[UPDATE 15/11/22 2:13pm]: After a little more testing, we’ve got an update on the transaction limit and shortcut function for Google Pay.

===

Google Pay through the Google Wallet app is now finally available in Malaysia. Sure, it comes after both Samsung and Apple have launched their own versions of this payment service, but isn’t the saying better late than never? Well, now that it’s here, let me give you a quick guide on how you can use this on your Android device.

How to add payment card

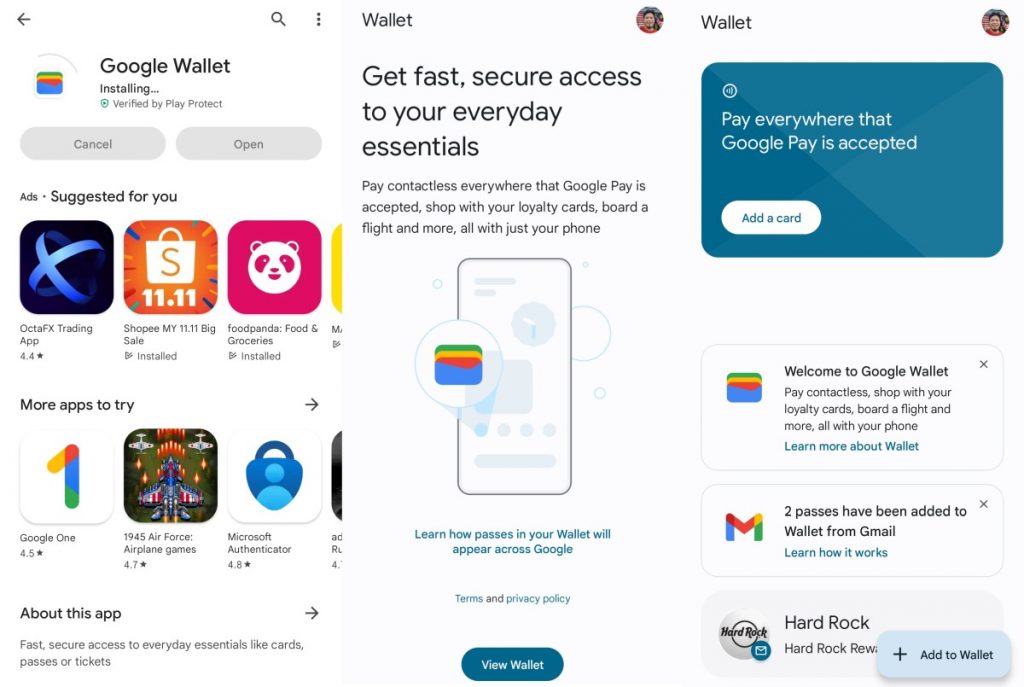

First, you’ll need to download the Google Wallet app on the Play Store. Once you have that downloaded, simply launch the app and you’ll be prompted to view your wallet and add a card. If you have any loyalty cards or passes that are associated to your Gmail, Google Wallet will automatically import them into your wallet. Let’s just put the concerns about this fact aside here for awhile.

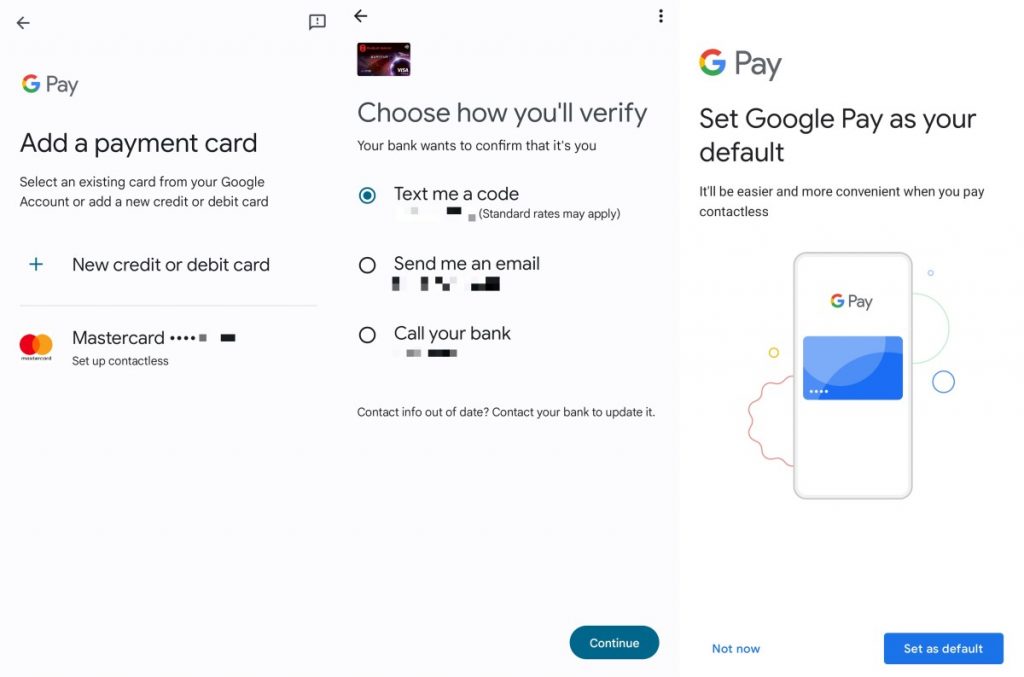

If you hit add a card, you’ll be greeted with a couple of options that let you add payment cards, loyalty cards, transport pass and gift cards. Not many from these other categories are fully supported in Malaysia right now, but you can go ahead and add your payment card into your Wallet.

