Besides the tax holiday for fully imported (CBU) EVs, the road tax waiver for EVs is also set to end on 31st December 2025.

However, if your EV’s road tax is expiring in January or February next year, you can still enjoy RM0 road tax but you have to act fast.

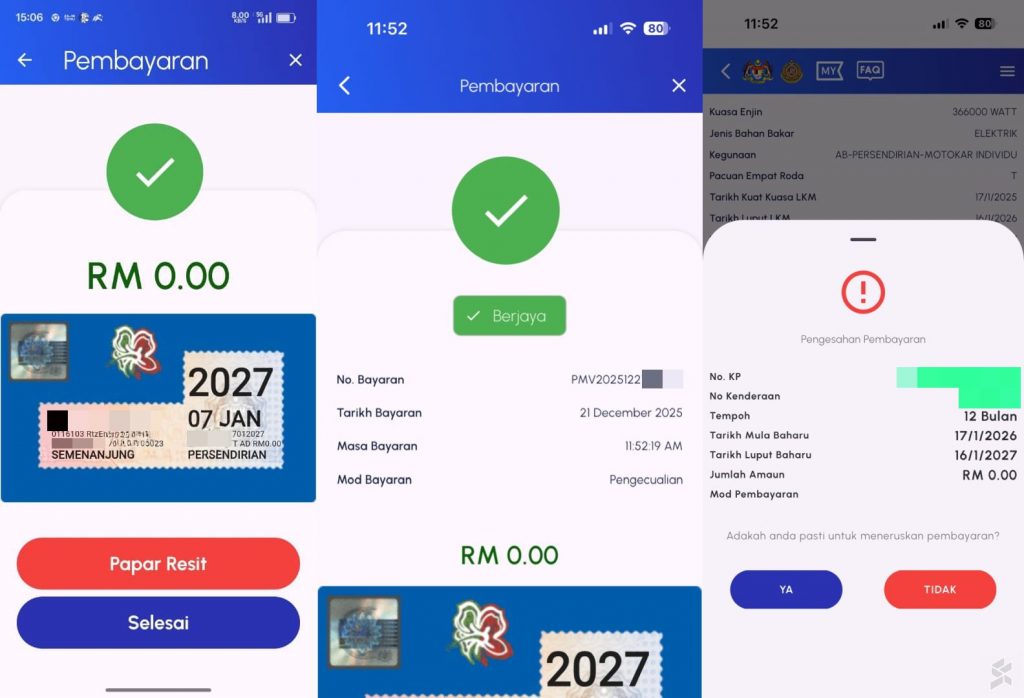

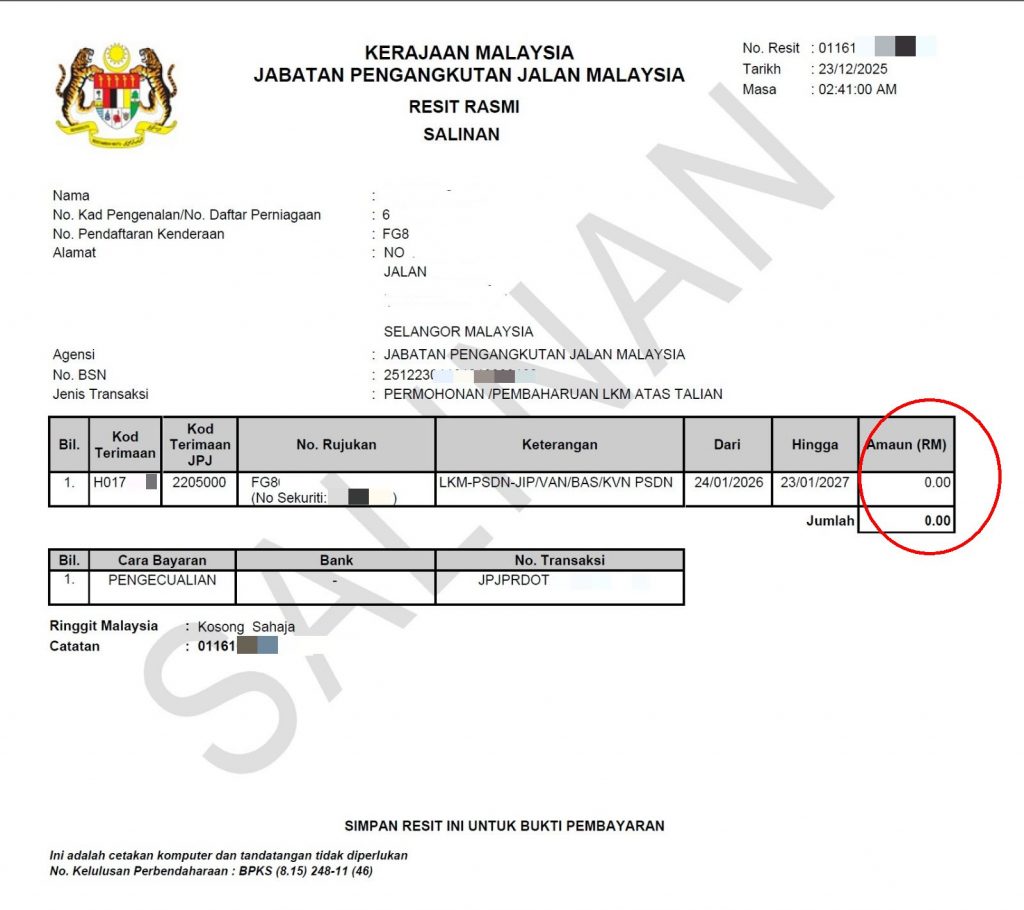

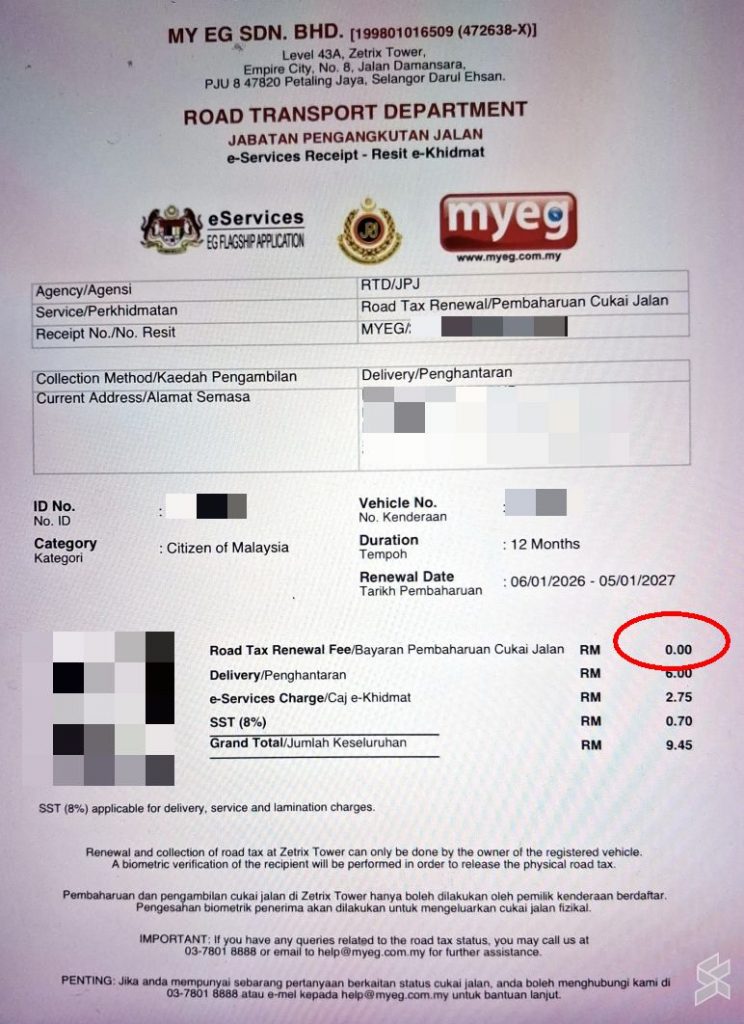

Several EV owners (us included) have renewed their road tax and still get to enjoy RM0 amount for the renewal.

From the looks of it, the road tax waiver for EVs is still applicable as long as you renew by 31st December 2025.

As shared by members in our EV user group, their road tax are due to expire in January 2026 and they managed to renew for RM0. Another EV member with road tax due for renewal on 4th February 2026 has also managed to renew for RM0.

Our own EV is also due for road tax renewal on 5th January 2026 and we also managed to renew for RM0 as shown below.

