During a panel discussion at IMKL 2023 Series 2 yesterday, Maxis CEO Goh Seow Eng said population coverage is not a good gauge for 5G coverage. This comes as Malaysia is focusing on expediting the 5G rollout via Digital Nasional Berhad to achieve 80% 5G population coverage by the end of this year. He highlighted the importance of in-building coverage which is severely lacking even in downtown Kuala Lumpur.

Goh asked the audience at the event to raise their hands if they are getting 5G on their mobile device. Presumably, most of the attendees would be using 5G-enabled flagship smartphones considering this is a business-related event organised by Bursa Malaysia.

It appears that none of the attendees is able to 5G indoors and Goh said, “This is pretty amazing. I don’t see a single hand up. Does this mean Maxis has a 100% market share here?”

Maxis is currently the only major telco in Malaysia without 5G as it has yet to sign the 5G access agreement with DNB.

Maxis CEO: 5G population coverage is not a good indicator of coverage. Indoor coverage is still lacking even in the middle of KL. Maxis will sign the 5G access agreement but coverage remains an issue and this is where the dual network comes in. pic.twitter.com/1fRzaCCJ7Y

— SoyaCincau (@Soya_Cincau) June 7, 2023

Goh said he asked the question to make a point that one of the things Malaysia lacks is in-building coverage and right here in KL, there was no 5G coverage in the venue. He iterated the issue isn’t a matter of Maxis not signing the access agreement which he also assures that Maxis will sign the 5G access agreement with DNB. But there’s also a matter of coverage which needs to be highlighted and this is something telcos need to work together and that’s where the dual network comes in, he added.

