It’s almost 14 years since Mobile Number Portability (MNP) was implemented in Malaysia and it was seen as a game changer. Before 2008, mobile numbers were fixed to their respective telcos, for example, 012 and 017 were assigned to Maxis, 016 to Digi, 013 and 019 to Celcom and 018 was assigned to U Mobile. With MNP, customers could finally switch telcos while keeping their numbers. It sparked fierce competition among telcos as they had to work harder to retain customers who now have the freedom to change telcos if they are not satisfied with their service.

Malaysia has not yet implemented Fixed Number Portability

Interestingly, Malaysia has not implemented number portability for fixed-line numbers. This means if you have a TM home or business line number from decades ago, you can’t move it to other providers. The lack of Fixed Number Portability (FNP) is seen as a barrier for consumers to switch their fixed line or broadband service as they don’t want to lose their numbers. It is more apparent for businesses as their phone number can be a crucial sales channel and it would be costly for them to inform their customers about the change.

All telcos support FNP except for TM

According to MCMC’s Public Consultation Report released on 16 July 2021, all telcos that have submitted feedback including Celcom, Digi, Maxis, Redtone, Time, U Mobile and YTL Communications support the implementation of FNP except for Telekom Malaysia (TM).

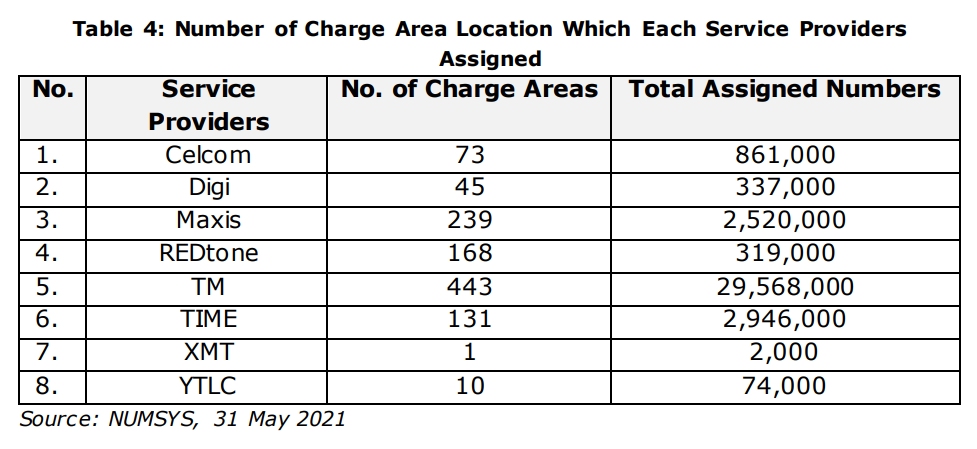

TM is the dominant fixed-line player and they currently control over 90% market share in Malaysia. According to NUMSYSM, they have a total of 29,568,000 numbers assigned to them and the next closest provider is Time with 2,946,000 numbers, followed by Maxis with 2,520,000 numbers.

TM has provided five reasons why FNP should not be implemented. The first reason was the current imbalance of market share as it puts TM at an unfair disadvantage. It wanted the MCMC to encourage other providers to invest in the fixed network to increase coverage rather than eroding the value of service providers that took the risk to invest in the early days. With a market share of over 90%, they know that it is more likely for customers to port out the numbers from TM rather than new customers porting in from another telco.

The second reason is that TM thinks the fixed-line business has been stagnant as there are 6.4 million subscribers versus 43 million mobile subscriptions. It doesn’t believe that FNP will guarantee price reduction and increase fixed broadband penetration as they are expecting porting to occur within the existing customer base.

Thirdly, TM feels that FNP is an unnecessary diversion of focus and investment, and resources should be better focused on improving fixed coverage and providing better broadband services. In short, they think FNP is just a waste of resources and the regulatory focus should be on mobile and broadband services.

The fourth reason is that TM thinks fixed numbers are not a barrier to competition because businesses can easily switch providers and inform their customers of their new numbers. If there’s a change, businesses can easily make the change of phone numbers on their digital platforms. They also emphasised that fixed numbers are the least popular method in personal and business communications.

Lastly, TM says FNP is uneconomical to implement given the expected complexities and costs as compared to the insignificant benefits that will be gained from FNP.

