Payments Network Malaysia Sdn Bhd (PayNet) has launched a new initiative that aims to supercharge the local fintech scene. Called the PayNet Fintech Hub, the initiative is designed to provide promising Malaysian fintech startups with not just funding and mentorship, but also the connections and international exposure needed to grow and scale.

During the launch, PayNet CEO Farhan Ahmad shared his experience with building startups and the challenges faced by the local startup community. He said a thriving fintech industry is the key to delivering future-ready and inclusive financial services that can advance Malaysia’s growth and innovation goals.

He added that successful fintech innovation is one of the best ways to ensure Malaysia keeps up with the fast-evolving nature of financial services due to the rapid growth of AI. The launch of the PayNet Fintech Hub is described as a decisive step forward in enabling this vision.

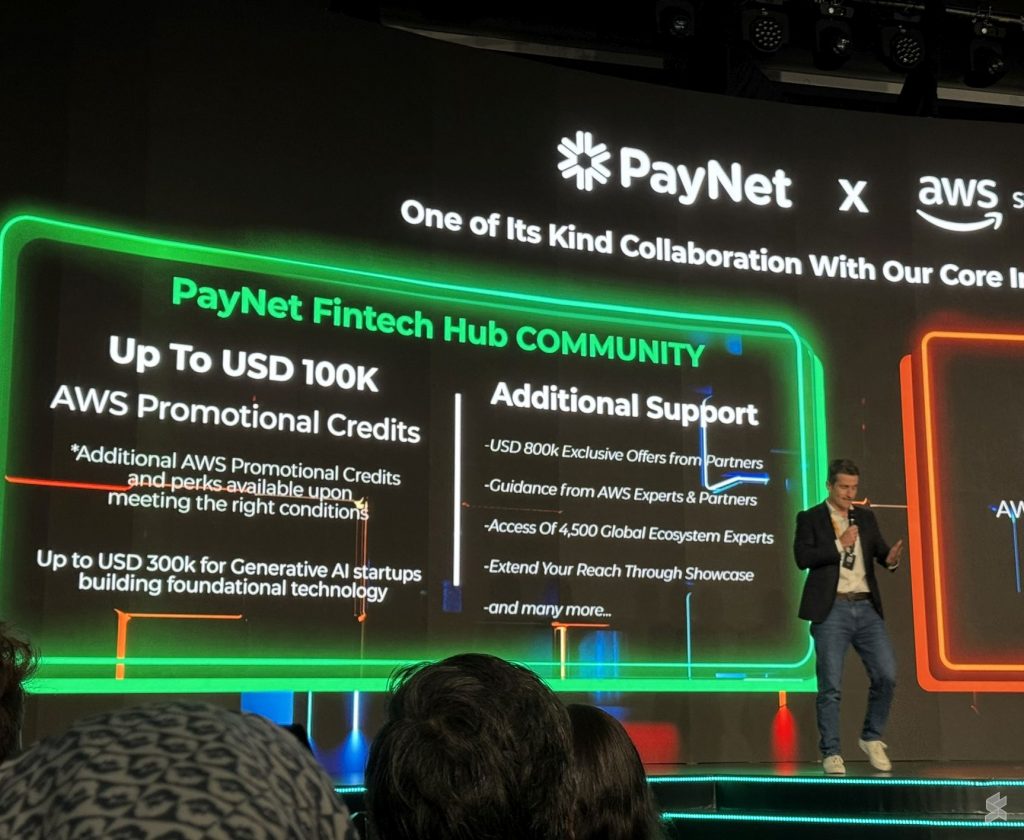

The programme has two main pillars: Community and Catalyst. Startups that make it into the Community track will get access to over RM1 million worth of PayNet value-added credits; over RM600,000 worth of sponsored advisory services covering legal, finance, HR and market research; up to RM3 million in cloud infrastructure credits; and a sponsored co-working space.

They’ll also receive hands-on mentorship from industry veterans and strategic introductions to banks, tech players, and potential investors.

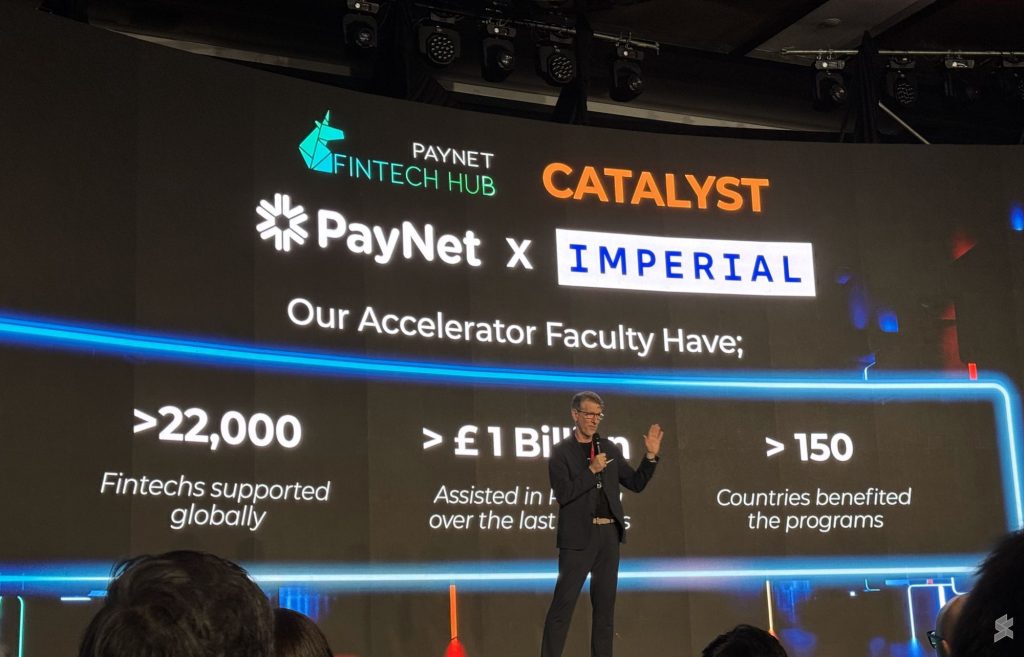

Selected startups from the Community will be elevated to the Catalyst programme which will receive a fully sponsored accelerator that’s conducted in collaboration with Imperial College London. This includes a 10-week curriculum and a week-long trip to London, where founders can engage directly with the Imperial faculty, fellow international startups, and venture capitalists.

Catalyst startups will have the opportunity to gain additional AWS Promotional Credits up to USD 25,000 (for top 3). In addition, they will also get access to Fintech Innovation Sandbox to support use case development with realistic test data on AWS Malaysia Region.

Farhan describes the Fintech Hub as a truly unique and transformative initiative that’s dedicated to scaling startups beyond the foundational stage. It aims to tackle key issues faced by local fintechs and to accelerate growth in the country. He added that the Hub is PayNet’s response to a global call for smarter collaboration and accelerated innovation, uniting the fragmented fintech ecosystem and to create real and scalable outcomes.

PayNet Fintech Hub is now open to any fintech startups incorporated for more than a year. While it is focused on Malaysian startups, fintech startups from South East Asia are also welcomed to join.

Registrations are now open until 5th June 2025 and the members will be announced on 15th June 2025. To learn more, you can visit the Fintech Hub page.