Maybank has introduced ATM Cash-out on MAE, a cash withdrawal feature that lets you withdraw money by scanning a QR code on your smartphone. This comes 8 years after Maybank2u cardless withdrawal was introduced, which allowed users to take out money without a physical card.

With the Cash-out feature, there’s no need for you to use an ATM card, touch the keypad or screen for a contactless cash withdrawal experience. All you’ll need is just your smartphone with the MAE app installed and use a supported Maybank ATM. The MAE app is available on the Apple App Store, Google Play Store and Huawei AppGallery.

How to set up contactless ATM withdrawal on MAE?

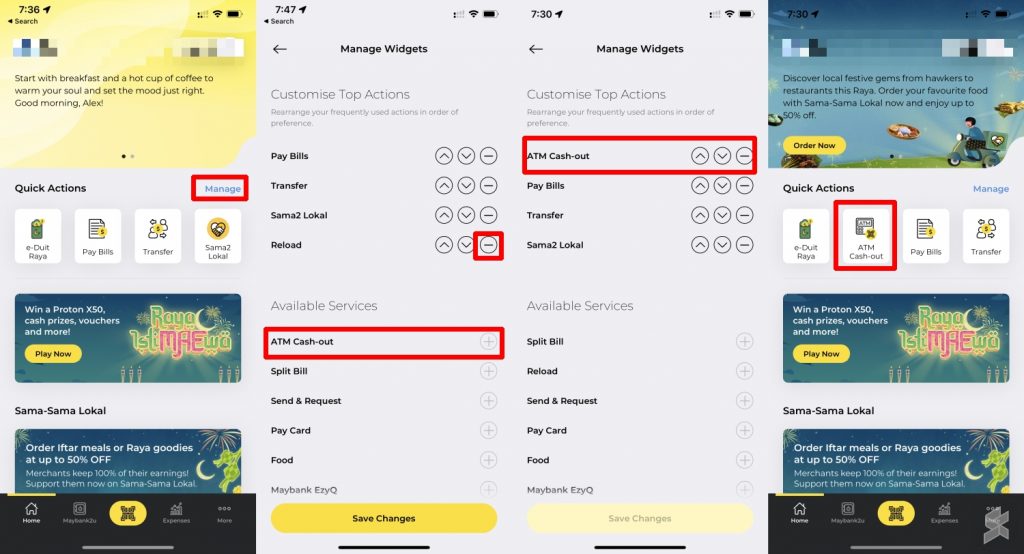

Before you can use the ATM Cash-out feature, you must first bring up the shortcut on your MAE’s home screen. To do so, launch the MAE app and tap on “Manage” on the Quick Actions section. You may have to remove one action which you don’t use and then add ATM Cash-out to the list. Once that’s done, you should see “ATM Cash-out” on the home screen of your MAE app.

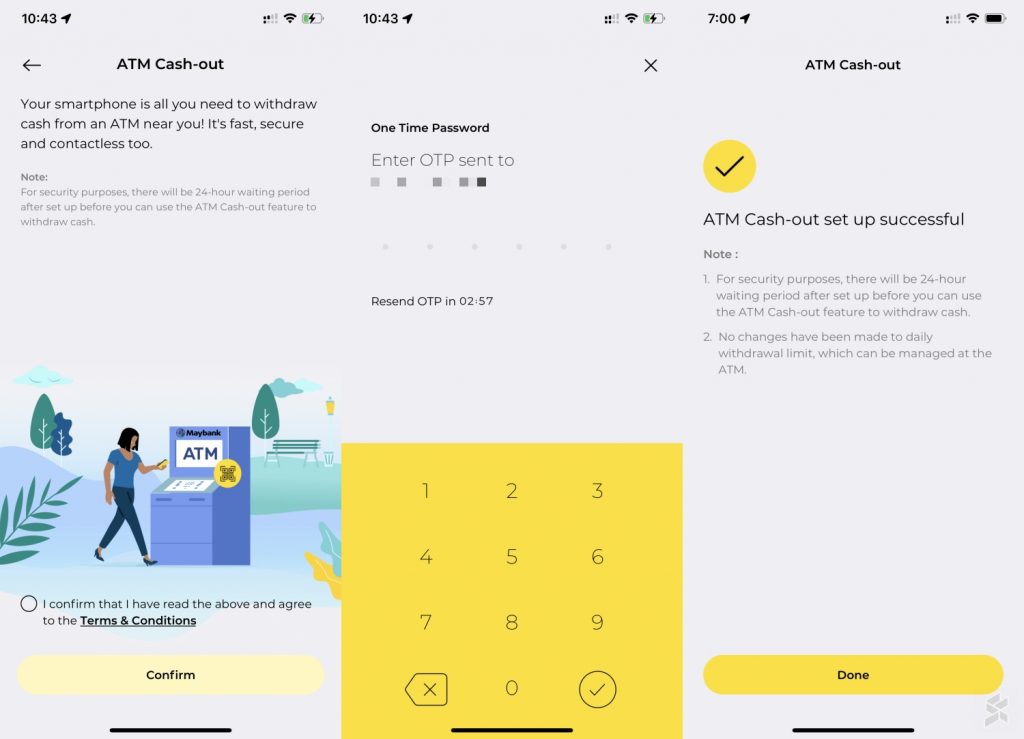

For first-time users, you’ll need to agree to the T&C and verify your activation with a One Time Password (OTP) that’s sent to your registered mobile number. Upon completion, you’ll have to wait for 24 hours before you can start using the feature and it will follow your existing daily withdrawal limit. If you need to increase your daily withdrawal limit, you can do so at the ATM and this action will require your ATM card.

How to withdraw cash with MAE app?

24 hours after your initial activation, you can start using the feature on a Maybank ATM that has the QR code on the home screen. According to Maybank, the feature is being rolled out nationwide and it’s currently available at 998 ATMs nationwide listed here.

Similar to making an eWallet transaction, just launch the MAE app and tap on the QR button at the bottom of the screen to start scanning the code. You will then need to authenticate your transaction by entering your PIN or you can use your phone’s fingerprint or facial recognition feature.

Next, just enter the amount and then select which account you wish to withdraw from. For withdrawals over RM1,000, the app will require an additional Secure2u authentication on your registered mobile device. Once that’s done, your money will be dispensed from the machine. To make your next withdrawals easier, you can save up to three preset amounts in the Cash-out page.

Unlike the previous cardless withdrawal feature, Maybank says there are no additional charges that will be incurred for using ATM cash-out. Take note that the ATM will not print out any receipt if you use MAE’s cash-out feature and you can refer to the digital receipt in the app. Obviously, this will not work with non-Maybank ATMs.

[ SOURCE ]