BigPay has updated its app to push its new terms and conditions in a less aggressive way. As highlighted last week, BigPay had blocked its users from using their app unless you accept their T&C without explaining what the changes are. To mitigate the issue, they immediately removed the “force accept T&C screen” the very next day.

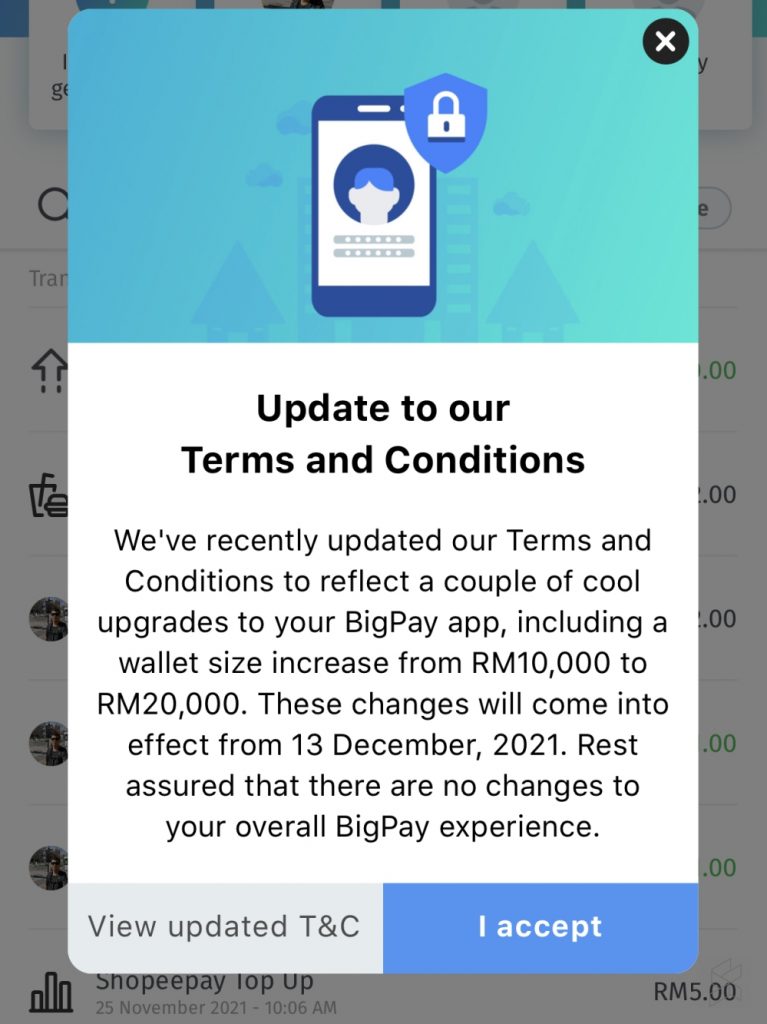

If you haven’t accepted their new T&C, you will now be greeted by a new pop-up that now mentions that the terms and conditions will reflect “a couple of cool upgrades to your BigPay app” which include increasing the wallet size to RM20,000. The changes will come into effect from 13th December 2021 and it assured that there are no changes to your overall BigPay experience.

The pop-up also provides a link to view the updated T&C and if you don’t have time to go through it, you can skip this prompt by tapping on the “X” button. At least users are now given the freedom to use their app without restrictions before accepting the new T&C. Both versions of the T&C (Cardholder agreement) are available for viewing under Settings > Security and Legal.

Shortly after our initial post last week, BigPay responded by apologising for the inconvenience and user experience, and they promised to work diligently to improve the user experience. They also clarified that the T&C does not affect the user’s account security and it is merely to increase the maximum wallet balance from RM10,000 to RM20,000. Besides BigPay, several other players including Touch ‘n Go eWallet and MerchantTrade Money have increased their wallet sizes to RM20,000. Grab still has a Premium wallet size of RM1,500 while Boost’s Premium Wallet size is RM4,999.

In case you didn’t know, BigPay has reduced its credit card top-up limit to RM1,000 per month since October 2020. However, you can top up more multiple times via other channels such as online banking. Previously, users could top up a maximum of RM10,000 per month.