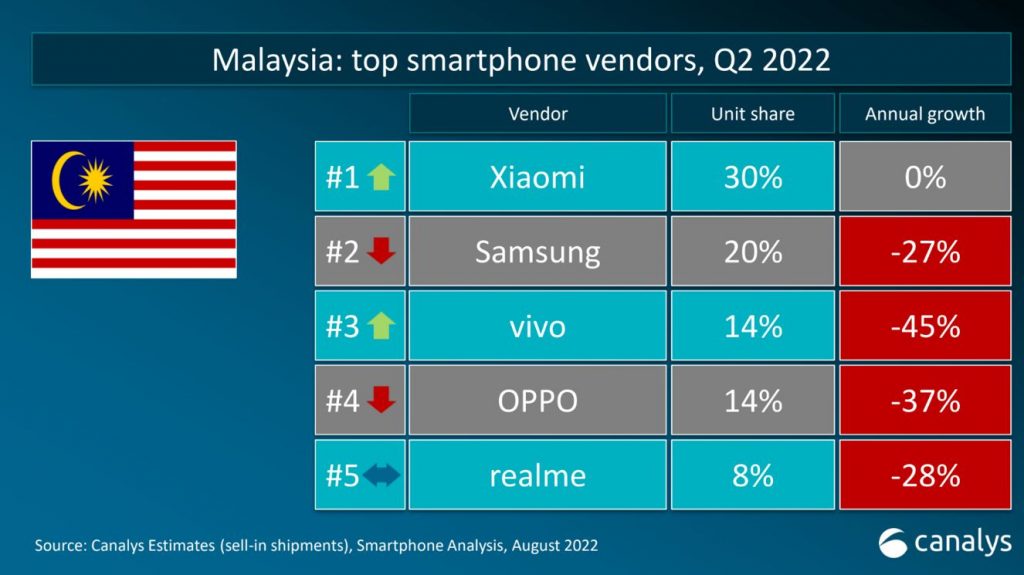

The second quarter of 2022 has been rough for the smartphone industry worldwide. Despite the challenging period, Xiaomi has emerged as the top smartphone maker in Malaysia last quarter with a 30% market share based on the latest sell-in shipment estimates by Canalys.

Among the top five smartphone makers, all except Xiaomi have shown significant decline in growth between 27 to 45%. Despite not recording any growth, Xiaomi claims to have increased their market share by 5% from Q1 2022. Samsung currently is #2 with a market share of 20%, followed by BBK Electronics group brands Vivo, Oppo and Realme that command 14%, 14% and 8% market share respectively.

Xiaomi said their success in the last quarter is attributed to its premium flagship devices such as the Xiaomi 12 series. Targeting the masses, Xiaomi has a variety of affordable mid-range smartphones under its Redmi Note 11 series which has been a hot seller for the sub-RM1,200 category. Also not forgetting Xiaomi’s Poco brand which has been popular for offering the best hardware for your money. In April, they launched the Poco F4 GT which is Malaysia’s most affordable Snapdragon 8+ Gen 1 flagship smartphone that’s offered from under RM2,000 during sales.

Overall for 2021, Xiaomi was named the #1 smartphone brand in Malaysia by Canalys with a market share of 25% and they have recorded a tremendous annual growth of 93%.

