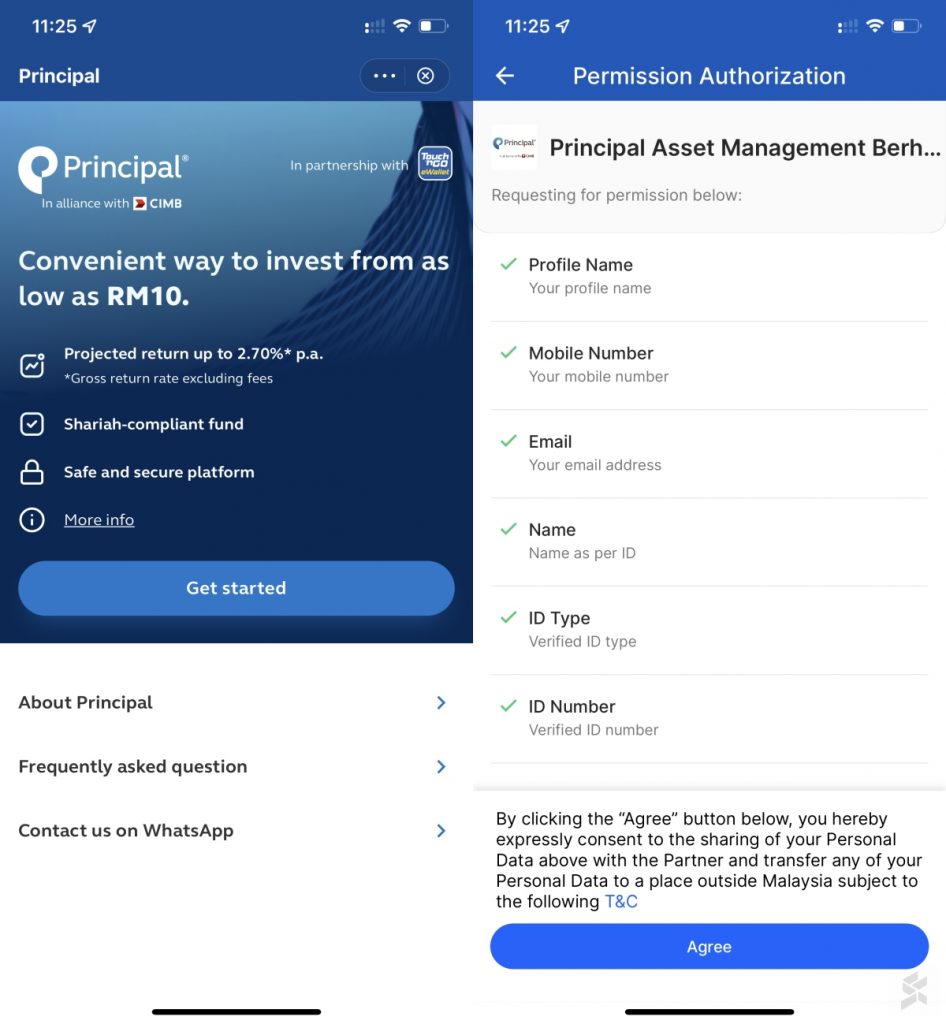

Touch ‘n Go eWallet has introduced a new investment product called GoInvest. Not to be confused with the previously launched Go+, GoInvest is described as a goal-based investment platform and it offers a higher projected return of up to 2.70% per annum. According to Touch ‘n Go, the fund is based on Principal’s Islamic Money Market Fund (Class D) which is Shariah-compliant.