FNP may affect TM’s revenue

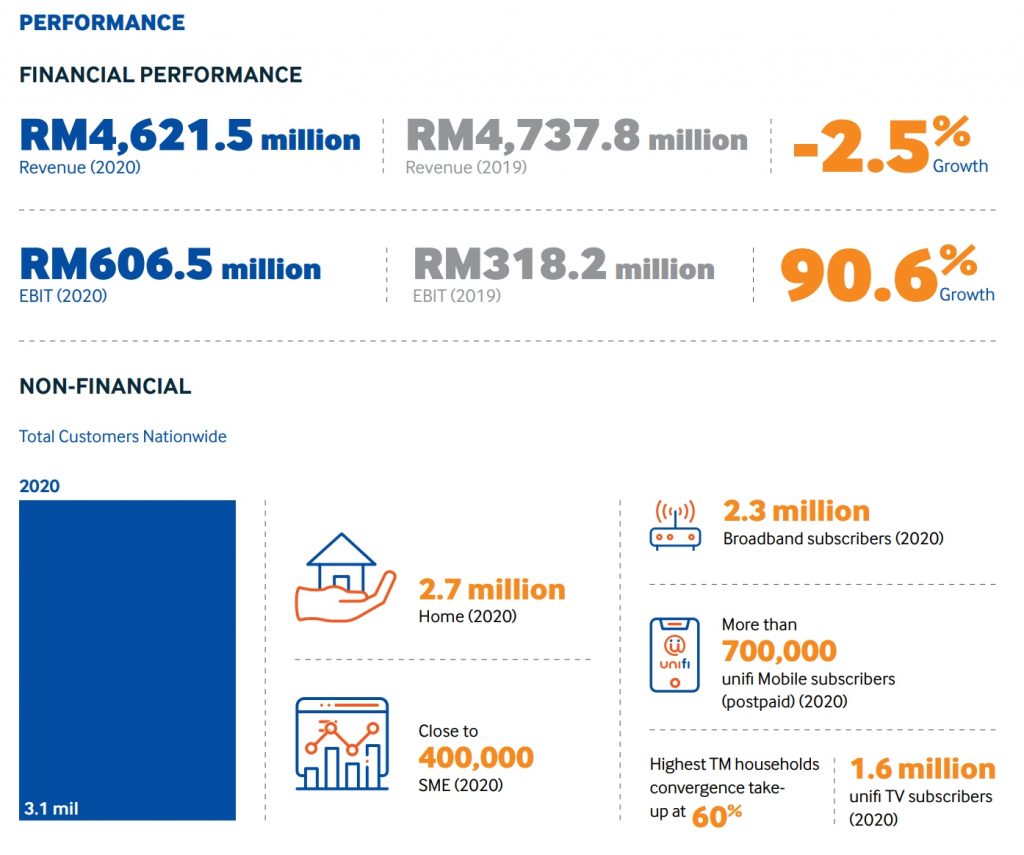

It is no secret that the fixed telephony service is a huge business for Telekom Malaysia. In 2020, the company posted a revenue of RM10.84 billion and Unifi contributed RM4.62 billion. TM’s Unifi service currently covers 3.1 million customers which include 2.7 million home customers and close to 400,000 SMEs as of 2020.

Cenerva, an ICT Regulatory Policy Consultancy firm, has shared with the MCMC that MNP tends to enhance choice for retail subscribers while FNP typically generates strong demands from the corporate sector. Quoting an example in Brazil, the FNP rates were 4.4%, largely driven by enterprise use versus 3.6% for MNP.

Cenerva also emphasised the importance of FNP in enhancing market competition should not be underestimated. It said not only it is an enabler for consumer choice but it is also a key driver of competition. In their response to MCMC in July 2021, they found that 4.4% of Malaysian mobile subscribers have attempted to port their numbers over the past 12 months but more than 50% of the requests were rejected. This shows that the successful porting rate for Malaysia is quite low compared with other countries such as India which has a porting rate of 6.45%.

FNP encourages competition and innovation

For FNP to be implemented successfully, Cenerva said the porting process must be efficient and consumer-friendly with minimal scope for unfair rejection. It believes number portability forces service providers to compete harder, through pricing, quality and innovation, in order to retain existing customers and win new ones from other providers.

Besides having the ability to keep favourite numbers, FNP also encourages greater innovation for fixed phone numbers. Instead of having a standard phone that’s plugged into the wall, consumers and enterprises will be able to move their numbers to IP-based services.

