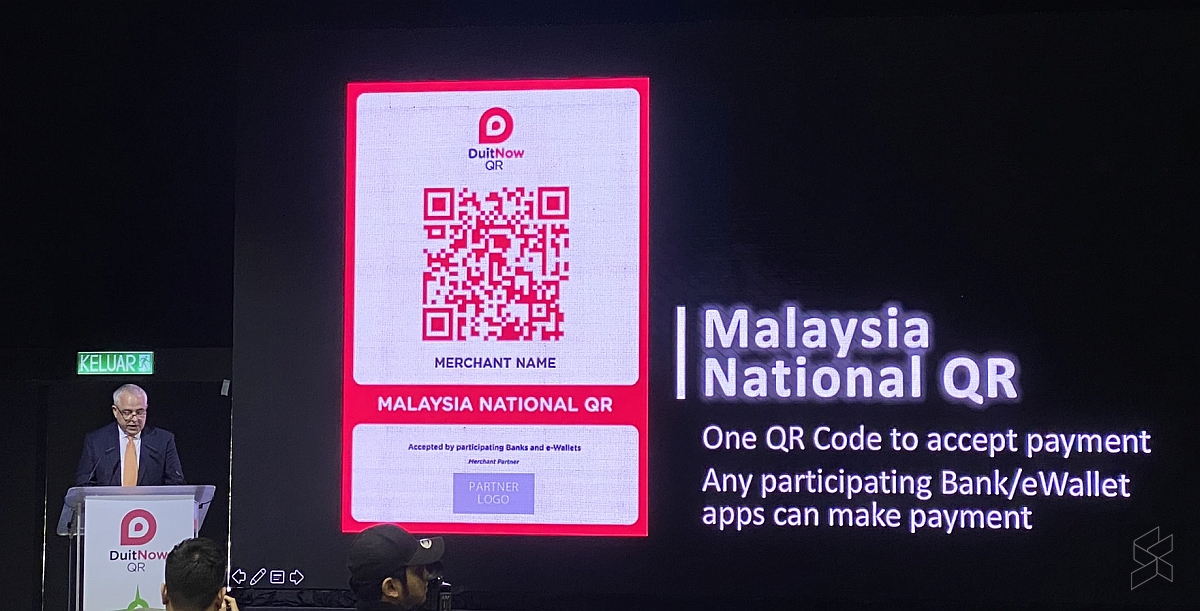

TNG Digital has announced that its Touch ‘n Go eWallet will adopt PayNet’s DuitNow QR. This is Malaysia’s National QR Standard which will unify all cashless payments and eWallet QR codes that are displayed at merchant outlets.

In addition, Touch ‘n Go eWallet will also participate in the DuitNow ecosystem which will enable an efficient and seamless way for interoperability between cashless platforms. At the moment, the DuitNow ecosystem has 40 banks and 9 of them are already offering DuitNow QR in their banking apps. The remaining 38 banks, eWallets and non-bank acquirers are expected to implement the unified QR code over the next 6 to 9 months.

Touch ‘n Go eWallet will be available on DuitNow by July 2020 and they plan to transition all of its merchants to DuitNow QR code. With DuitNow QR, merchants will only need to show one QR code and they can accept payments from over 22 million bank and eWallet account holders. For consumers, this also means wider acceptance as long as your eWallet or online banking app supports the DuitNow QR standard. By participating in the DuitNow platform, Touch ‘n Go eWallet users can soon transfer funds instantly to other eWallets and bank accounts. At the moment, Touch ‘n Go eWallet has 9 million users and 135,000 merchant touchpoints.

TNG Digital CEO, Ignatius Ong said, “We are thrilled to be expanding Touch ‘n Go eWallet by becoming part of the DuitNow eco-system. As a brand, we constantly strive to make our eWallet accessible at all touchpoints by providing a seamless transaction experience. Our users and merchants are our utmost priority, and we strive to enable a seamless cashless experience for all. We can now proudly say we stand with PayNet as they rally to do the same. Merchants will now be able to run their businesses hassle-free knowing that users can seamlessly transact with their Touch ‘n Go eWallet through the DuitNow National QR Standard.”

Apart from TNG, other eWallets that will support the unified QR code include Grab, BigPay, FavePay and ShopeePay. At the moment, it is already being integrated by 9 banks such as Public Bank, Public Islamic Bank, Ambank, Ambank Islamic, Bank Muamalat, RHB Bank, RHB Islamic Bank, HSBC and HSBC Amanah.