Aeon Bank has officially launched today just days after opening registrations to the public. Aeon is one of the five successful Digital Bank licence holders awarded by Bank Negara Malaysia and it is the first Islamic Digital Bank to launch in Malaysia. Unlike your typical bank, a digital bank doesn’t have any physical branches as it operates fully online.

Here are 8 things you need to know about Aeon Bank.

First Islamic Digital Bank, open to all Malaysians

Licensed under the Islamic Financial Services Act 2013 (IFSA) and regulated by Bank Negara Malaysia, Aeon Bank is Shariah-compliant and it is open to all Malaysians aged 18 years old and above. Aeon Bank is also a member of Perbadanan Insurans Deposit Malaysia (PIDM) and depositors are protected up to RM250,000.

To register, you’ll have to download the Aeon Bank app which is available via the Apple AppStore and Google PlayStore. Take note that it only works on iPhone devices running on iOS 15.0 or above, or Android devices running on Android 12 or above.

Aeon Bank Debit Card-i is numberless

Upon registration, you can opt to get the physical Aeon Bank Visa Debit Card-i which is currently offered for free and it supports Visa Paywave. As part of their introductory offer, Aeon Bank is waiving the RM12 issuance fee and the card will be delivered to your registered address.

Similar to TNG eWallet Visa card, this Aeon Bank Visa Debit card is also numberless as it doesn’t have the typical 16-digit card number, expiry and CVV printed on the card. The only personal detail is your preferred cardholder name printed on the back.

The debit card can be used to withdraw cash at ATMs with the MEPS or Visa logo. Local cash withdrawals at MEPS ATMs will cost you RM1 per transaction while foreign cash withdrawals at Visa ATMs will cost you USD 1 (about RM4.71).

[ UPDATE 6/06/2024 ] ATM Withdrawals overseas costs RM10 and there’s a 2% transaction fee for foreign transactions.

When you use the card overseas, Aeon Bank says there’s no FX Markup but Visa’s foreign exchange rates will apply. If the payment terminal asks you to choose which currency to charge, always pick the foreign currency and not MYR for lower rates.

According to Aeon Bank, they are also working on enabling Apple Pay and Google Pay support for its Debit card. Once implemented, the feature will enable virtual card users to make cashless payments with their smartphones and smartwatches.

[ UPDATE 12:30 27/05/2024 ] Aeon Bank Visa Debit Card-i transactions don’t reflect in the transaction history in real-time.

DuitNow and DuitNow QR ready

For shops that don’t accept card payments, the Aeon Bank app supports DuitNow QR from day 1. Just launch the app and tap on scan. Aeon Bank holders can also receive or transfer funds to other external bank accounts via DuitNow transfer.

Aeon Bank Savings Account-i offers 3.88% p.a. profit rate

As part of its introductory campaign which runs until 31st August 2024, Aeon Bank is offering 3.88% per annum profit rate for its Savings Account-i and Savings Pot.

Unlike GXBank which credits the interest daily into your account, Aeon Bank’s Profit Rate is calculated based on the total balance of your Savings Account-i at the end of each day, but the profit will be paid into your account on the last day of the month.

Aeon Bank has not shared the normal profit rate after the campaign period so we’ll have to wait and see after 31st August.

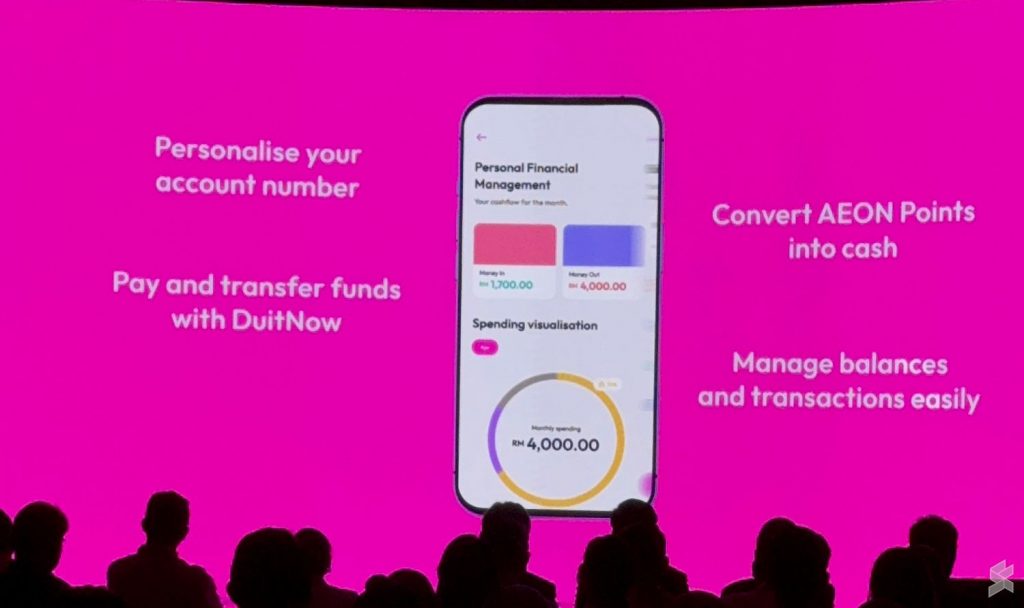

Personalised account number and finance management

Aeon Bank also provides a nifty feature that’s not offered by any other bank in Malaysia right now. New customers are given the option to personalise their bank account number by picking their preferred last 4-digits, subject to availability.