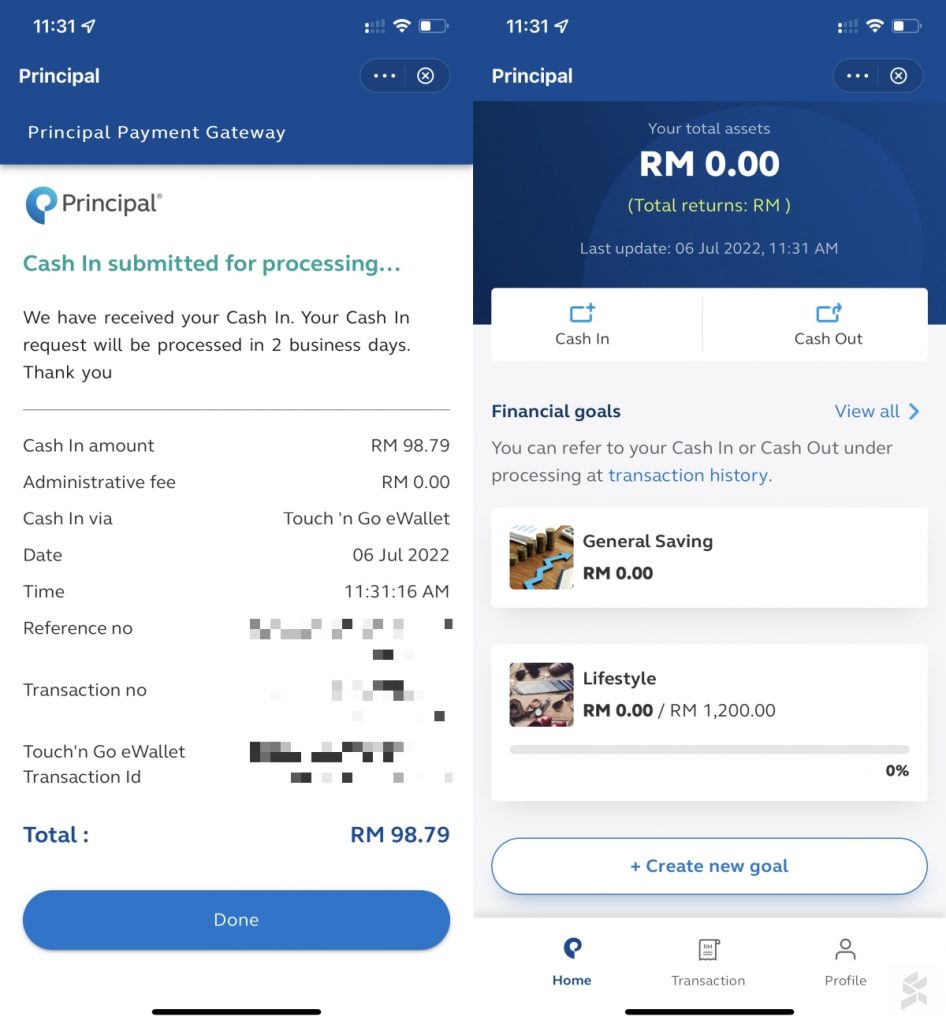

Unlike Go+ which is interlinked with your main Touch ‘n Go eWallet, the GoInvest feature operates with a clearer degree of separation. While you can top-up via FPX or with your current TNG eWallet balance, the only way to cash out is to your bank account which can take two business days. This also means that if you’re making an eWallet, PayDirect or RFID transaction with an insufficient balance, the eWallet won’t deduct any amount from your GoInvest fund, keeping your investment intact at all times.

In short, Go+ is suitable for short-term savings where you can earn interest on a daily basis with greater flexibility to cash in and out from your eWallet. However, GoInvest is catered for long-term investment and it can be used to save up to achieve a certain financial goal.

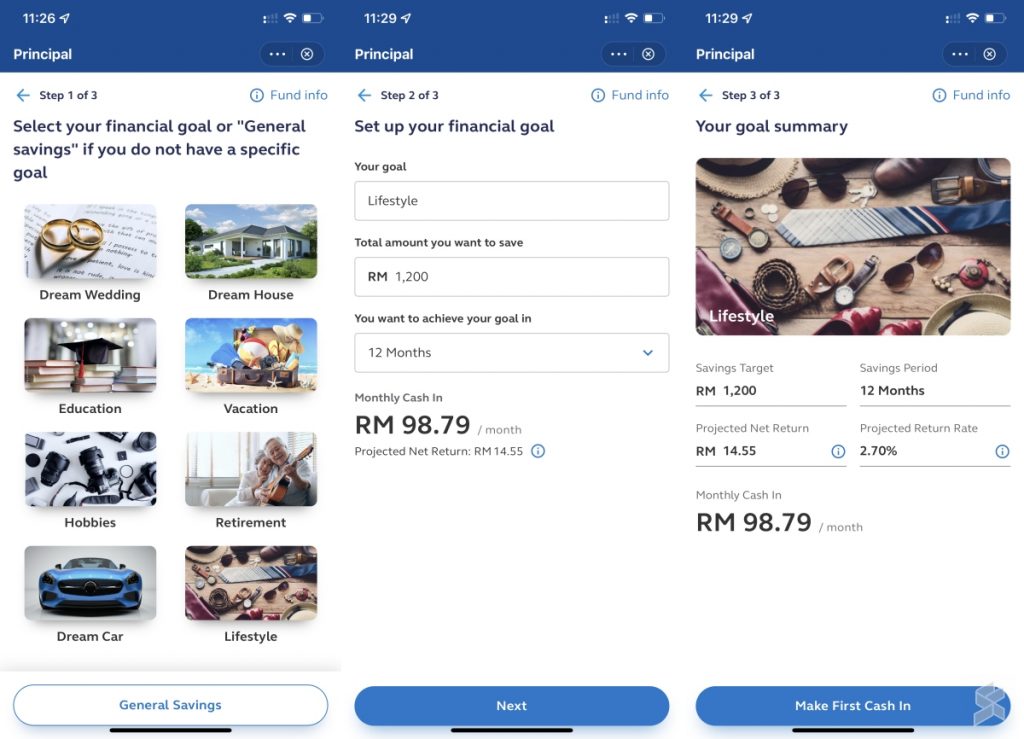

If you have not enabled Go+, you will have to go through an eKYC (electronic know your customer) process. Once that’s done, you can start by creating your financial goal or a general savings fund. With a goal, you can set your target amount of how much you wish to save, as well as the duration. The app will calculate your monthly required cash-in and it will show you the projected net return and interest rate for the period.

The projected return rate of 2.70% is calculated based on the current gross yield of the portfolio, less the fees for Management and Trustee fees during the period. As a comparison, Go+ currently has a listed nett daily return rate of 1.8% pa.

According to the FAQ, the minimum cash-in amount is RM10 and there’s no limit for GoInvest. However, the amount that you are permitted to cash in is subject to the transfer limit of your Touch ‘n Go eWallet or bank account. For FPX, there’s a limit of RM30,000 per transaction. At the moment, there’s no auto monthly deduction or standing instruction feature to fund your financial goal and you’ll have to do it manually using the Cash-In feature on Touch ‘n Go eWallet or FPX. For first-time investor for the fund, there’s a cooling-off period of 6 business days.

The fund has no capping amount or lock-in period, and GoInvest is open to all Malaysian Touch ‘n Go eWallet users above 18 years old.

To learn more, you can tap on GoInvest in the Touch ‘n Go eWallet app and check out the FAQ.