Once you select that, you’ll be prompted to add your credit card information, billing address and phone number. Then, verify the card and you should be good to go. Keep in mind that Google Pay only supports four banks right now, which is CIMB Bank, Hong Leong Bank, Hong Leong Islamic Bank and Public Bank. You can check out our recent post for a full list of supported credit and debit cards.

How to use Google Pay

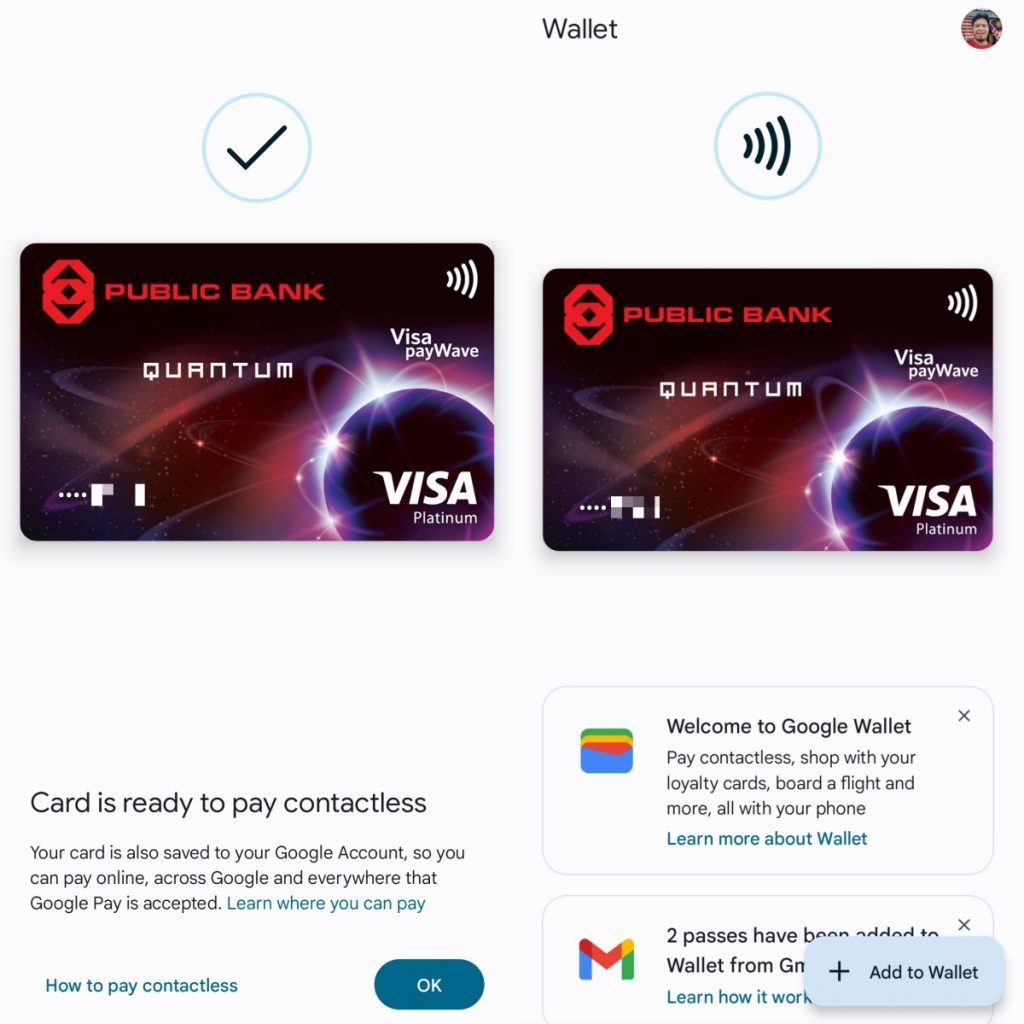

Much like Apple Pay and Samsung Pay, Google Pay uses NFC to pay and can make payments at pretty much any contactless payment terminal or anywhere you see the Google Pay logo. To pay, simply launch the app, select your card and tap on the contactless payment terminal.

Now, you may notice that there is no additional authentication before making a payment, and you’d be right because from what we can tell the only authentication that’s required is your screen unlock. Once that’s done, you can immediately make payments as soon as you launch the app. Unlike Apple Pay and Samsung Pay, which require an additional layer of authentication (be it fingerprint or Face ID), Google Pay doesn’t have this.

Google Pay does use an alternate card number which is device specific for your payments, a feature that’s also similar to Apple Pay and Samsung Pay. Once you’ve made your payment, the transaction will be logged into your “Recent activity” tab.

[UPDATE 15/11/22 2:13pm]

After a little more testing, we learned a couple more things about Google Pay in Malaysia. While previously stated that we could not find a shortcut function to activate Google Pay, it turns out you don’t need to activate it at all. You can simply tap it on an NFC or contactless payment terminal and it will automatically pay for you.

There’s no need to double tap your power button like Apple Pay, and no need to swipe up from the bottom like Samsung Pay. It automatically detects and pays without you needing to launch the app or even unlock your screen.

But, if you do tap your phone without unlocking your smartphone first, Google Pay will have a transaction limit of RM250. That being said, a CIMB rep informed us that once you have unlocked your smartphone, that transaction limit is removed. For context, Samsung Pay has a pinless limit of RM250 which is the same as your normal contactless card limit set by the bank, while Apple Pay does not have a transaction limit. Google Pay does not have a minimum spend limit.

With this new information, I guess Google Pay with Google Wallet works the most similarly to a regular contactless card. Just tap away to pay. Google does advise on their website that you should set up your phone so that it must be unlocked to complete an NFC transaction “for added security”. However, we weren’t able to find this setting on our devices, so it appears that Malaysia isn’t one of the countries with the capability to enable this feature. ‘