This includes services such as Omni which is a cloud-based service that doubles as a virtual call centre. If a customer calls the number, they can be greeted by a virtual receptionist which will direct calls to the respective staff or department. For businesses that don’t want to miss a call, it can be set to ring all mobile numbers in a sales or support team until someone picks up. The staff can also contact customers using the company’s fixed-line number via VOIP.

These cloud-based telephony solutions are typically offered on a monthly subscription which eliminates expensive hardware and setup cost associated with traditional PABX systems. This is also one of the ways to digitalise small businesses.

Until FNP takes place, customers who wish to use such services with the same number will have to maintain their existing fixed-line service and enable call forward. Not only does this add complexity but also extra cost to businesses that want to keep their number. FNP could also possibly create healthier competition for fibre broadband as existing TM Unifi or Streamyx customers would be more willing to consider other providers if they can keep their home number.

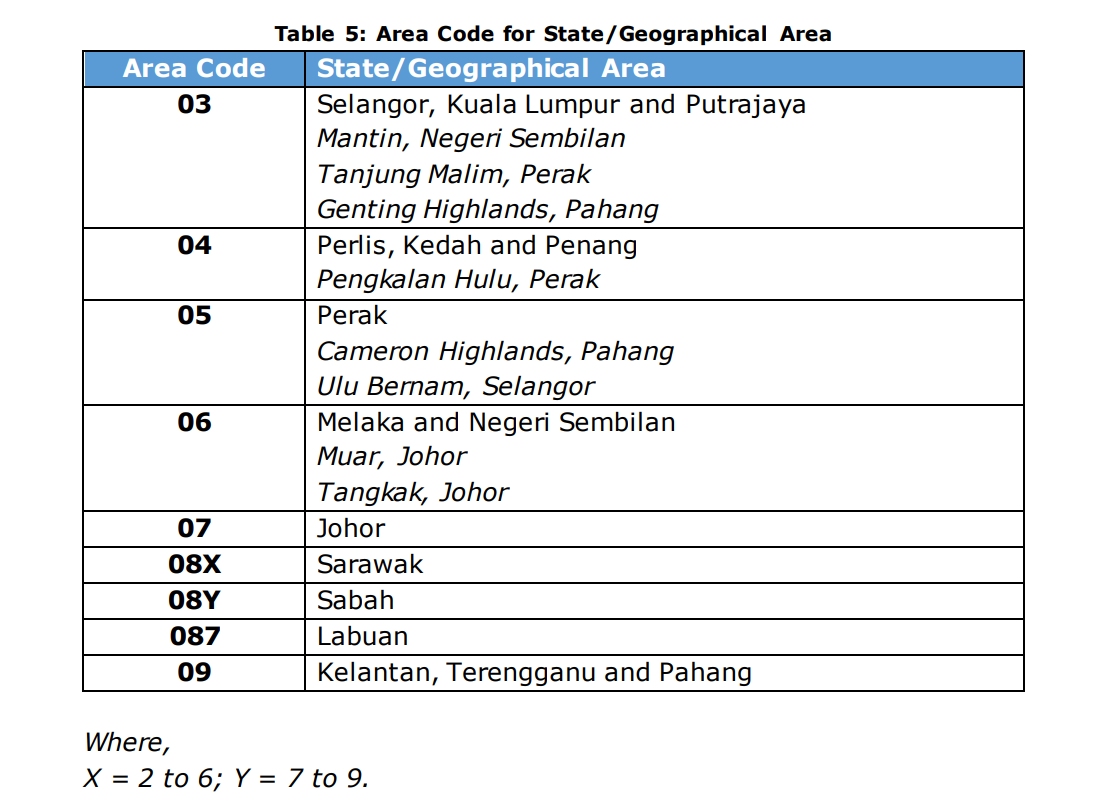

According to the MCMC, it aims to implement FNP within the same area code by the end of 2022. This means if you’re having a 03 number, you can only move it within the 03 zone. For FNP to take place, there’s an Industry Working Group (IWG) consisting of telcos to finalise the details and execution. The IWG will determine the actual implementation and guidelines to ensure consumers can enjoy FNP as soon as possible.

Can Malaysia implement FNP by the end of this year? We will have to wait and see. Let us know your thoughts about FNP in the comments section down below.

[ IMAGE SOURCE ]