Deputy Communications and Digital Minister Teo Nie Ching said the Malaysian Communications and Multimedia Commission (MCMC) has issued a directive to all telcos to block links sent via SMS. The move is aimed at preventing users from becoming victims of online scams.

She said the directive is to ensure that no one presses on the wrong link and possibly ends up as a scam victim. She added that several online scams occurred after people clicked on the link and provided their personal details. The move to block links in SMS will be implemented in phases and she hopes that all involved companies will be able to implement the directive soon.

Weh. Ni scam using GOV SMS platform ke? @my_sejahtera pic.twitter.com/pdWNjMzvm8

— Haaziq Zahar (@haaziq_mz) July 30, 2022

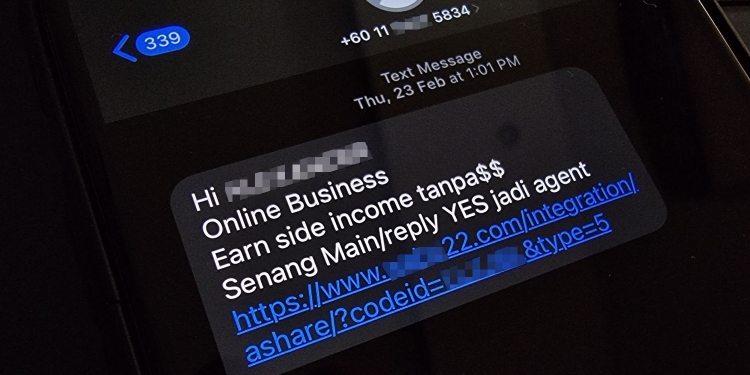

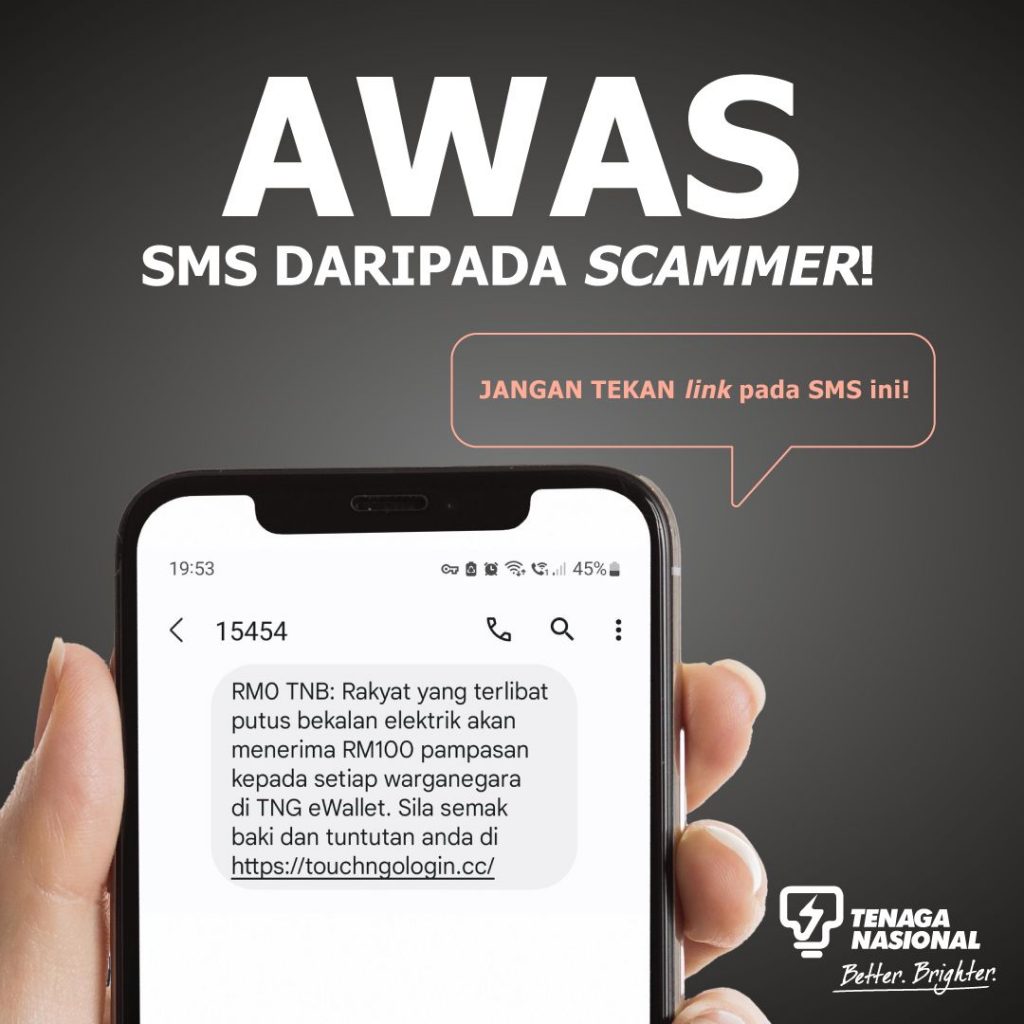

Phishing scams via SMS are very common and the messages can look very convincing as scammers can easily spoof the receiver ID. Usually, these scam SMSes tend to promise victims cash aid or compensation, and they are required to log in to their eWallet to redeem the money. The links may look similar to the URL of a bank or eWallet and are often directed to a fake website which looks exactly like a legitimate login page.

Once the victim provides their login details and One-Time-Password (OTP), the scammers will be able to gain access to their account and withdraw all funds. Despite countless public service announcements, these phishing scams are still happening today.

The move to block URLs via SMS is a good move but it won’t stop phishing scams sent via instant messaging platforms such as WhatsApp. There’s still a need to improve digital literacy in Malaysia and to educate the public about potential scam tactics. The best practice is not to click on any links sent from unknown senders and to only login to your eWallet or online banking account via the official URL and mobile app.

Bank Negara Malaysia (BNM) has also instructed financial institutions to stop sending OTP via SMS and to implement various security features including a cooling-off period for new devices. Most major banks and eWallets have started their migration to app-based SecureTAC for authentication while introducing new stringent checks and cooling-off periods for new devices accessing your account. Last month, Touch ‘n Go eWallet claimed to be the first eWallet to meet BNM’s safety and security measures.

If you or someone you know has become a scam victim, you are urged to call the National Scam Response Centre (NSRC) at 997 as soon as possible. If a report is made within 24 hours, there’s a higher chance for Bank Negara Malaysia to stop the outflow of funds. In the last quarter of 2022, the NSRC managed to recover about RM1.4 million for scam victims.

[ SOURCE ]