BigPay, the digital prepaid card from AirAsia, is among 8 companies that have gotten the green light from Malaysia’s Ministry of Housing and Local Government (KPKT) to provide online loans. The approval for BigPay Later Sdn Bhd was announced by Zuraida Kamaruddin on Friday during the online money lending guidelines virtual session.

AirAsia Group CEO, Tony Fernandes had posted on Instagram that BigPay has received provisional license for lending and users will soon be able to apply for fast loans at low interest rates. He told Bernama that the approval was a lifeline to BigPay and he hoped that it would provide people the chance to do business and have a decent life.

He added that the financing will be available to the B40 group and the aim is to try to get loans approved within minutes. Although B40 would be the biggest beneficiary from the approval, the financing will also be made available to other groups as well.

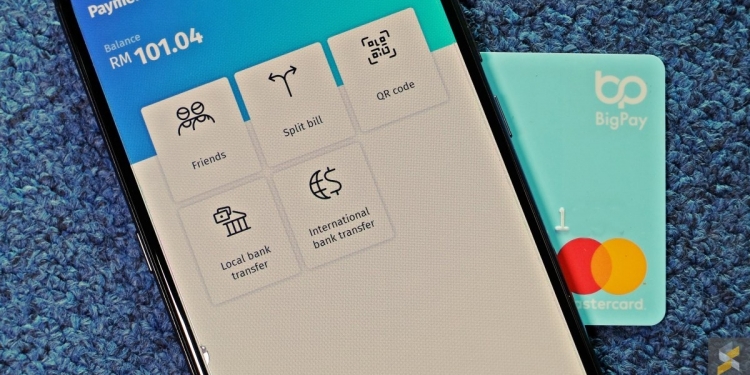

The ability to offer loans will boost BigPay’s Fintech game. Apart from offering a physical prepaid card that’s managed like an eWallet, BigPay also offers attractive foreign exchange rates for overseas transactions as well as bank transfers to local and international bank accounts. A few months ago, they have introduced a new feature where BigPay users can send money to AliPay users in China.

Apart from BigPay, the Ministry has also approved seven other providers namely Axiata Digital Capital Sdn Bhd, Grabfin Operations (M) Sdn Bhd, GHL Payments Sdn Bhd, Presto Credit Sdn Bhd, JCL Credit Leasing Sdn Bhd, Fortune Tree Capital Sdn Bhd and Hoop Fintech Sdn Bhd. With the implementation of online money lending by licensed community credit companies under KPKT, the Ministry hopes to modernise the money lending industry to create a more conducive, secure, controlled and orderly money lending business environment.