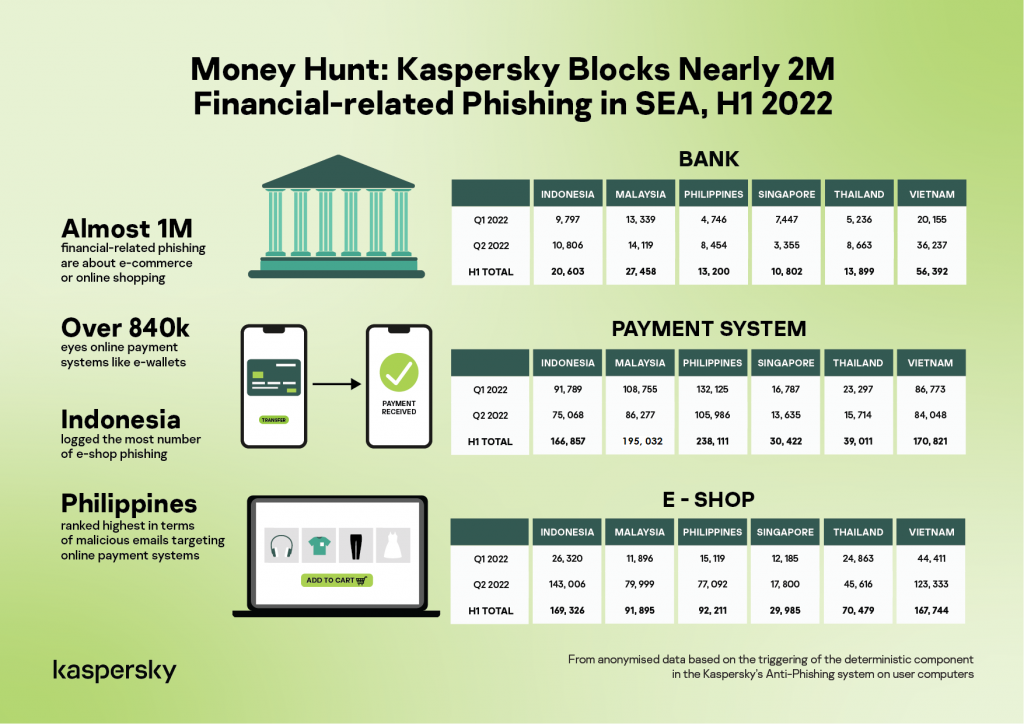

A report by Kaspersky showed that Malaysia alone had a total of 195,032 payment system-related phishing activities in the first two quarters of 2022. Compared to other Southeast Asian countries, the total makes the country one of the top ones when it comes to financial phishing.

According to Kaspersky’s infographic regarding financial-related phishing in the SEA region, Malaysia had a reported 108,755 payment system-related phishing activities in quarter one and 86,277 in quarter two. It might not be as much as in the Philippines, where it has a total of 238,111 reported payment system-related phishing activities in both quarters. But Malaysia is still in the top two rankings, above Vietnam, Indonesia, Thailand, and Singapore.

Malaysia is in the mid-tier for bank-related phishing scams, with a total of 27,458 reported activities in both quarters. It also is in the mid-tier for e-shop-related scams, with a total of 91,895 reported activities.

Kaspersky wrote that the data shown are from “anonymised data based on the triggering of the deterministic component in the Kaspersky’s Anti-Phishing system on user computers”. According to the cybersecurity provider, it detects pages with phishing content that the user has tried to open by following a link in an e-mail message or on the web.

The data from Bank Negara Malaysia revealed that the average number of digital payment transactions per capital has more than quadrupled in the last ten years—increasing from 49 in 2011 to over 221 transactions per capita in 2021. Cashless adoption will remain a part of an ongoing effort of the government to bolster the domestic fintech industry, but it’s also a convenient source for more online-related scams.

“It is a welcome development with possible great economic gains, for us and the cybercriminals. With most users here aware of the threats targeting our online money, it is time to act now and secure your mobile devices to enjoy the perks of a more connected, regional financial environment,” said Yeo Siang Tiong, General Manager for Southeast Asia at Kaspersky.

It’s good practise to keep a keen eye on suspicious emails—if it looks too good to be true, check, double-check, and triple-check. Kaspersky also advises that you should maintain two email addresses—one for official use and one for websites that require you to log in or gather information.

Be careful of messages that will lead you to a website as there are a number of malicious software that can gain entry into your contacts list and financial apps. Use reliable security solutions with anti-phishing and secure payment capabilities, and be vigilant. There is no harm in being too cautious, especially as most financial transactions are now done online.

[ IMAGE SOURCE ]