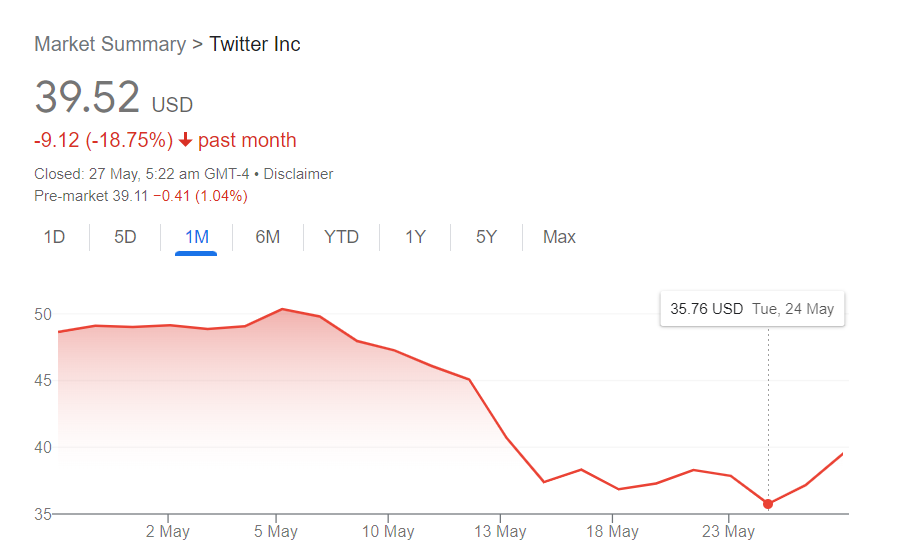

Musk’s tweets—including a Twitter spat with its CEO Parag Agrawal—had then caused Twitter’s share prices to nose dive, going from as high as USD50.36 on 5 May to as low as USD35.76 on 24 May. Heresniak’s complaint notes that Musk, despite having agreed the USD44 billion deal with Twitter, continued to make statements and tweets to cast doubt over the deal to drive Twitter’s stock value down. This was done so that Musk could get leverage to either back out of the deal or renegotiate the agreed upon buyout price.

Heresniak also pointed out that Musk had first started buying Twitter shares in January 2022. He soon owned over 5% of Twitter but had failed to file a particular document called Form 13G in time, which would have revealed to the world that Musk was buying up Twitter shares at a high rate. He continued to buy Twitter shares at these low prices, before finally filing Form 13G; once he did file Form 13G, Twitter shares would rise 27%. Had he bought those shares at the risen price, he would’ve had to pay an additional USD156 million for them.

Heresniak claims that this is yet another example of Musk manipulating the market to buy Twitter shares at an artificially lower price, violating the California Corporations Code.

“Musk’s disregard for securities laws demonstrates how one can flaunt the law and the tax code to build their wealth at the expense of other Americans.

Musk’s insider trading profits may come with a slap on the wrist in the form of a fine from the SEC but will probably be limited to hundreds of thousands of dollars, according to legal and security experts,” – Heresniak’s class action complaint

The lawsuit is now seeking damages that will be paid out to anyone that owns stock in Twitter. It’s also seeking for an injunctive relief from the courts, which may end up forcing Musk to continue with the Twitter takeover at the previously agreed-upon USD44 billion price.

This is actually the second time in just this month that Musk has faced legal action over his attempts to buy Twitter. A few weeks ago, the Orlando Police Pension Fund in Florida brought a class action lawsuit against Musk, filing the suit in the state of Delaware. They argued that, due to Delaware laws, Musk would need another three years before he can officially close the deal. You can read more about that here.

[ SOURCE 2 3, IMAGE SOURCE ]