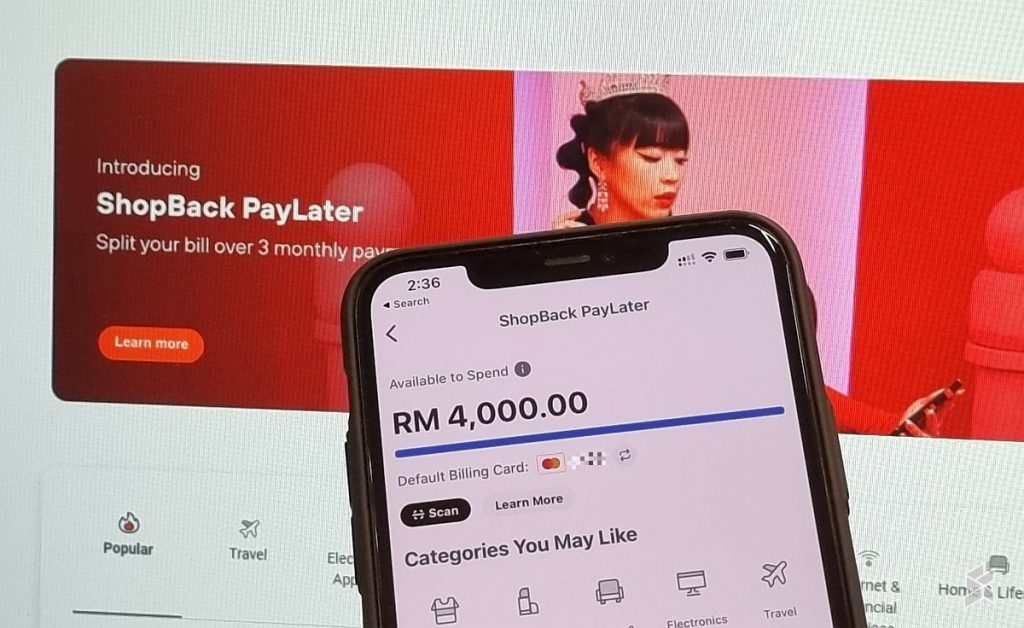

ShopBack, the popular cashback platform for shoppers, has officially introduced ShopBack PayLater as part of its global rebranding exercise. The Buy Now Pay Later (BNPL) feature is made possible following its acquisition of Hoolah. The updated ShopBack app has integrated Hoolah’s capabilities to provide a seamless, convenient and rewarding way to shop.

At the moment, ShopBack has over 35 million users across 10 countries including Malaysia, Singapore, Philippines, Indonesia, Taiwan, Thailand, Australia, Vietnam, South Korea and Hong Kong. The platform has helped to generate over 1 million shopping trips per day across its partner merchants. In Malaysia, ShopBack currently has over 5 million registered users and more than 900 merchants. Since its introduction, ShopBack has given out RM150 million in cashback and rewards to its customers.

Besides helping customers to save money through cashbacks, ShopBack wants to make shopping more accessible with zero-interest payments through its BNPL offering. BNPL is gradually becoming a popular payment method and Malaysia is said to be one of the fastest markets in the region.