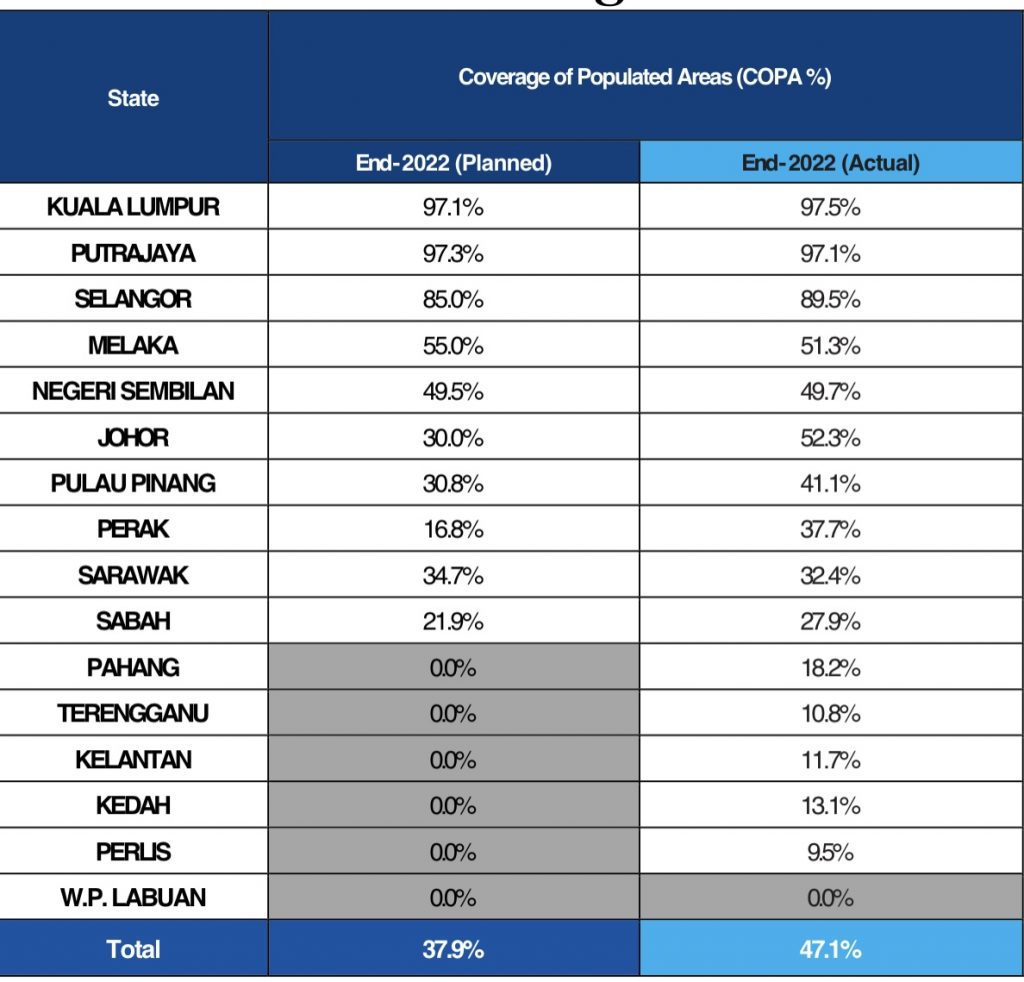

As highlighted by Communications and Digital Minister Fahmi Fadzil yesterday, Malaysia’s 5G population coverage is at 62% as of 31st May 2023. Last year, DNB said its 5G rollout is among the fastest in the world and it has exceeded its 2022 target by claiming 47.1% 5G population coverage as of end-2022.

DNB claimed a higher population coverage despite deploying about 3,900 sites which is less than its original target of 4,018 sites planned for 2022. After a public rebuke by Fahmi Fadzil, DNB later revealed that users in only 38% of populated areas are able to access 5G as there are sites that have yet to be onboarded by the telcos. Besides appointing Ericsson, DNB is using ZTE for indoor 5G coverage rollout.

In the Klang Valley, DNB said it has 97.5% 5G population in Kuala Lumpur, 97.1% 5G population coverage in Putrajaya and 89.5% 5G population coverage in the Klang Valley as of end-2022. Despite the coverage claims, most popular shopping malls and office buildings still lack 5G coverage indoors which can be a problem for users with a telco that doesn’t have an extensive 4G network.

The government has recently decided to switch from a Single Wholesale Network to a Dual Network model to encourage network competition which will then drive innovation and resilience for Malaysia’s 5G infrastructure. However, the second 5G network will only begin after DNB achieves its 80% 5G population coverage by the end of this year.

After more than a year of government-led 5G rollout, Malaysia’s 5G adoption rate is among the lowest in the region behind the Philippines, Indonesia, Singapore and Thailand. The MCMC recently shared that Malaysia’s 5G adoption rate is at 3.1% as of 30th April 2023.

A 5G Task Force has been formed to ensure a smooth transition to a dual network model and it is currently addressing issues related to DNB’s 5G access and equity agreements. Following the government’s policy shift on 5G, both CelcomDigi and Telekom Malaysia have terminated their respective share subscription agreement with the state-owned 5G network provider. The Chairmen of the Task Force aims to sort out these issues by the end of June so that more providers including Maxis will be able to provide 5G services to consumers.

