Maybank announced that they have jointly launched the Maybank-Bakong Cross Border Funds Transfer with The National Bank of Cambodia (NBC). The service offers real-time fund transfers between Malaysia and Cambodia through NBC’s Bakong eWallet (iOS, Android) and Maybank’s MAE app (iOS, Android).

“Leveraging our ASEAN connectivity and digital capability, we have transformed the inter-country funds transfer experience between Malaysia and Cambodia, making it the most convenient yet cost-effective in the market. The launch also marks a new milestone for Maybank’s digital journey as it is the first overseas fund transfer feature on our MAE app,” said Datuk Abdul Farid Alias, Group President and CEO of Maybank.

Starting from now, Malaysians are able to transfer funds directly to Cambodians via Maybank’s MAE app. Cambodians would just need to make sure that their mobile phone numbers are registered with the Bakong eWallet. However, Cambodians will have to wait for “a later date” if they want to transfer funds to Malaysia.

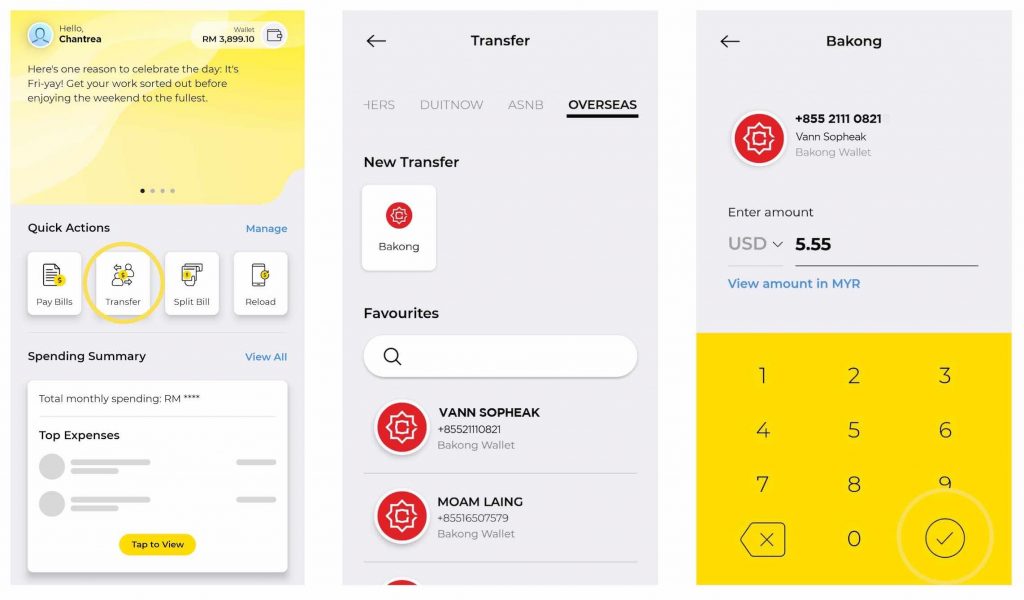

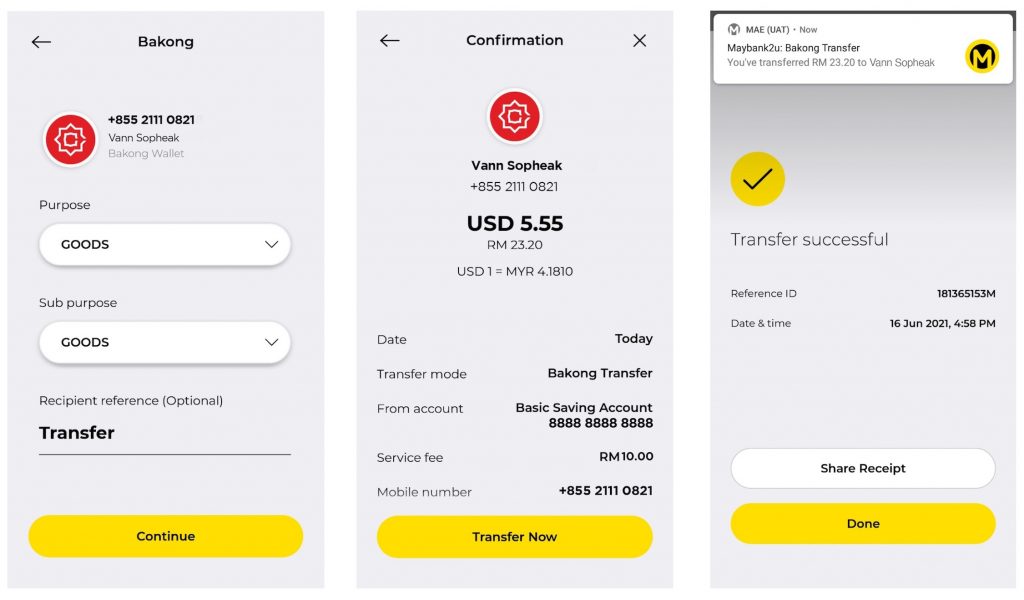

How to transfer funds from MAE to Bakong

- Log in to the Maybank MAE app

- Select ‘Transfer’ on your homepage

- Tap ‘Overseas’, then select your recipient

- Enter the transfer amount you wish to send

- Select the purpose of the funds transfer and press ‘Continue’

- Review the transfer summary

- Select the account you wish to transfer from

- Confirm your transaction by pressing ‘Transfer Now’

- After the successful transfer, you may select to ‘Share Receipt’ if you wish

The service will charge a service fee of RM10 at a fixed rate. However, Maybank is currently having a promotion and will waive the service fees for all transfers made from now until 31 December 2021. You are also able to transfer funds up to USD2,500 (RM10,000 equivalent) daily.

“It will certainly help lessen the burden of Cambodians working in Malaysia and their families, as they are able to receive the funds instantly and hassle-free. This is very much in line with Maybank Cambodia’s focus to create a digital network to provide a seamless, secure and stress-free banking experience for our customers. We are also proud to support the move towards a cashless society in Cambodia and to accelerate financial inclusion, particularly among underserved communities,” said Dato’ Mohd Hanif Suadi, CEO of Maybank Cambodia.

Bank Negara Malaysia has also recently announced cross-border QR payment linkage with the Bank of Thailand. In the first phase, Thai users can use their eWallet to pay at Malaysian merchants with DuitNow QR codes. In Phase 2, Malaysian users will be able to use their eWallets to pay at Thai QR code merchants. During the announcement in June, CIMB Thai Bank and Public Bank are the first two banks to offer cross-border QR code payment service to their customers.