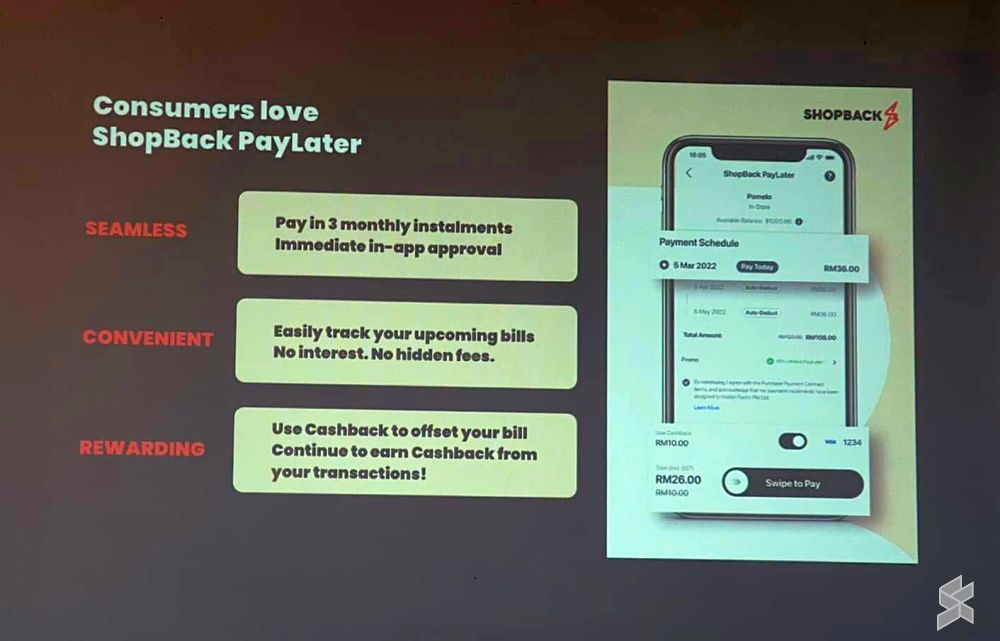

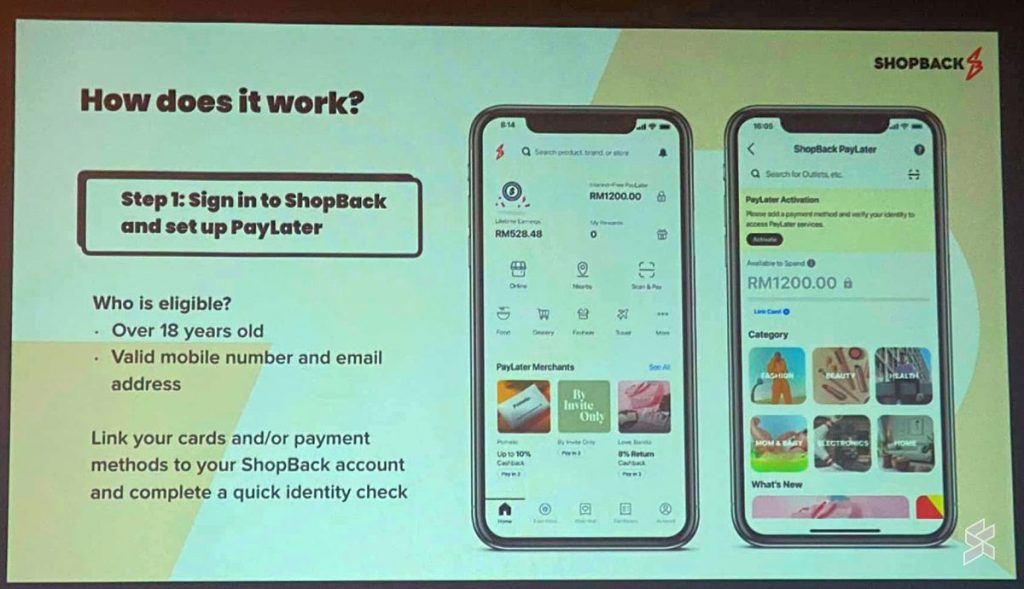

ShopBack PayLater is open to users aged 18 years old and above with Malaysian-issued credit or debit card. Similar to other BNPL offering, users can split their payments into three 0% interest instalments. The first instalment is paid during the first transaction, and the subsequent payments are due 30 and 60 days later respectively.

At the moment, the PayLater feature is supported at over 2,000 online and brick and mortar stores. Some of the popular stores include Love Bonito, Zalora, JD Sports, Malaysia Airliens, Royal Sporting House and Jakel Malaysia.

