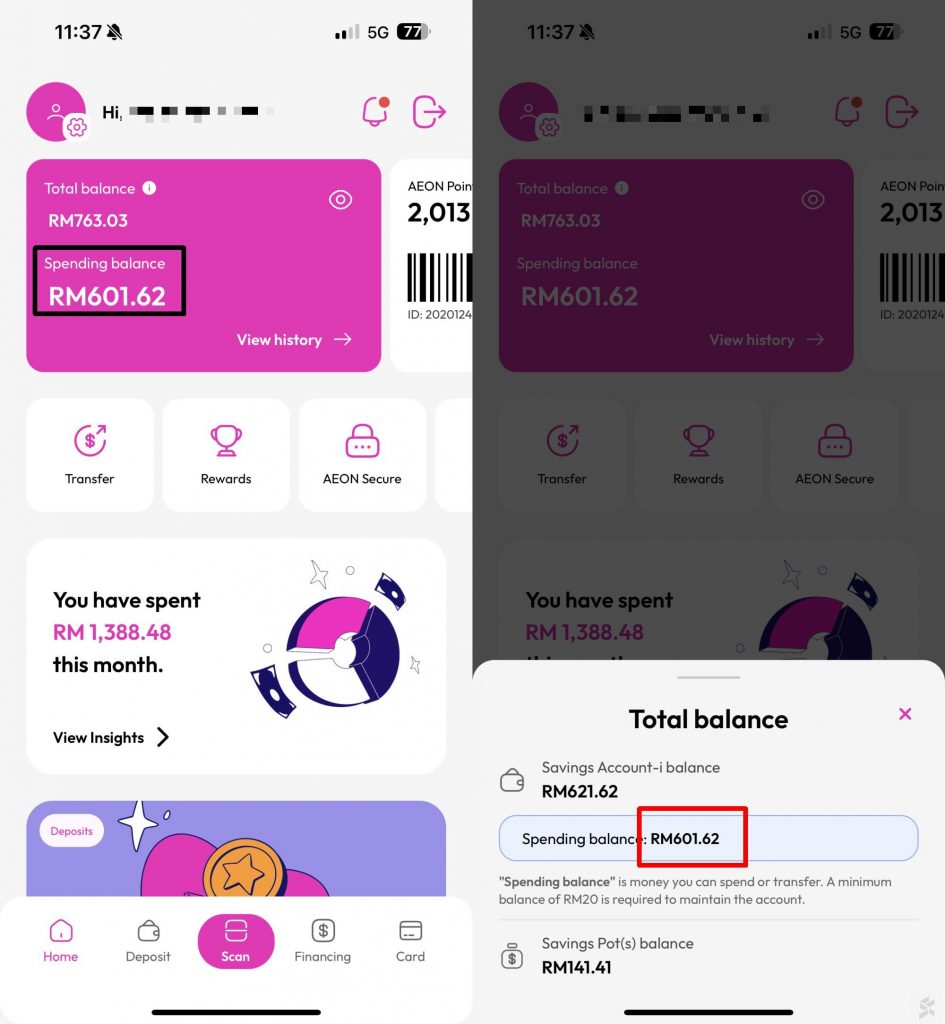

Aeon Bank, Malaysia’s first Islamic digital bank, has just updated its app which makes it clearer to view their available balance. Before this, users were required to tap in to view the breakdown of the Total Balance which is split between Savings Account and Savings Pots. In addition, users would also need to factor in33 the minimum RM20 balance that’s required to maintain their account.

On the new home screen, the top panel now shows the Total Balance as well as the Spending Balance. The Spending Balance represents the actual amount that you can spend via your Debit Card and DuitNow QR.

In case you missed it, Aeon Bank has recently fixed its debit card transaction history issue and all card transactions (including pending status) are now reflected instantly after the payment is made. This allows users to keep track of their expenses and actual remaining balances in real-time.

In case you missed it, Aeon Bank currently offers 3.88% p.a. profit rate for deposits made to its Savings and Savings Pot. In addition, they are offering an effective 1.5% cashback with its 3x Aeon Points promo (3 Aeon Points for every RM1 spent). These points can be redeemed (200 Aeon Points to RM1) as cash credited into your Aeon Bank Savings account. The profit rate and extra cashback perks are offered under Aeon Bank’s launch campaign promo which is valid until 31st August 2024.