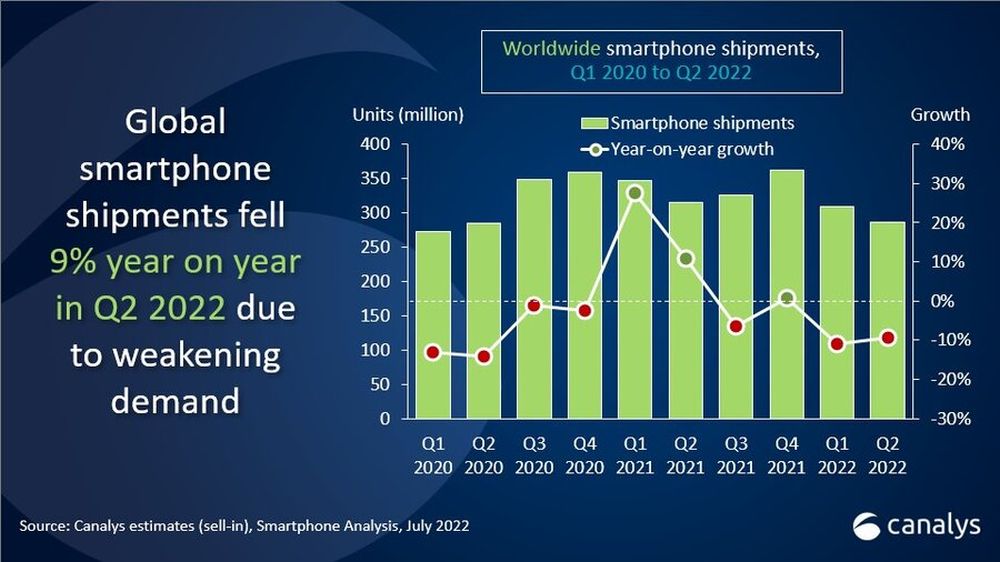

Looking at the global situation, Canalys reported a 9% year on year decline in Q2 2022 due to slow demand. This is due to economic headwinds and regional uncertainty. Analyst Toby Zhu said the falling demand is causing great concern for the entire smartphone chain. He added while component supplies and cost pressures are easing, a few concerns remain within logistics and production with some emerging markets tightening import laws and custom procedures which can delay shipments.

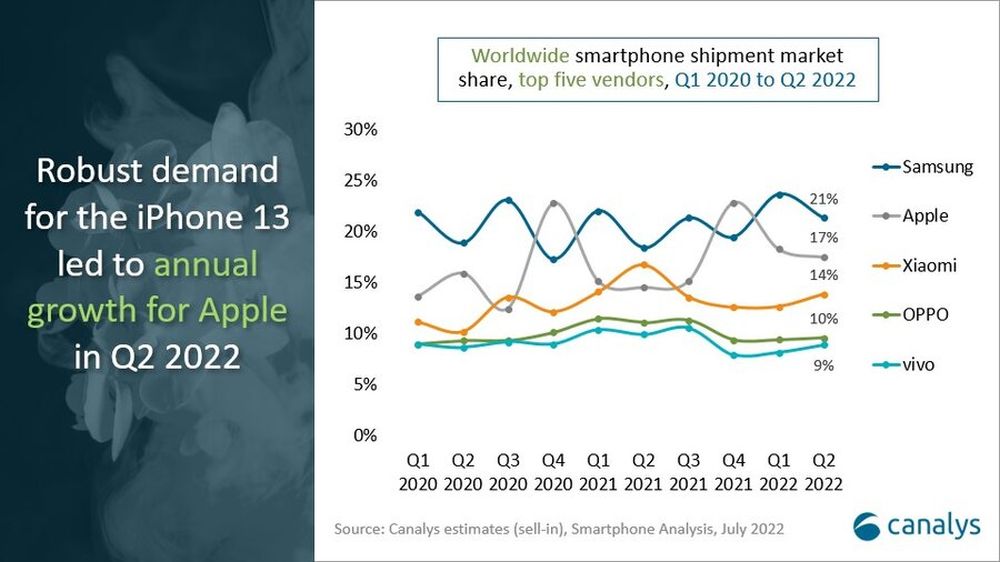

Globally, Samsung remains the top smartphone maker with a 21% market share, followed by Apple at 17%, Xiaomi at 14%, Oppo at 10% and Vivo at 9%. According to Canalys, demand for Apple’s iPhone 13 remains high while Xiaomi, Oppo and Vivo are currently struggling in their home market in China.