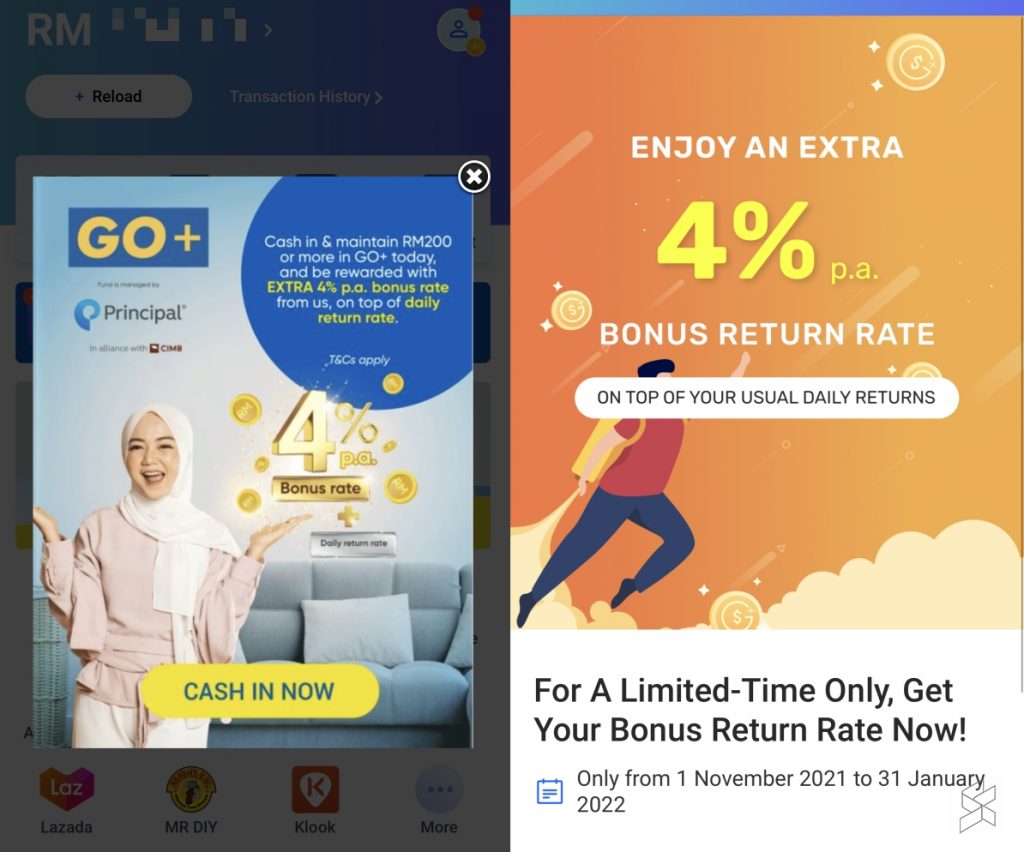

Go+, the investment feature on the Touch ‘n Go eWallet, is now having a promo where they are offering an additional 4% p.a. bonus return rate. The investment promo is offered for a limited time and all you’ll need is to top up and maintain a minimum of RM200 in your Go+ account.

Assuming that the current daily rate is 1.45% p.a., that means you can enjoy 5.45% p.a. total return rate during the promo. The bonus return rate campaign runs for 3 months from 1st November 2021 until 31st January 2022. Users can cash out anytime and currently, Touch ‘n Go eWallet does not impose any fee or charges to withdraw funds from Go+. Cash-out to eWallet is done immediately while cash-out to a bank account will take at least one business day.

According to the T&C, the campaign has an allocation of RM4,000,000 for the bonus return rate reward. This means the campaign may end earlier once the full allocation is exhausted.

To recap, Go+ is an investment-linked feature that’s anchored on Principal’s e-Cash Fund which is Shariah-compliant since mid-August 2021. Users can top up from a minimum of RM10 to a maximum account size of RM9,500. The base daily interest rate hovers around 1.3-1.5% and interest is credited on a daily basis.

Users can top up their Go+ account using their current eWallet balance or online banking via FPX. If your main eWallet balance is low, Touch ‘n Go eWallet’s quick payment feature will automatically transfer funds from your Go+ to ensure that your transaction goes through when it’s required. According to Touch ‘n Go Digital, the balance in Go+ should not be treated as eMoney, deposit, and is neither capital guaranteed nor capital protected by PIDM.

You can learn more about the promo in the official FAQ.