To help you manage your budget, the Aeon Bank app has a Budget Centre which lets you set budgets for different transactions. The feature also provides a comparison of your current month’s spending versus previous months.

For greater control, users can manage their card from the Aeon Bank app. This includes locking the card, changing PIN, set transaction limits and block online or overseas usage.

“1.5% cashback” with 3x Aeon Points promo

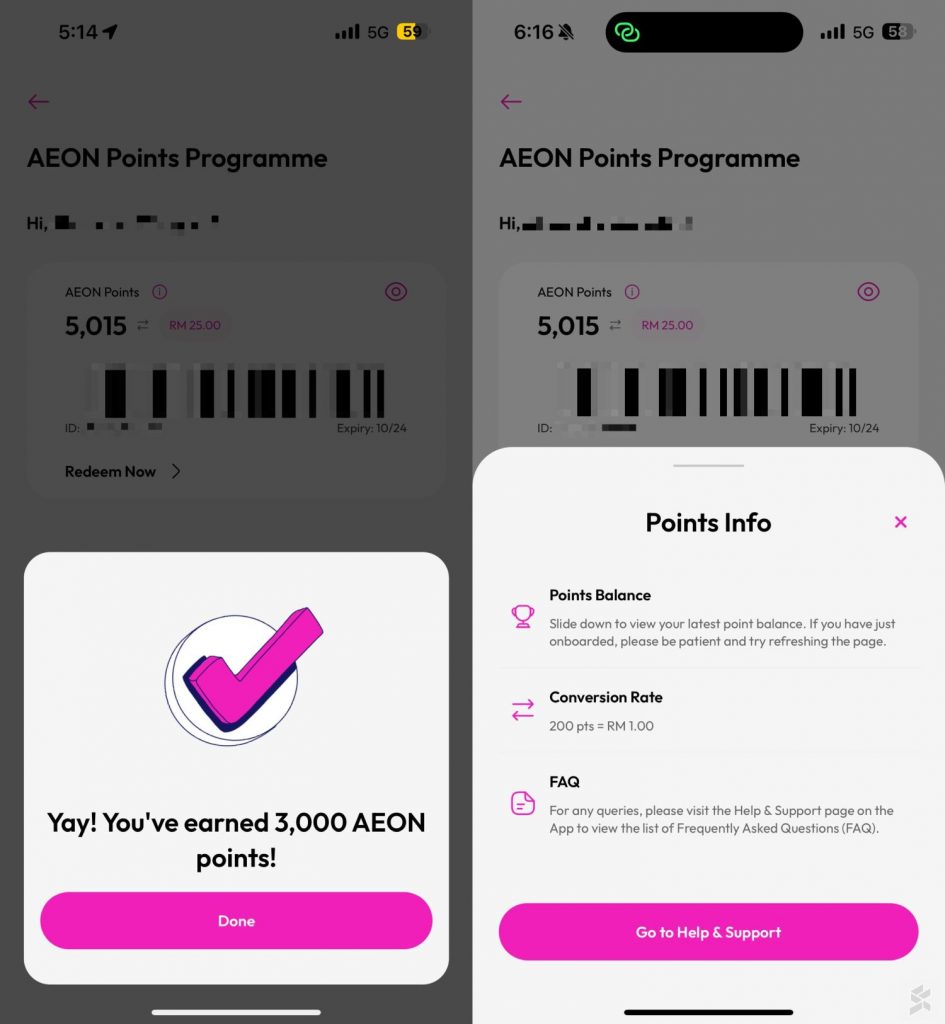

As the first bank with retail integration in Malaysia, Aeon Bank offers seamless integration with Aeon Points Programme. Upon registration, you will receive 3,000 Aeon Points and you can view your current points directly from the Aeon Bank app.

As part of Aeon Bank’s promotion, they are also waiving 1-year membership fee worth RM12.00 for its Aeon Points Programme.

When you spend with the Visa debit card, you will earn 1 Aeon Point for every RM1 spent. As part of its promo until 31st August 2024, you can earn 3X points for every RM1. This means if you spend RM100, you’ll earn 300 points. The Aeon Points are only applicable when you spend using the card and it excludes DuitNow QR payments.

From the Aeon Bank app, you can redeem Aeon Points as cash at a rate of 200 points to RM1 and the amount is credited directly to your savings account. Effectively, this is equivalent to 1.5% Cashback during the promo period.

In addition, Aeon Bank’s FAQ also states that you can earn extra Aeon Points when you show your Aeon Points Programme barcode from the Aeon Bank app at the cashier or self-service check-out scanner to earn 1 Aeon Point for every RM1 spent at Aeon stores, Aeon MaxValue Prime, Aeon Wellness and Aeon Big Hypermarkets.

You won’t earn points for certain excluded transactions including Shahriah non-compliance transactions at merchants with certain MCC (Merchant Category Codes), eWallet top-up, cash withdrawals, insurance payments, cryptocurrency, void transactions, government-related payments and more.

Minimum RM20 balance required at all times

During sign up, you must deposit a minimum of RM20 from another bank that’s registered under your name. Take note that Aeon Bank requires a minimum balance of RM20 at all times. This means if you have a RM100 balance, you can only spend up to RM80.

It is also stated that if your Savings Account-i account is closed within 3 months of account opening, a fee of RM20 will be charged.

More financial services are coming soon

For now, Aeon Bank is offering personal banking services which include a Savings account with a Debit Card and DuitNow QR support. Eventually, it would expand its financial services to serve the underbanked community, including micro and small businesses especially suppliers and tenants of Aeon’s retail business.

For more information, you can visit Aeon Bank’s website and refer to their FAQ.