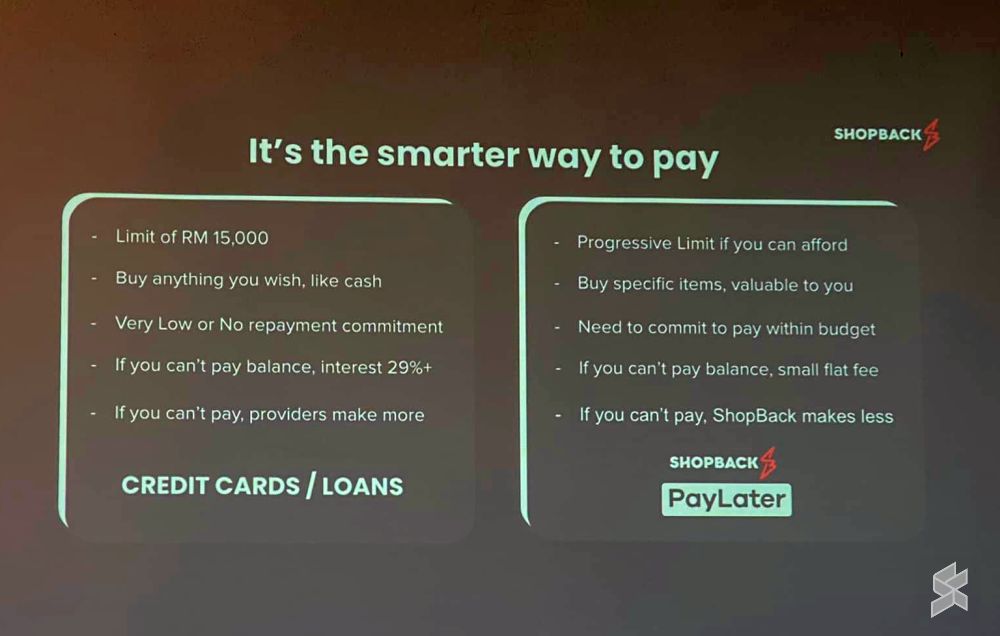

New ShopBack users will be given a smaller limit of RM1,600 as a start and this will be increased progressively according to their spending and repayment habits. On concerns of users overspending and defaulting on payments, ShopBack emphasised that it is important to them that customers are able to pay within budget as they will make less money if people can’t pay.

In the event of a financial difficulty, customers who can’t pay will be charged a small flat fee. According to their FAQ, the late payment charge is RM7.50 for orders less than RM100, RM25 for orders valued between RM100-RM499.99 and RM75 for value of RM500 and above. ShopBack says they will send several reminders before the payment due date. If users overlooked or forget a payment, their representative will reach out to them to provide any necessary assistance.

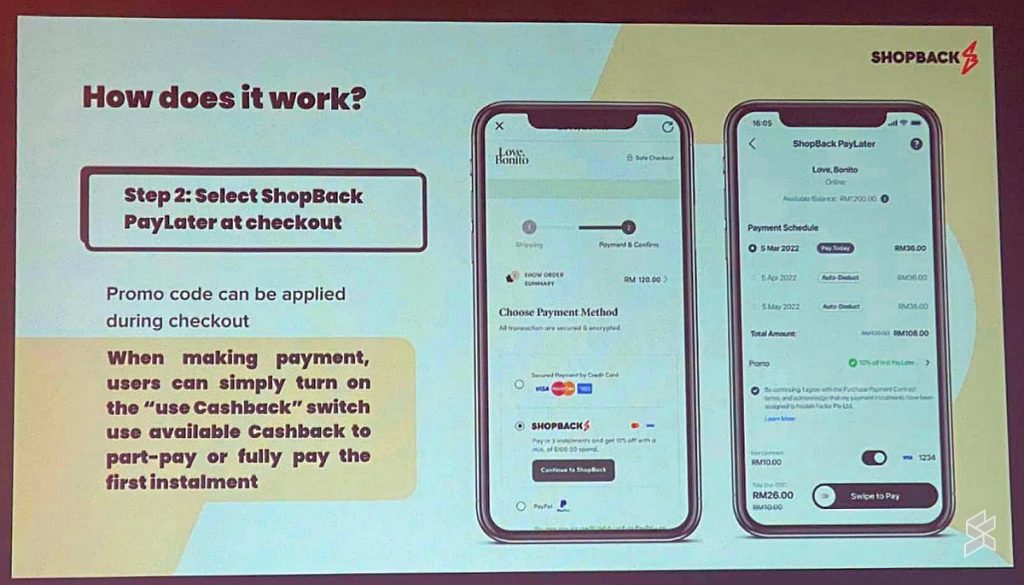

To use ShopBack PayLater, you will need to activate it on the Shopback app which is available on Android, iOS and Huawei App Gallery. You’ll have to perform an electronic Know Your Customer (eKYC) process which involves taking a picture of your IC along with a selfie picture. Once that’s done, you will need to link it to your preferred credit or debit card. To make a payment, just look out for the ShopBack PayLater QR code at a participating store, scan the QR code using the app and follow the rest of the instructions.

Besides being able to split payments without interest, ShopBack PayLater users can enjoy exclusive deals and promos. New users can get 25% off (capped at RM25) for their first ShopBack PayLater bill with no minimum spend using the promo code FEELSGOOD25. Users can also stand a chance to win up to RM50,000 worth of prizes at participating brands at selected stores and dates listed below:

- JD Sports (1 Utama) – 23 to 24 July 2022

- Mimpikita (Jalan Ara, Bangsar) – 28 to 29 July 2022

- Love Bonito (MidValley Megamall) – 30 to 31 July 2022

- Royal Sporting House (Pavilion Kuala Lumpur) – 5 to 7 August 2022

- Pomelo (1 Utama) – 13 to 14 August 2022

- Al-Ikhsan (IOI City Mall Putrajaya) – 20 to 21 August 2022

- JD Sports (Pavilion Kuala Lumpur) – 27 to 28 August 2022

As usual, users can earn cashback from their purchases at selected merchants. On top of that, you can also use your available cashback to pay for your ShopBack PayLater transaction. For more info, you can check out ShopBack’s website.