Apple Pay was officially launched in Malaysia early this month and it’s almost six years after Samsung Pay arrived in our local market. Some might asked, what’s the big deal? Samsung Pay is able to do the same contactless payment since 2016. To understand the difference, here’s what you need to know about using Apple Pay in Malaysia.

What you need to use Apple Pay

Apple Pay contactless payments use NFC and it works on the iPhone 6 and above, which also includes the iPhone SE. If you have an Apple Watch, you can also enable Apple Pay from Series 1 and above.

In terms of compatible bank cards issued in Malaysia, Apple Pay supports Ambank, Maybank and Standard Chartered at the moment. Only Maybank supports credit, debit and prepaid cards, while the other two only support credit cards. For now only Visa and Mastercard are accepted, but Apple has teased that American Express cards will be supported soon. More bank cards will be supported at a later date and CIMB has announced that it will enable Apple Pay sometime in the second half of 2023.

As a comparison, Samsung Pay currently supports cards issued by 8 banks in Malaysia which also include CIMB, Citi, Hong Leong Bank, HSBC, Public Bank and RHB.

How to setup Apple Pay?

To use Apple Pay, you will need to add your payment card in the Wallet app on your iPhone. Just launch the Apple Wallet app, tap on the plus (+) button in the top right corner, and follow the instructions. You will need to perform a verification which can be done via SMS OTP or through a phone call.

To use Apple Pay on your Apple Watch, you’ll have to add them again via the Watch app under Wallet. Another verification process is required for each device that you have.

You can add multiple cards to your Apple Wallet. To set one as default, just hold and drag the card to the front in the Apple Wallet app.

How safe is Apple Pay?

According to Apple, they do not store your full card details on the server, iCloud or on the device itself. After a card is approved, the card issuer will create a device-specific Device Account Number, and it is encrypted and stored on the iPhone’s secure element. Apple Pay only keeps a small portion of your card number and if you want to use it on your Mac, iPad or Apple Watch, you’ll have to add them individually with verification required.

When you make a payment using Apple Pay, your device is not sharing the card number with the merchant. It only sends the device account number and a dynamic security code to complete the transaction. So this is a lot more secure than taking out your physical card at the counter.

How to use Apple Pay?

Using Apple Pay is super easy. If you’re using newer iPhone models with Face ID like the iPhone X, iPhone 11 or the latest iPhone 13, just double-press the power button, verify using your face and pay. On the iPhone 12 and above, you can use Face ID while wearing a face mask. If you’re using an older model, you’ll have to take off your mask to make a payment. Alternatively, you can use your passcode to authenticate the payment.

Meanwhile, for those who use iPhone models with Touch ID such as the iPhone SE, Apple Pay is authenticated using the fingerprint sensor.

The most convenient way to use Apple Pay while on the go is with the Apple Watch. Just double press the side button and tap the screen on the reader. In case you’re wondering if using the Apple Watch is safe, the Watch will lock up automatically once it is taken off your wrist. This prevents others from misusing your Watch without your permission.

Take note that not all Apple Pay services are available in Malaysia just yet. There’s no Apple Card or Apple Cash for our local market and that also means you can’t send or receive money via iMessage. The Apple Wallet also supports Transit cards in selected markets but unfortunately, you can’t add the Touch ‘n Go card to your iPhone.

Ease of use

From a usability standpoint, it seems that Apple Pay is slightly more convenient to use as it can authenticate payments instantly using your face. On a Samsung device, it is a bit different as it doesn’t support Face Unlock for Samsung Pay. Its facial recognition feature isn’t as secure as Apple’s Face ID. You’ll have to swipe up from the bottom of the screen and then use your fingerprint to authenticate.

Apple Pay vs Samsung Pay

As we’ve established earlier, Apple Pay works almost the same as Samsung Pay. Both will work on any card terminals with NFC. On the older Galaxy models, Samsung Pay can work with the older magnetic stripe card terminals as it has Magnetic Secure Transmission (MST). However, MST is no longer supported on the newer Galaxy models including the S21 and S22.

