During its GX 2.0 event, GXBank revealed its new digital financial products aimed at helping Malaysians and MSMEs achieve their financial goals. As teased earlier, GX FlexiCredit is finally rolling out to GXBank customers gradually starting this month and they are also introducing its new digital product for business owners.

GXBank is Malaysia’s first digital bank and they have acquired almost a million Malaysians who have collectively made 24 million transactions and set up more than 900,00 Savings Pockets. GXBank CEO Pei-Si Lai said with these insights about their customers, they are excited to now support Malaysians with lending facilities to support their financial goals.

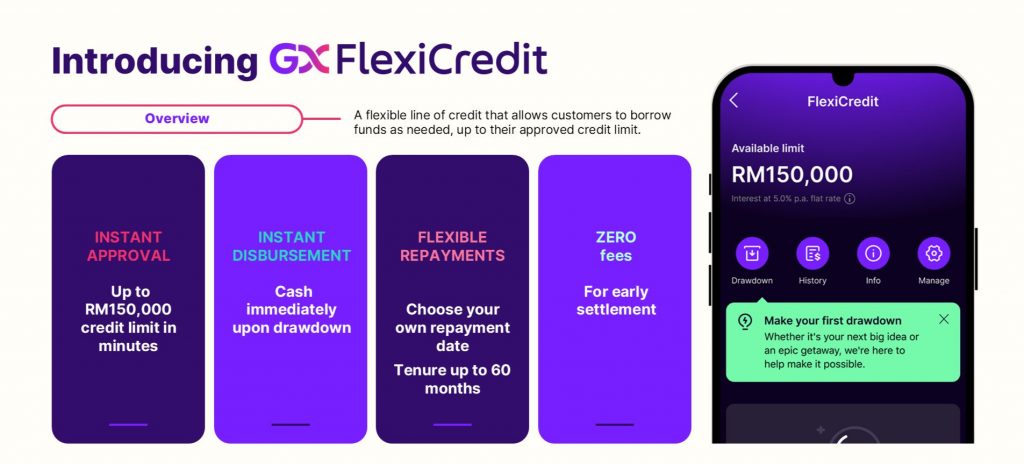

GX FlexiCredit: It’s not a loan but a flexible credit line

GX FlexiCredit is GXBank’s credit line facility where users can obtain a credit limit of up to RM150,000 with instant approvals within a few minutes. The feature will be rolled out progressively to GXBank account holders starting from November 2024 to eligible Malaysians who meet the requirements.

With the credit line approved, customers can withdraw cash immediately and the interest will only be charged on the drawdown amount. GX FlexiCredit users will also get the flexibility to settle repayment early with zero fees. Users will be given the flexibility to choose their repayment options including repayment date and tenure of up to 60 months.

According to the FlexiCredit page, the interest rate starts from 3.88% p.a. (EIR 6.62% p.a.) and users can get RM20 cashback when they activate their credit limit. The GXBank app will require you to login into your KWSP i-Akaun for income verification.

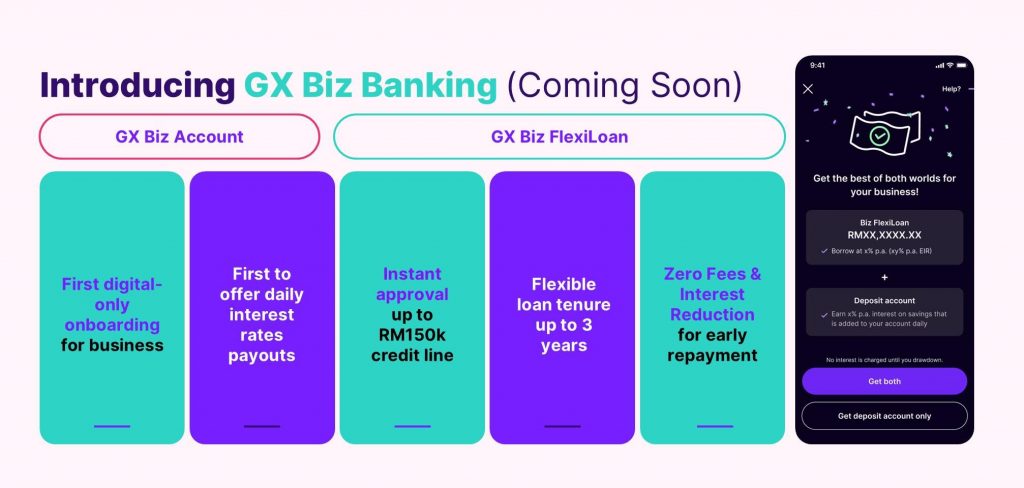

GX Biz Banking is rolling out to Business owners soon

After launching consumer banking products, GXBank will soon introduce GX Biz Banking which offers a fully digital banking experience for business owners. GXBank says it will be the first in Malaysia to offer a digital-only onboarding process and it aims to be a one-stop solution for the business community to open an account and gain access to financing support, which is a pain point for small businesses in Malaysia.

Similar to its retail banking offering, GX Biz Account holders will also enjoy daily interest rate payouts, which is also a first for business banking.

GXBank is also introducing GX Biz FlexiLoan which provides a credit line of up to RM150,000. Eligible business owners can apply for Biz FlexiLoan with instant approval and enjoy flexible loan tenure of up to 3 years. GXBank also offers the flexibility to settle the loan early with zero fees and interest reductions.

GXBank will roll out GX Biz Banking beginning with merchants in Grab Malaysia’s ecosystem, followed by small businesses across Malaysia by the first quarter of 2025.

Meanwhile, GXBank users can still continue to enjoy unlimited 1% cashback with its GX Debit Card. Cardholders can still enjoy 1% cashback for overseas in-store spending, zero markup fees on foreign exchange and zero fees on ATM withdrawals, however, cashback for local spending has been revised to 0.1%.