Take note that you need to renew your motor insurance before you can proceed to renew your road tax. EVs registered under companies will require a physical road tax printout.

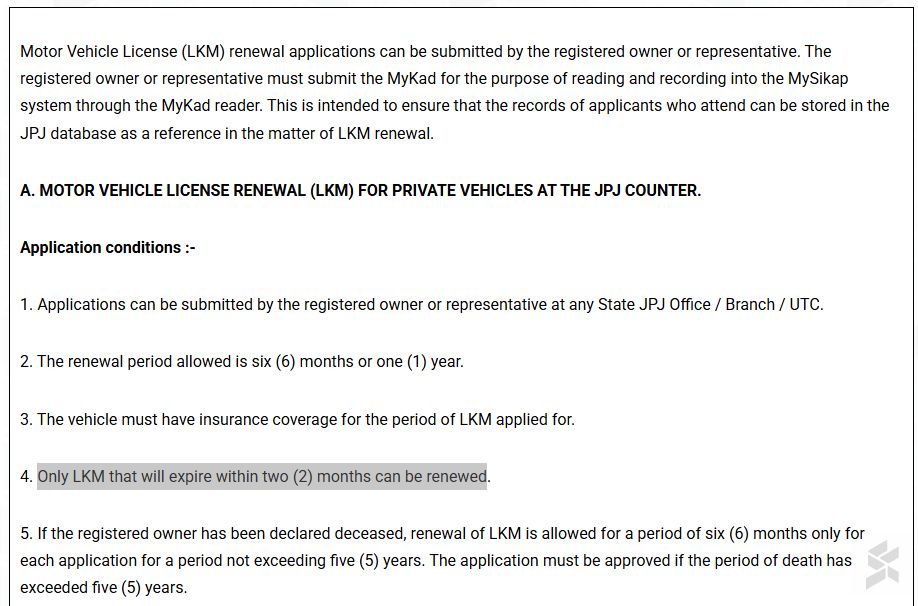

According to JPJ’s motor vehicle license renewal (LKM) guidelines, you can renew your road tax early if it will expire within 2 months. So this means that if your EV’s road tax is due to expire before the end of February 2026, you should be able to renew it today.

Just make sure you renew your insurance and road tax by 31st December 2025.

EV Road Tax Calculator 2026

If you own an EV and wondering how much you need to pay for road tax, you can use the calculator below. Unlike petrol or diesel vehicles which calculates road tax based on the engine’s displacement (cc), road tax for EVs is calculated based on the motor output in kW.

For example, the Proton e.MAS 7 has a 160kW motor so it is RM180/year. Meanwhile, the Tesla Model 3 Long Range AWD with 366kW output costs RM865/year.

Malaysia EV Road Tax Calculator

EV Road Tax: RM

Terima kasih, Hanif Azrai. 😀