Soon you can use GrabPay in even more places worldwide as they have just introduced their very own card powered by Mastercard. According to Grab, this is Asia’s first numberless card, which is similar to Apple’s sleek titanium Card.

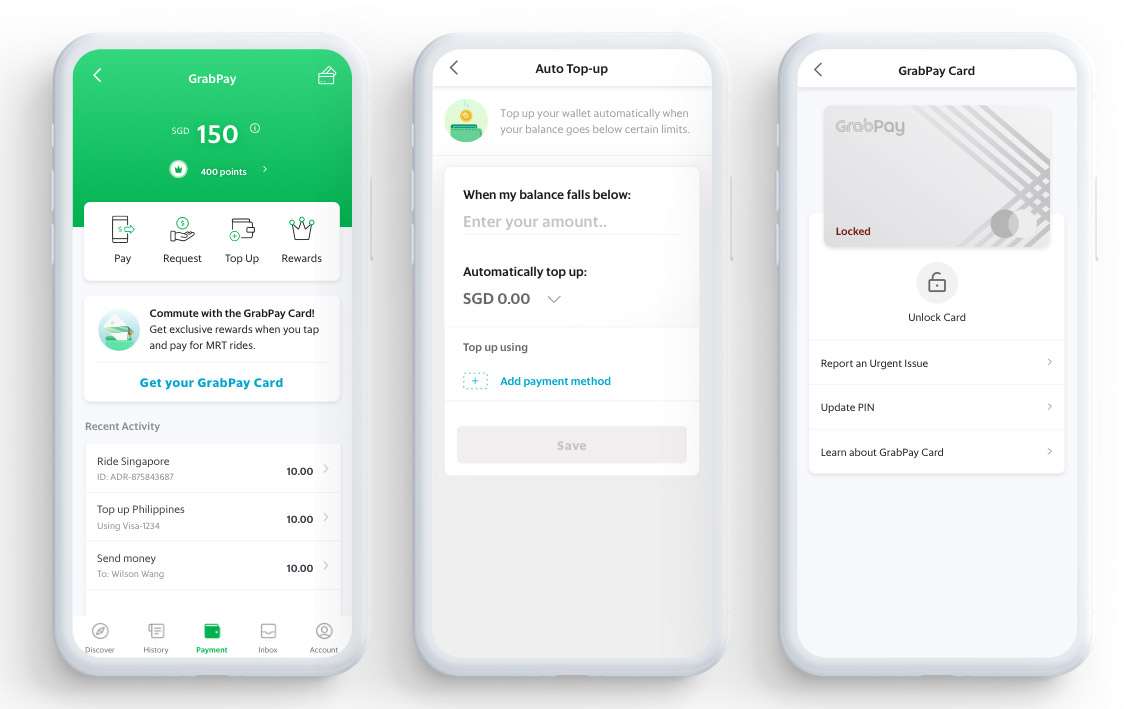

Unlike traditional cards, the GrabPay Card has no numbers on both front and back. This offers greater security which is a huge concern for a lot of users. You can view your actual card details such as number, expiry and CVV via the Grab app.

Since it taps onto Mastercard’s network, you can use it at nearly 53 million merchants worldwide. The card is also PIN protected and it also comes with 3DSecure technology to prevent online fraud. The card is managed from the Grab app and you can suspend the card instantly if it’s lost.

The GrabPay Card is linked directly to your GrabPay eWallet and this means all transactions will deduct from your eWallet balance. Despite having a chip, the FAQ states that the GrabPay physical card can only work with NFC terminals and you can’t pay at non-NFC POS. It isn’t clear if this is limited to just Singapore but there’s still a significant number of merchants that only accept payments via Chip-and-Pin. However, you are able to use the card for cash withdrawals when travelling overseas.

At the moment, GrabPay card is currently available in Singapore and users can start applying for the digital card. The physical card can be requested once they have received their digital card. The card is offered for free until 31st January 2020. According to Grab, the digital GrabPay card will be launched in the Philippines in Q1 2020 and other Southeast Asian countries will follow in the first half of the 2020.

The GrabPay card also offers reward points when you transact at merchants that accept Mastercard or for Grab services. As a launch promo, they are offering 10x GrabRewards points for every dollar spent and this can be used to redeem GrabRewards offers anywhere in Southeast Asia. If you’re using it overseas, you can view each transaction and exchange rates via the Grab app for better tracking of your expenses.

What’s even better is that GrabPay will work with Samsung Pay. If you have a supported Samsung Galaxy device, all you’ll need to do is launch Samsung Pay and add your GrabPay card details. In Singapore, you can earn up to 30 Samsung Rewards points for every transaction.

The GrabPay card also offers extra benefits which include mobile protection insurance against accidental damage or theft if you pay your mobile bill via the card. You also get e-commerce protection where they will provide coverage for wrong, non-delivery, defective or damaged delivery for eligible items brought online. On top of that, it also has Mastercard Flight Delay Pass where you can get complimentary access airport lounges if your registered flights are delayed for at least 2 hours.

Overall, it looks like Grab has combined the best features from Apple Card and BigPay with the added accessibility of Samsung Pay. Grab is currently one of the leading eWallets in the country and this new offering makes GrabPay even more accessible worldwide.

For more info, you can check out the Singapore product page.

[ SOURCE ]