One advantage Apple Pay has is that you can make pinless transactions above RM250. Typically if you use paywave or Samsung Pay, a pin or signature is required for payments over RM250. Because of Apple Pay’s security and verification features, there’s no such restriction and the only limit is the one that’s set on your card. That means you can tap for a RM1,000 transaction and you don’t need to punch in your pin at the terminal machine.

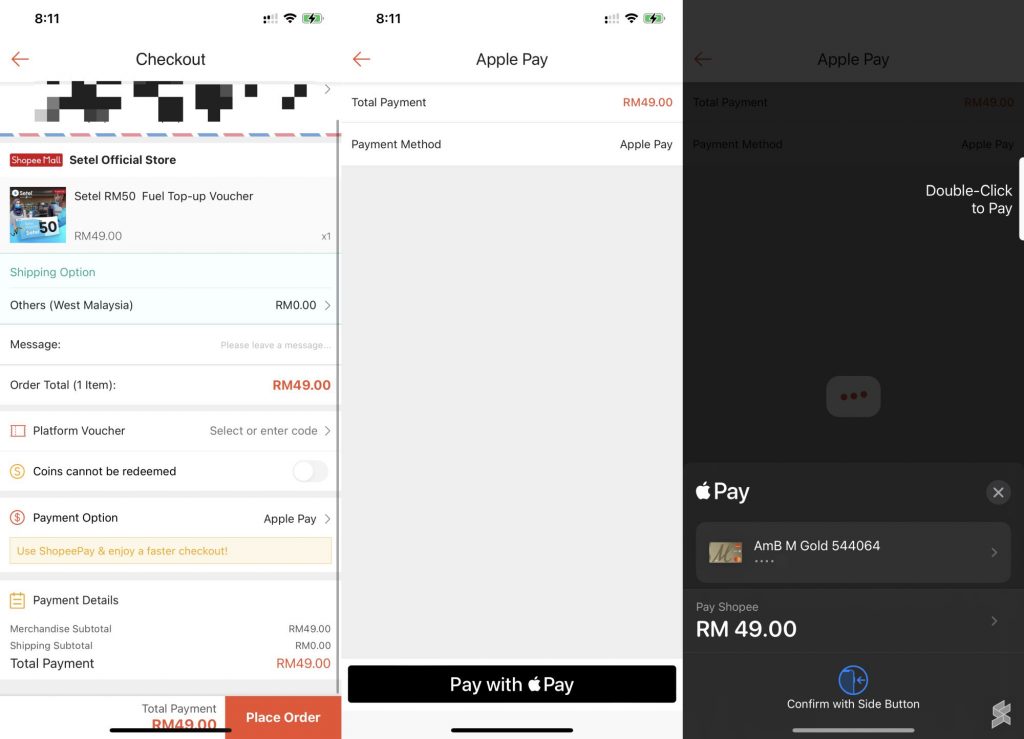

Besides physical payments, Apple Pay is also available for websites and in-app purchases. This includes Shopee and Atome, where you can select Apple Pay as your mode of payment. Using Apple Pay on websites and apps is more secure and convenient as you don’t have to store your credit card details with them. You can approve the transaction just by double pressing the power button and you don’t need to wait for the OTP. Take note that in-browser Apple Pay only works on Safari running on Apple devices.

Meanwhile, Samsung has its own rewards where you can earn points for every Samsung Pay transaction. The points can be used to redeem vouchers and other member benefits. There’s also a tiered reward system where you can earn higher points if you’re a frequent user. However, the type of freebies and benefits offered isn’t as exciting as they used to be during the early days of Samsung Pay.

Debunking Apple Pay myths

As mentioned before, Apple Pay will work with all contactless terminals that accept Visa Paywave or Mastercard Paypass and this includes car parks and vending machines. The terminal doesn’t have to be clearly marked as “Apple Pay” supported. To avoid any confusion or hesitation, just tell the cashier that you want to use paywave. Once they show the terminal, just proceed to tap with your phone or watch.

There is some speculation that retailers or merchants will have to pay more to accept Apple Pay. That’s not true. According to Maybank’s FAQ, the merchant discount rate (MDR) for Apple Pay acceptance is the same as the existing MDR for Amex, Visa or Mastercard debit or credit cards. It will be treated like a regular credit card payment. If your card has its own extra points and benefits, you can enjoy the same perks when you pay via Apple Pay.