The minimum on-the-road (OTR) price for fully imported, Completely Built-Up (CBU) electric vehicles in Malaysia now has to be above RM250,000. This is based on the latest amendment that the Ministry of Investment, Trade, and Industry (MITI) has quietly applied to the Franchise Approved Permit (AP) regulations for motor vehicle imports.

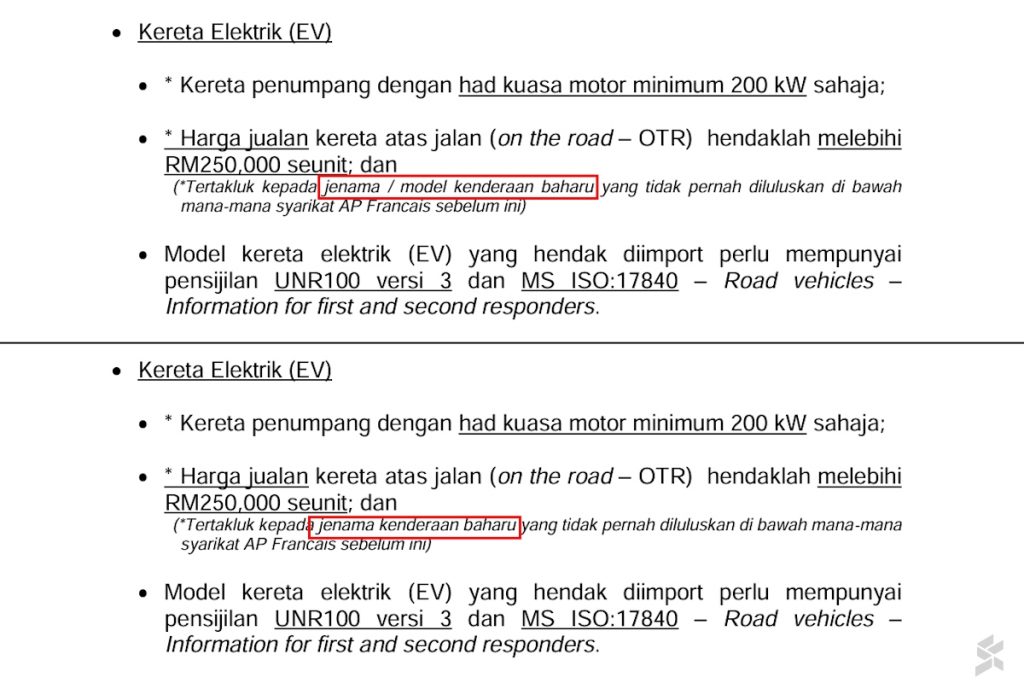

In the original version of the document, which we reported on 31 December 2025, the new ruling supposedly didn’t affect EV brands that are already in Malaysia. With the latest amendment, MITI has applied the ruling to all new CBU EV models, even for existing EV brands in our market.

Furthermore, imported EV models must be certified under UNECE Regulation No. 100 Revision 3 (UNR100 v3). They must also comply with MS ISO 17840, which covers the standardised template of the rescue sheet for first and second responders.

Yesterday, the Malaysian Automotive Association (MAA) confirmed that the government is going to impose 30% import duty and 10% excise duty on CBU EVs, in addition to the standard 10% sales tax. That being said, EVs originating from certain countries, such as China, might be able to enjoy lower import duty rates due to free trade agreements between them and Malaysia.

Will the new regulation kill mainstream and entry-level CBU EVs in Malaysia?

Aside from the minimum RM250k price tag, the 2026 regulation also stated that CBU EVs must have a minimum power output of 200kW (268hp). Electric motors with 200kW output or more are usually equipped in premium EVs, while mainstream and entry-level EVs generally have an output of 160kW and below.

Given these two main requirements, it makes no economic sense for automakers to import their mainstream and entry-level EVs into Malaysia anymore. Just take a look at 2025’s EV registration data: 5 of the top 10 EVs in Malaysia were mainstream EVs, while almost all the premium EVs in the top 10 list still have a starting price of under RM200k.

It is quite obvious that both of these requirements were aimed at pushing automakers to set local assembly (CKD) operations in Malaysia. After all, the government has always looked at CKD operations as one of many ways to help stimulate the local economy, talents, and supply chain ecosystem.

In fact, several companies already assemble their EVs in Malaysia, including Volvo, Mercedes-Benz, Chery, and BMW. Other automakers that are picking up the CKD route for their EVs also include Proton, Perodua, BYD, Leapmotor/Stellantis, MG, TQ Wuling, Volkswagen, XPeng, and Zeekr.

Nevertheless, it might still be difficult for automakers to immediately react to this hard push as their plans for 2026 likely have been set months in advance. In addition to that, the excise duty and sales tax exemptions for CKD EVs will only last until the end of 2027, which has been seen by some automakers as too short a period to be fully beneficial to them.

Meanwhile, MAA is said to already be working to obtain further clarifications from MITI regarding the new regulation. The association will also provide the industry’s feedback on the new regulation to the ministry.