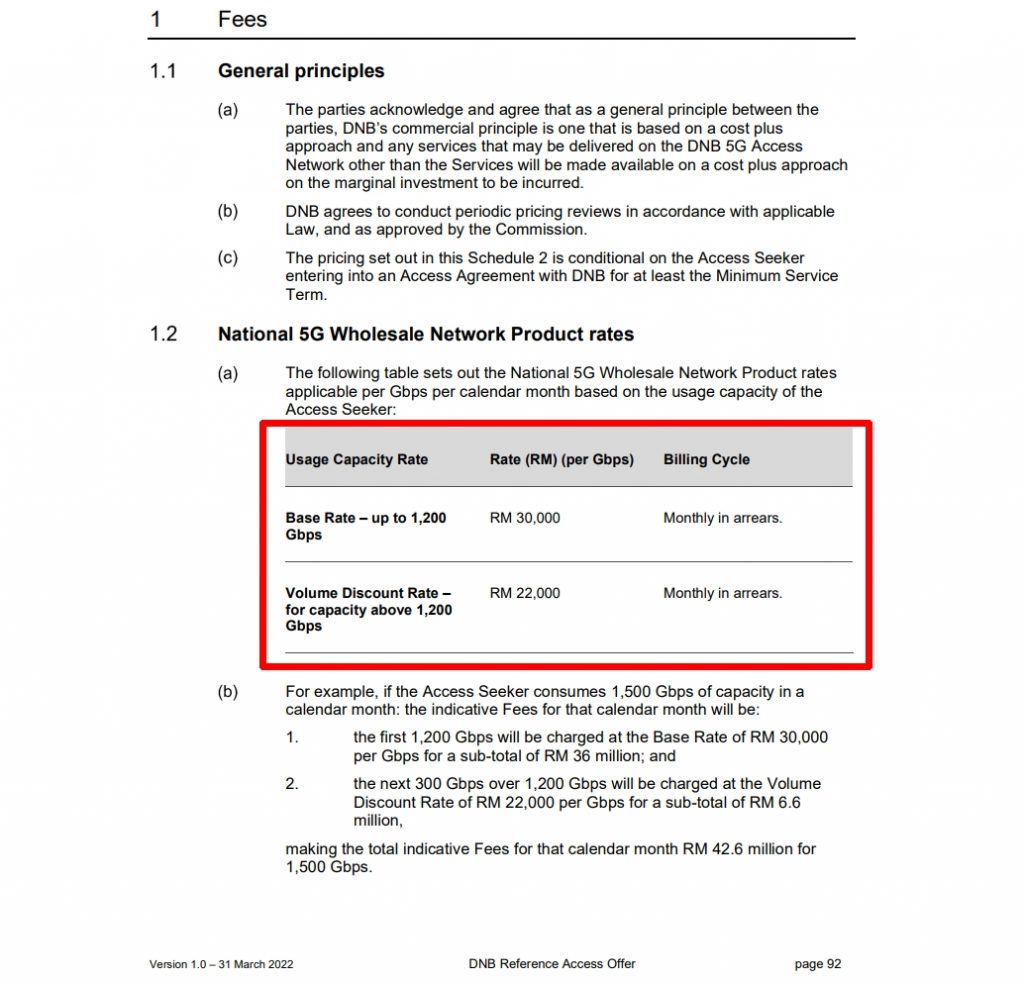

According to DNB’s reference access offer (RAO), telcos are required to pay DNB RM30,000 per Gbps per month for 5G access and the agreement is locked to a minimum period of 10 years. Last year, the big four telcos which include Celcom, Digi, Maxis and U Mobile jointly issued a statement saying that DNB’s 5G access offer will not ensure affordable and quality 5G services and they have highlighted to the MCMC and DNB that the key principles proposed must be consistent with industry best practices. On the opportunity of taking a stake in DNB, the four telcos previously said it must be done through a Mergers and Acquisition process and they proposed setting up project teams to align on the processes such as due diligence, transaction timelines, and other administrative matters.

Back in 2020, the MCMC said it is putting an end to exclusive telco agreements for high-rise buildings. All telcos and building managements with exclusive arrangements have been instructed to take immediate remedial measures or face appropriate actions under the Communications and Multimedia Act (CMA) 1998 by the MCMC and the Competition Act 2010 by MyCC. The MCMC highlighted that the infrastructure planning guideline prohibits exclusive arrangements between telcos and property developers or building management.

Related reading

- Maxis may soon offer 5G services after 5G Task Force addresses DNB access agreement issues

- Malaysia’s 5G adoption rate remains low at 3.1% despite DNB having 59.5% 5G population coverage

- Fahmi: DNB’s 5G coverage is at 59.5%, CelcomDigi and TM’s SSA terminations won’t impact implementation

- Fahmi announces 5G Task Force to ensure smooth transition towards Dual Network model in Malaysia