In just one year, Touch ‘n Go eWallet has disbursed RM91.1 million worth of loans through its GoPinjam feature as of the end of March 2023. This was revealed by the Ministry of Finance in a reply to a question from Batang Sadong MP Rodiyah Sapiee in Parliament.

According to the Ministry, a total of 88,620 individuals have taken loans from TNG eWallet’s GoPinjam. About 55% of the applicants are youths under 30 years of age with an average loan amount of RM1,500 per person.

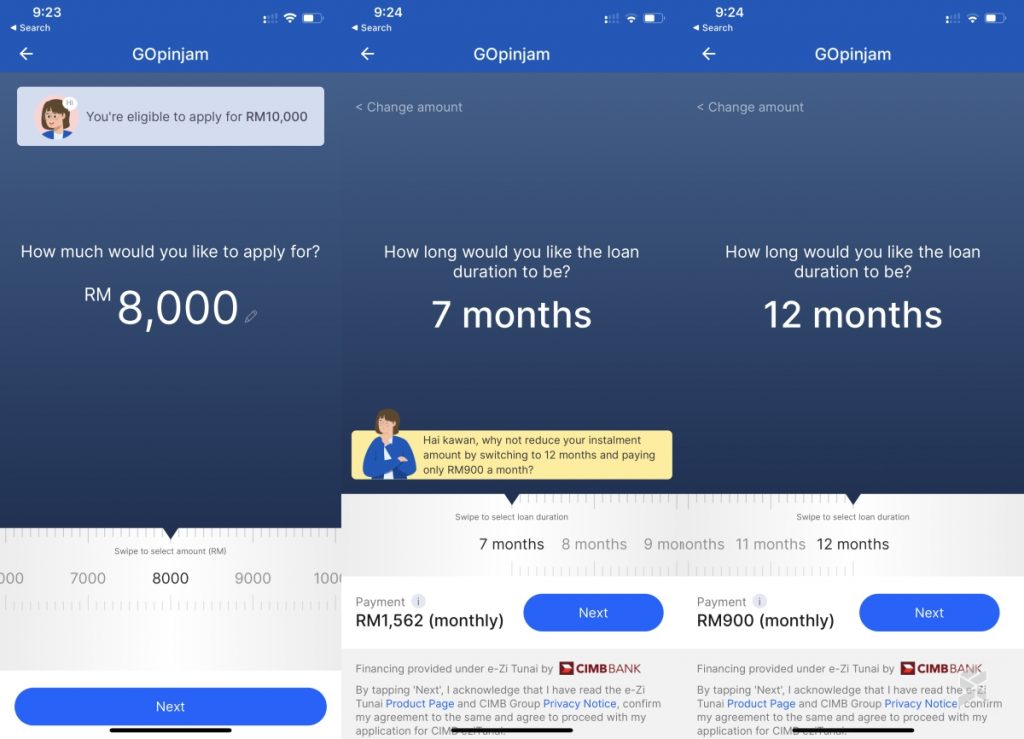

Introduced in April 2022, GoPinjam is a digital personal loan that’s offered in partnership with CIMB. It is financed under CIMB’s e-Zi Tunai product. The loan feature is open to all Malaysians with a minimum monthly income of RM800 and individuals can borrow as little as RM100 for a week up to RM10,000 for 12 months. Depending on the loan amount, tenure and eligibility, the fixed interest rates range between 8% to 36% per annum.

According to the Ministry of Finance, all financial institutions are required to comply with the requirements outlined by Bank Negara Malaysia to ensure fair treatment of consumers and protect consumers from excessive debt burdens and financial difficulties. It added that their responsibilities include carrying out affordability assessments and adhering to prudent debt service ratios to ensure consumers are able to repay the financing throughout the financing period. This includes implementing adequate and effective controls to monitor and evaluate the performance of borrowers carefully to detect and resolve any issues that may cause problems to users immediately.